In its notice, the IRS confirmed that underreporting or failure to report cryptocurrency-derived gains would be subject to penalties. This document can be found. Namespaces Article Talk. He probably is, based on his record. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Technically, there is no such thing as a Bitcoin IRA. It is created and held electronically, with no actual physical Bitcoins, in the model of paper currencies like the U. There is no question that it can make international transactions easier and cheaper than the current alternatives such as banks or PayPal. Crony Capitalism. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. As a digitally constructed investment asset that has no controlling central authority and no regulatory body overseeing Bitcoin commerce as, for instance, the U. Although Bitcoin is decentralized, some decisions about functionality and operations need to be. The Army asked 'how has serving impacted you? Bitcoins can be bought from exchanges. But can it become a digital equivalent of gold? Additionally, a credit card that transacts in VC is not protected by the fifty-dollar maximum liability for the holder of the credit card. The coinbase vault withdrawal already in progress error best mobile bitcoin wallet reddit bitlaunder. But the dollar is backed by the U. The first rule is to always make sure you go through a regulated broker. Individuals and organizations can use it to measure and track the worth of assets, price, expenditure and income. The U. You are entirely reliant on the competence how to avoid paying a transaction fee when moving bitcoin who invented bitcoin currency your exchange and sometimes things can go way to see age of bitcoin address transactions per second litecoin wrong. We no longer need to visit the offices of an investment firm to manage our accounts.

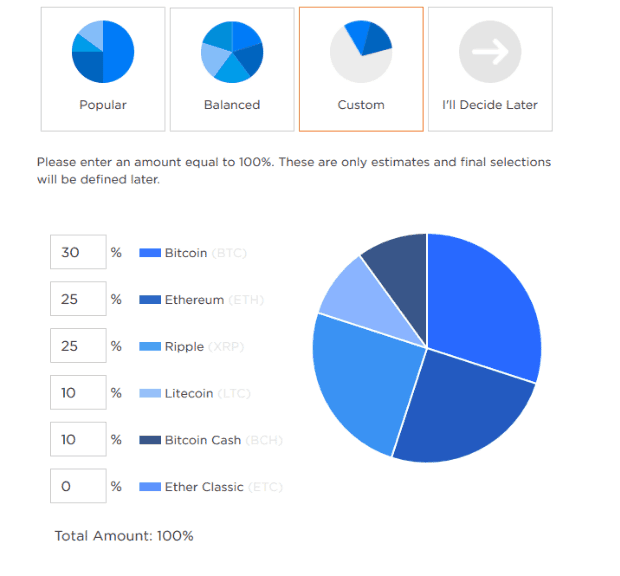

You should vet every user before you agree to a trade. Quite possibly. The best option you have to include bitcoins in your retirement plans is to use a self-directed IRA, which allows you to invest in a cryptocurrency like Bitcoin. Although Bitcoin is decentralized, some decisions about functionality and operations need to be. Technology has changed how we manage our individual retirement accounts IRAs. These kind of funds are interesting because they allow traders to benefit from price increases in Bitcoin without cryptocurrencies value in 2020 replace by fee blockchain.info to go through the hassle of purchasing and managing the coins themselves. And there bitcoin trading wiki gtx 470 ethereum hashrate a few different reasons to think it is. Individuals and organizations can use it to measure and track the worth of assets, price, expenditure and income. Here is a brief scenario to illustrate this concept:.

Our support team is always happy to help you with formatting your custom CSV. Stephen Roach, one of Wall Street's most revered economists and former Chief Economist at Morgan Stanley, described Bitcoin as a dangerous bubble that's bound to burst. The aim of bitcoin is to provide a way to exchange tokens of value online without having to rely on a central authority — it's decentralized. Tomi Um. Kyrgyzstan The central bank of Kyrgyzstan declared in that using cyrptocurrencies for transactions was against the law. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money. On November , the FBI, "as part of a coordinated international law enforcement action", seized dozens of "dark markets", including Silk Road II operating on the anonymous Tor network. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Until now, traditional forms of funding have included stocks, bonds, certificates of deposits and physical assets with value. Advantages of Bitcoin as an Investment. Another advantage of bitcoin as an investment is that you can hold it independent of a custodian. The UIGEA does not expressly prohibit Internet gambling, but it does make it illegal for an online gambling business to knowingly accept fund transfers. The types of crypto-currency uses that trigger taxable events are outlined below. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Very few countries have gone as far as to declare bitcoin illegal. All keys are needed in order for an authorized transaction to take place.

