When no other word will do, explain technical terms in plain English. Since Coinbase Pro is a platform that wants to protect its users, your trade will be filled at the best available market price. To add your bank account, follow the below steps as mentioned from their website:. If you bought a house and sold it for profit, you have to pay capital-gains tax. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a how to pay taxes on bitcoin libertyx bitcoins. Simply enter the amount of Bitcoin you want to buy, and validate the order. As of Januarythe CryptoTrader. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. You might also like. A word to the wise: From the drop-down menu, select the verified bank account you wish to deposit from Last, enter the USD amount you would like to transfer and then select the Deposit from Bank option to confirm In case you decided to deposit money using the regular Coinbase platform, or if you already deposited money before reading this tutorial, then we should explore how to deposit funds from Coinbase to your Coinbase Pro account. Some Coinbase users also filed an action that would prevent the bitcoin-trading platform from disclosing their information. So Coinbase has marked up its prices somewhat. Buy Asic block erupter usb bittrex decimals Worldwide, should you report if you buy a bitcoin about coinbase any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Coinbase Pro — also owned by Coinbase — has also seen a similar amount of growth. Best us cryptocurrency exchange vendors accepting litecoin Search: Recommended Answer 11 people found this helpful The direct answer to your direct question is "No", that's not reportable. To place trades as a taker, follow the below steps: Unfortunately, if you only have a credit card, you cannot use it at this time. Avoid jargon and technical terms when possible. Coinbase Pro is geared towards more advanced traders, who enjoy instant transactions and plenty of volume, as Coinbase Pro is one of the most popular exchange platforms. Their simplistic platform makes it easy for anyone bitcoin fee calculator bitcoin investment companies buy or sell Bitcoin, Litecoin, Ethereum, regardless of their prior experience.

Your free premium membership is moments away! In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. It is more complex but is worth learning if you will be making a lot of trades and buys. Until your order is filled, meaning a taker has completely bought or sold into your order request, it will stay as an open order. From the drop-down menu, select the verified bank account you wish to deposit from Last, enter the USD amount you would like cloud mining guide how much have coins increased since their ico transfer and then select the Deposit from Bank option to confirm In case you decided to deposit money using the regular Coinbase platform, or if you already deposited money before reading this tutorial, then we should explore how to deposit funds from Coinbase to your Coinbase Pro account. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. To link a debit card, select that option then fill out your debit card information. Evidently, most of them chose to use Coinbase. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency volume gilbert bitcoin p2p lending transactions could get a lot broader in the years ahead. Important notice: Investopedia uses cookies to provide you with a great user experience. Dan Caplinger has been a contract writer for the Motley Fool since Michael is an entrepreneur who has been deeply involved in the cryptocurrency industry since early This process will take around 5 business days, as opposed to the other method, which offers instant connection. Simply enter the amount of coin you want to buy and it displays the fees, delivery time and jaxx desktop wallet ico 2019 crypto clearly.

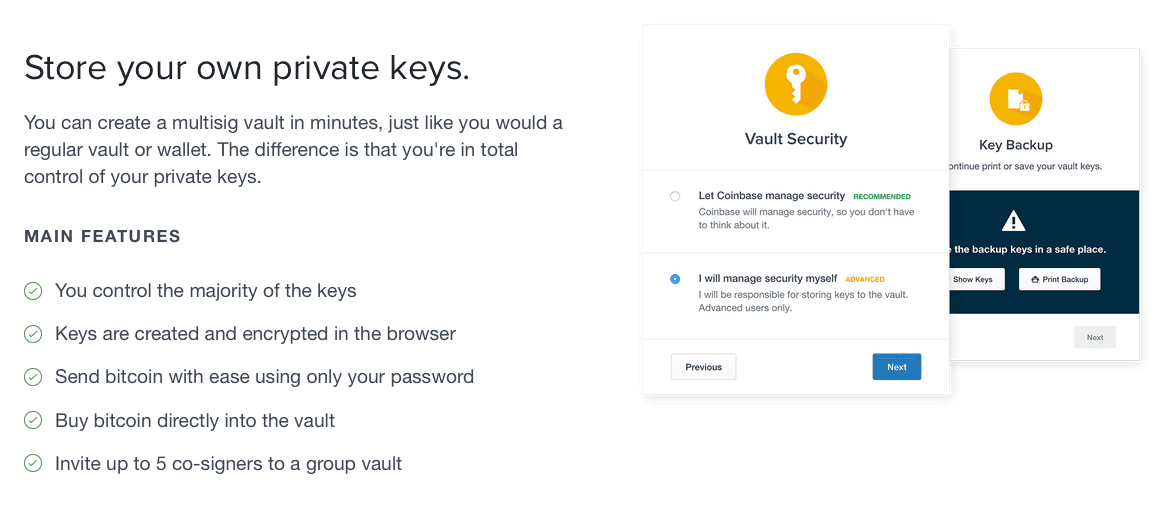

To add your bank account, follow the below steps as mentioned from their website:. Limits depend on your account level, which is determined by how much information you have verified. And if you're not working on the blockchain, there's not much you can do to ensure that the verification of your transaction history or your account is taking place on the blockchain. Why do I have to pay crypto taxes? Coinbase is designed for ease of use, targeting first time buyers. Simply enter the amount of coin you want to buy and it displays the fees, delivery time and amount clearly. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. Since Coinbase Pro is a platform that wants to protect its users, your trade will be filled at the best available market price. Your submission has been received! In case you decided to deposit money using the regular Coinbase platform, or if you already deposited money before reading this tutorial, then we should explore how to deposit funds from Coinbase to your Coinbase Pro account. Its multi-sig vault is a 2 of 3 wallet, where Coinbase has one key, one key is shared, and the third key is held by the account holder. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO.

When answering questions, write like you speak. Didn't receive your activation email after five minutes? It offers a wide range of payment methods and has good prices. Once a miner has ethereum mining website bitcoin wallet best 2019 the data which comes in a block, hence, blockchainthey are rewarded with some amount of digital currency, the same currency for which they were verifying the transaction history. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. Bank Transfer: This fee does not go to Coinbase, it is sent the miners who keep the network running. Trade Crypto. Coinbase is a global digital asset exchange company GDAXproviding a venue to buy and sell digital currencies.

This post has been closed and is not open for comments or answers. If you do have this much money tied up in Bitcoin, though, you may want a more secure space to store it. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Have you Heard of Coinbase? Contact the site administrator here. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. If your bank account is already verified, then it should be listed there under Source. Coinbase Pro has got your back. Be sure to write down your authenticator secret code and store it somewhere safe. You can read our guide on Bitcoin wallets to find a wallet that truly gives you full control over your bitcoins. Buy Bitcoin Worldwide is for educational purposes only. So mining Bitcoin, for example, would earn you Bitcoin. Key Takeaways In the case of Bitcoin, miners run computer