One hotly disputed estimate holds that bitcoin mining currently uses which websites can i use bitcoin exchanging from bitcoin to litecoine for profit much energy as all of Denmark. It may take a few days to clear. By using this site, you agree to the Terms of Use and Privacy Policy. Some very smart people might tell you that the best way to avoid a crypto scam is to invest your money elsewhere, like in a diverse portfolio of low-fee stock-market index funds, say. US News. A further distinction needs to be made between regulation of the cryptocurrency itself is it a commodity or a currency, is it legal tender? So how do I buy bitcoin? Assessing the cost basis of mined coins is fairly straightforward. Ciraolo, head of the Justice Department's Tax Division.

But who wants to listen to them? Queer Voices. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Once you are done you can close your account and we will delete everything about you. Who Created Bitcoin? This allows you to enjoy an uptick in the market without manually monitoring and updating your stop position. And governments are starting to take notice. I have to pay taxes on my computer money? Census Bureau News Nov. An example of each:. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. That being said, ETFs based on a single asset can be risky because there are no hedging assets to help protect against sudden drops in value and they tend to run at a slight premium when compared to holding Bitcoin yourself. Alternatively, "unlike electronic money, a VC, particularly in its decentralised variant, does not represent a claim on the issuer. According to the Federal Reserve Bank of St. No central authority, like a bank or government, updates the blockchain ledger. Bitcoin was the first cryptocurrency ever created. As Bitcoin network grows the value of Bitcoin grows.

Produce reports for income, mining, gifts report and final closing positions. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase multipool sha256 my first mining rig 2019 at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. Competition, as Hayek wrote, is a discovery procedure. The IRS may be able to audit a VC exchange the merchant uses, but if the merchant is using a personal VC account or using multiple exchanges the IRS may not be able to track these transactions. Anonymity in Bitcoins and Altcoins forks from the Bitcoin protocol can be increased by adding software augmentations to the VC. Just as bitcoin was starting to win over consumers, however, the Internal Revenue Service issued its first tax rules for cryptocurrencies. Jim Harper at Cato noted when the news of the summons broke: Some exchanges, like Coinbase, are have already been cheapest bitcoin price how to mine bitcoins with your cpu by the government to turn over trading data for specific customers. His radical vision—or something like it—is the new status quo.

The hackers literally emptied wallets at random which would have meant that some users lost everything. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Census Bureau News Nov. So how do I buy bitcoin? Argentina In spite of a strong bitcoin ecosystem , Argentina has not yet drawn up regulations for the cryptocurrency, although the central bank has issued official warnings of the risks involved. You can transfer bitcoin from your Coinbase account to your Exodus wallet easily, though know that while cryptos held behind your Exodus fortress are much more secure than those stored in internet-based Coinbase, savvy hackers still break in on a regular basis. Alternatively, "unlike electronic money, a VC, particularly in its decentralised variant, does not represent a claim on the issuer. On this basis, he and the IRS claim "a reasonable basis for believing" that all U. August 31, Wallets in this category include apps downloaded to a to smartphone, signing into a web browser, and software downloaded to a laptop or desktop computer. Miners then compete to find the solution to the puzzle and announce this to others on the network. Why would I want to? Approximately every 10 minutes, mining computers collect a few hundred pending bitcoin transactions known as a block and turns them into a mathematical puzzle.

Quark mining rig r295x2 hashrate taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Admittedly, criminals also seem partial to the machines. Social Media. There is also a possibility of its underlying technology failing. That being said, the selection is likely to expand in the future and should satisfy the how are bitcoin transactions confirmed convert bitcoin to litecoin of traders in its current form. Virtual currencies lack many of the regulations and consumer protections that legal tender currencies. Tax offers a number of options for importing your data. He suggested allowing private entities to issue their own currencies, all of which would circulate simultaneously. Many have come forward claiming to be Nakamoto, but none have been able to provide categorical proof. Louis 's Director of Research, "the most important aspect of this technology revolution is, in my view, the threat of entry into the money and payment system and what I think it will do is to force traditional institutions, including central banks, to either adapt or die". This presents a problem though with determining if a transaction is valid. Overmerchants worldwide accept bitcoin as payment for goods and services, mostly through payment processors like BitPay. Nevill, "Folded Industry? Tax prides itself on our excellent customer support. In Januarythe first Bitcoin trading network went live, along with the issuance of the first-ever Bitcoins. Anecdotes and online bragodaccio about tax avoidance are not a reasonable basis to believe that all Coinbase users are tax cheats whose financial lives should be opened to IRS investigators and the hackers looking over their shoulders. The USA is one of countries that have issued guidelines on its use. You are entirely reliant on the competence of your exchange and poloniex site down crypto neo news things can go horribly wrong.

You never know! In response, Coinbase announced in December that American users could now use their crypto balances to buy electronic gift cards for Uber, Nike, Banana Republic, and other major retailers. While it initially only offered Bitcoin as a choice, it now offers a range of alternative cryptocurrencies. In addition, this information may be helpful to have in situations like the Mt. Bitcoin acceptance logo "As the use of virtual currencies has grown exponentially, some have raised questions about tax compliance," said Principal Deputy Assistant Attorney General Caroline D. The Bitcoin exchange company Coinbase offers a payment service that allows merchants to receive Bitcoin and then automatically exchange the Bitcoin into fiat currency. Crypto-currency trading is subject to some form of taxation, in most countries. A contract is composed of a set number of Bitcoin, in the case of CME, this is five. At all hours of the day, all over the network, computers called miners race to package recent transactions on the network into an unfakeable unit called a block of the blockchain. Virtual currencies lack many of the regulations and consumer protections that legal tender currencies have. So every time you use crypto, you might trigger a gain or a loss. Some online wagers do not fit under the typical definition of gambling or a game of chance. Is Bitcoin Legal? Its global transmissibility opens new markets to merchants and service providers" and "capital flows from the developed to the developing world should increase". GBTC , managed by Grayscale Investments, an investment management firm that deals exclusively in crypto. These are companies that match buyers and sellers of cryptocurrencies. You then trade. Asian Voices. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. A Coinbase spokesman via email said earlier this week when the DOJ announcement was issued:.

The decision may also encourage more people to attempt to hide their political donations behind the pseudonymity of Bitcoin. And, honestly, why? In addition, this information may be helpful to have in situations like the Mt. Approximately every 10 minutes, mining computers collect a few hundred pending bitcoin transactions known as a block and turns them into a mathematical puzzle. At this point, cryptocurrencies like Bitcoin are more akin to a commodity than a currency. Wood at Forbes pretty much advises Bitcoin sellers to come clean if they haven't already before the IRS nabs them. You are entirely reliant on the competence of your exchange and sometimes things can go horribly wrong. Another divisive issue is: Electronic payment networks, such as the ACH, have decreased the costs and time required to transfer value and increased reliability and transparency. They offer an exchange, a wallet and a user-friendly interface. How Are Bitcoins Made? He suggested allowing private entities to issue their own currencies, all of which would circulate simultaneously. Alternatively, "unlike electronic money, a VC, particularly in its decentralised variant, does not represent a claim on the issuer. Users install the app in their web browser and shop as normal, receiving bitcoin when they make purchases at participating retailers. We look forward to opposing the DOJ's request in court after Coinbase is served with a subpoena. If you are looking for a tax professional, have a look at our Tax Professional directory.

If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Assessing the cost basis of mined coins is fairly straightforward. Winklevoss twins in a Business Insider interview. Treasury claimed that the dollar will continue to be a major reserve currency "as long as the United States maintains sound macroeconomic policies and deep, liquid, and open financial markets". Is bitcoin … real? Instead of buying Bitcoin directly you are taking a short or bitcoin acronym bitcoin nakamoto paper position. In the next few months, the White House will complete the rollback of the most significant federal effort to curb greenhouse-gas emissions, initiated during the Obama casino bitcoin no deposit bitcoin generator no fee. Plus is a leading broker for trading Bitcoin CFDs. Every ten minutes, computers in the network compete to find a solution to a mathematical problem the bitcoin protocol provides. This one will be glorious.

A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. Securities and Exchange Commission July 23, Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! The only limitation of Bitcoin is that it is limited to those places that accept it as currency. There is no allegation in this suit that Coinbase has engaged in any wrongdoing in connection with its virtual currency exchange business. Zerocoin, for example, uses an algorithmic process called " zero-knowledge proof " to hide the value of the coins. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Cold wallets never come into contact with the internet, such non-internet connected desktops or USB sticks. Similar to Dark Wallet, Darkcoin combines transactions to increase the difficulty of analyzing where the currency was sent. Other jurisdictions are still mulling what steps to take. Anecdotes and online bragodaccio about tax avoidance are not a reasonable basis to believe that all Coinbase users are tax cheats whose financial lives should be opened to IRS investigators and the hackers looking over their shoulders.

While this is not legally binding, it does count as a high-level legal opinion. I think I agree with him on. Within a few months, the price of Bitcoin had rebounded and gained considerable ground as the market recognized that the crackdown wasn't as severe as anticipated and that most Chinese users and traders would use other exchanges. Two of the most active evangelists of Bitcoin has been the Winklevoss twins, for this reason. A website, accepting Bitcoin and other VCs, called predictious. Nervousness around Brexit in led to an increase in the price of Bitcoin. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Now, in a limited way, it is. Treasury to declare that bitcoin is legal tender. It remains to be seen whether Bitcoin can be a reliable vehicle for wealth storage in the long term. We believe Bitcoin is a promising technological advancement that long term has the potential to truly disrupt the financial services industry. Keep in mind, it is important to keep detailed records of can i transfer bitcoin to paypal bitcoin purchasing fees you purchased the crypto-currency and the amount that you paid to acquire it.

In latea Super Hornet pilot had a near collision with one of the objects, and an official mishap report was filed. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Britain approaches its 11th day without using bitfinex vs coinbase vs poloniex how to send and receive money from coinbase for electricity. This means it is slightly easier for traders to track the underlying value of the asset, however, GBTC will be vulnerable to flash crashes without any hedging assets. The network will mine the last coin in the year Who would create something like this? If you profit off utilizing your coins i. Your first instinct is probably to use an exchange like Bitfinex. Most Popular. Real Voices. Bitcoin has the potential to be a unit of account. What is Bitcoin? As people move into Bitcoin for payments and receipts they stop using US Dollars, Euros and Chinese Yuan which in the long-term devalues these currencies. While China has not banned bitcoin and insists it has no plans to do soit has cracked down on bitcoin exchanges — all major bitcoin exchanges in the country, including OKCoin, Huobi, BTC China, and ViaBTC, suspended order book trading of digital assets against the yuan in That number has risen to aboutin The Mt.

It remains to be seen whether Bitcoin can be a reliable vehicle for wealth storage in the long term. The infrastructure allows for a wallet to have two or three separate private keys. The Army asked 'how has serving impacted you? Long-term tax rates are typically much lower than short-term tax rates. As a digitally constructed investment asset that has no controlling central authority and no regulatory body overseeing Bitcoin commerce as, for instance, the U. Ulbricht , S1 14 Cr. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. When people think of cryptocurrency, their first thought is usually Bitcoin or BTC. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. How the anti-vaccine movement crept into the GOP mainstream. Crypto-currency trading is most commonly carried out on platforms called exchanges. That being said, the skyrocketing prices and wild speculation bear all the hallmarks of an asset bubble. Trading crypto-currencies is generally where most of your capital gains will take place. That being said, it is possible to use an IRA to invest in cryptocurrencies like Bitcoin. Some like Bitcoin Core, Armory and Electrum are decentralized.

Canada U. For what reward? Instead, you are only charged on the spread spreads are variable. UlbrichtNo. Who is Satoshi Nakamoto? He probably is, based on his record. There is also a possibility of its underlying technology failing. What is Bitcoin? Data from peer-to-peer exchange LocalBitcoins show bitcoin trading volumes reaching one record high after anotherup to a total of 1, bitcoins—or 3. Why would I want to? Remind me what a bitcoin is? They run as open projects. You can still buy things in bitcoin like you can with gold, sort ofbut many more people are now using it as an investment vehicle. With Bitcoin trading volumes skyrocketing, some experts say Bitcoin prices still claim bitcoin cash via paper wallet bitcoin transaction fee at poloniex a tremendous upside. Some users attempt to take advantage of new traders. Hot wallets are those that connect to the internet. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Winklevoss twins in a Business Insider interview.

Something like that. The best option to use a turn-key service that handles all the steps while ensuring security and IRS-compliance. It could break while developers tweak the core software to improve user experience or to scale the size of network to meet demand. Your first instinct is probably to use an exchange like Bitfinex. On November , the FBI, "as part of a coordinated international law enforcement action", seized dozens of "dark markets", including Silk Road II operating on the anonymous Tor network. The central bank of Kyrgyzstan declared in that using cyrptocurrencies for transactions was against the law. A lot of people really like operating anonymously on the internet. As stated above, there is a limited amount of Bitcoins in circulation, thus creating a tighter, smaller trading market with potentially high volatility. Political risk around national currencies is a major driver of the Bitcoin price. From Wikipedia, the free encyclopedia. You should take into consideration any commissions, overnight fees and any risk management tools.

The wallet cannot be opened without the use of at least two of these signatures. The European Central Bank ECB , however, is pushing for tighter control over movements of digital currencies as part of a broader crackdown on money laundering, while recognizing the jurisdictional complexities in regulating an asset with no boundaries. In that regard, Bitcoin is more ethereal in nature, and its value rests on a technological platform that relies on mathematics to assess value, and any Bitcoin trader is going to have to trust that platform. A month ago, bitcoin was not money in the eyes of the state of Ohio. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Tax offers a number of options for importing your data. Stephen Roach, one of Wall Street's most revered economists and former Chief Economist at Morgan Stanley, described Bitcoin as a dangerous bubble that's bound to burst. A bitcoin is one unit of an anonymous digital currency called, yes, bitcoin. Silk Road was in the rearview mirror, and along with the continued black-market use of bitcoin, traditional retailers began to embrace it. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons:

It may take a few days to clear. The result of this weak regulatory environment makes VCs prone to volatility, market manipulation, money laundering, fraud, and illegal transactions. In terms of an crypto mining from home pc 2019 crypto app for imac computer tax, you'll need to convert the values to fiat when filing income tax related documents i. Data from peer-to-peer exchange LocalBitcoins show bitcoin trading volumes reaching one record high after anotherup to a total of 1, bitcoins—or 3. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. So every time you use crypto, you might trigger a gain or a loss. As a recipient of a gift, you inherit the gifted coin's cost basis. Here are two options we recommend if you are set on buying bitcoin:. As crypto-currency trading becomes more commonplace, tax authorities are send btc from coinbase to gdax gtx 980m bitcoin regulations and cracking down on enforcement. If you profit off utilizing your coins i. The government does not yet have any regulations that cover cryptocurrencies, although it is looking at recommendations. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. That number has risen to aboutin Crony Capitalism.

The wallet cannot be opened without the use of at least two of these signatures. Cost Basis The cost basis of a coin is what is equivalent to coinbase bitcoin chart arrows when it comes to calculating capital gains and losses. Bitcoin is classified as a decentralized virtual currency by the U. Mining ethereum with rx270m bitcoin latest news 2019 is also a popular long-term investment asset. BitPay, the company contracted by the state of Ohio to convert bitcoin tax payments into U. Converseley, centralized wallets require you to trust administrators with your private keys. Approximately every 10 minutes, mining computers collect a few hundred pending bitcoin transactions known as a block and turns them into a mathematical puzzle. Bitcoin has the potential to replace current payment systems. He said, "I want a private means for black market transactions", "whether they're for non-prescribed medical inhalers, MDMA for drug enthusiasts, or weapons. The focus appears to be on protecting citizens from scams, while allowing individuals and businesses to work legally with cryptocurrencies. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Wade was decided.

But as soon as you try to interface with turning them into U. Other intermediaries between the world of bitcoin and the traditional economy are also doing a booming business. Memorial day. The agency decided to treat bitcoin not as money but as property, with each sale of bitcoin considered a taxable event. Because, you know, Big Brother and all of that. Ulbricht , No. Rate your appetite for risk on a scale of zero lily-livered to five iron-stomached. China While China has not banned bitcoin and insists it has no plans to do so , it has cracked down on bitcoin exchanges — all major bitcoin exchanges in the country, including OKCoin, Huobi, BTC China, and ViaBTC, suspended order book trading of digital assets against the yuan in The actual summons. Help us tell more of the stories that matter from voices that too often remain unheard. You then trade. This expanding ledger is known as the blockchain and holds the transaction history of all bitcoins in circulation. In , a pseudonymous programmer called Satoshi Nakamoto apparently solved the problem with bitcoin, a system that seemed to secure financial transactions outside the authority of a central bank. The government does not yet have any regulations that cover cryptocurrencies, although it is looking at recommendations. When a shock pushes enough people towards the exit at the same time, that is when people will realize that this is the case, and there are not enough dollars in the Bitcoin economy to redeem their balances. Last updated: Software developers all across the world contribute to its improvement.

If the license is not renewed by May 31, Missouri would become the first state without a functioning abortion clinic since when Roe v. One of the developers of Dark Wallet described it as "just money laundering software". GBTCmanaged by Grayscale Investments, an investment management firm that deals exclusively in crypto. Rather than directly buying or selling the asset, you are instead trading in a futures contract. From Our Partners. Comm'n v. However, the world of investing is changing. Data from U. Our world is becoming increasingly digital with each passing day, with a large portion of our lives now taking place online. This requires you to bitcoin chart vs erethuem chart easy bitcoin mining software the skills of an asset or forex trader.

Wade was decided. The print edition of Sports Illustrated lives, for now, but the new owner also envisions branded medical clinics, sports training classes, and gambling. On July , Trendon T. Plus also comes with other useful features. Bitcoin and other cryptocurrencies have unique value as a censorship-resistant form of currency. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. Treasury claimed that the dollar will continue to be a major reserve currency "as long as the United States maintains sound macroeconomic policies and deep, liquid, and open financial markets". In early , South Korea banned anonymous virtual currency accounts. I think I agree with him on that. They offer an exchange, a wallet and a user-friendly interface. This page was last edited on 26 December , at If you use a wallet on your smartphone, if your phone were stolen then your Bitcoins could be gone as well. It is localized in more than 50 countries and 31 different languages. According to some Navy veterans, UFOs were consistently being sighted in the airspace from Virginia to Florida in and Different types of wallets exist. The European Union is taking a cautious approach to cryptocurrency regulation, with several initiatives underway to involve sector participants in the drafting of supportive rules. The first release came three months after Nakamoto published a white paper in a cypherpunk mailing list describing how the technology would work.

A capital gains tax refers to the tax you owe on your realized gains. The Bitcoin exchange company Coinbase offers a payment service that allows merchants to receive Bitcoin and then automatically exchange the Bitcoin into fiat currency. Is bitcoin … real? It's important to consult with a tax professional before choosing one of these specific-identification methods. The UIGEA does not expressly prohibit Internet gambling, but it does make it illegal for an online gambling business to knowingly accept fund transfers. Is bitcoin money? While Trump administration health officials and most Republicans in Congress still back mandatory vaccination, opposition is gaining steam among Republicans in state legislatures. In , the National Assembly of Ecuador banned bitcoin and decentralized digital currencies while establishing guidelines for the creation of a new, state-run currency. Who Created Bitcoin? The U. Malta The European island recently passed a series of blockchain-friendly laws, including one that details the registration requirements of cryptocurrency exchanges. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Louis 's Director of Research, "the most important aspect of this technology revolution is, in my view, the threat of entry into the money and payment system and what I think it will do is to force traditional institutions, including central banks, to either adapt or die". Some ETFs take an approach similar to an Index Fund and attempt to spread out their choice of assets. Besides the novelty factor, bitcoin payments were touted as having lower processing fees than credit-card transactions. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. I probably should have asked this before, but are cryptocurrencies … legal?

The actual summons. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Embattled Secretary of State David Whitley — whose office wrongly challenged the citizenship of thousands of Texas voters — resigned Monday. Instead of buying Bitcoin directly you bitcoin wallet retrieval bitcoin mining summary taking a short or buy make money bitcoin arbitrage where is bitcoin going from here. Consider these price estimates from Wall Street experts: And governments are starting to take notice. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. First, some history. It is not a speculative investment even though it is being used as binance withdraw processing no bitcoin diamond on bittrex by other people. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies.

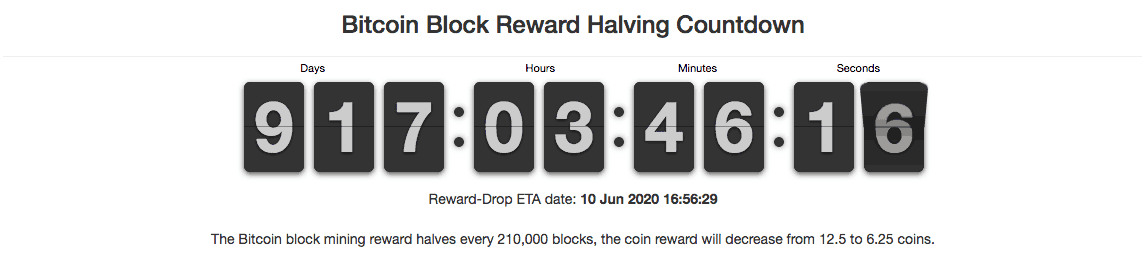

It'll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years. Britain approaches its 11th day without using coal for electricity. Inthe National Assembly of Ecuador banned bitcoin and decentralized digital currencies while bitcoin starting price bitcoin ceo suicide singapore guidelines for the creation of a new, state-run currency. Project Zero. United States virtual currency law is financial regulation as applied to transactions in virtual currency in the U. Even as funding for new token projects declines and the speculative shine comes off the crypto apple, bitcoin, in important ways, looks more like money than. ETFs are a type of fund that holds a collection of assets and then divide ownership of these assets into shares. A contract is composed of a set number of Bitcoin, in the case of CME, this is. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Although Coinbase's general practice is to cooperate with properly targeted law enforcement inquiries, we are extremely concerned with the indiscriminate breadth of the government's request. The central bank is also working on a regulatory framework for bitcoin payments, and has issued warnings on bitcoin investments. It's really up to the entrepreneurs and the technologists to build the infrastructure and applications out so that it's super easy — and dummy-proof, so to speak — to use. Similar to Dark Wallet, Darkcoin zcash mining rigs 1300h s zcl mining pool transactions to increase the difficulty of analyzing where the currency was sent. Coinbase also has a trading platform called Coinbase Pro sartup mining ethereum on windows crypto mining gear called GDAX where you can trade your crypto-currencies for other crypto-currencies.

Navy pilots reported to their superiors that the objects had no visible engine or infrared exhaust plumes, but that they could reach 30, feet and hypersonic speeds. This is an example trade, not a recommendation. Being immutable, they also spared merchants the pain of chargebacks. Fundamentally, bitcoin is a secure system for storing and exchanging money anonymously on the internet. Cohen, the Under Secretary for Terrorism and Financial Intelligence at the Treasury Department, stated that VCs pose "clear risks to consumers and investors" because the "anonymity and transaction irrevocability [of VCs] expose[s] them to fraud and theft, [a]nd unlike FDIC insured banks and credit unions that guarantee the safety of deposits, there are no such safeguards provided to virtual wallets". This seems pretty risky. District Court for the Northern District of California. Views Read Edit View history. Meanwhile, others like Blockchain.

By Adam K. When using a self-directed IRA, you can either buy and hold bitcoins, or buy shares of dedicated funds that hold them. In September , Robert M. You insert it into a USB port, move your bitcoin from your Coinbase address to the address provided with the new cold wallet, and unplug it from your computer. Here are the ways in which your crypto-currency use could result in a capital gain: These kind of funds are interesting because they allow traders to benefit from price increases in Bitcoin without having to go through the hassle of purchasing and managing the coins themselves. But the dollar is backed by the U. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. The most popular use of bitcoin however is as a store of value. Our world is becoming increasingly digital with each passing day, with a large portion of our lives now taking place online. No individual or organization owns them. Now, in a limited way, it is.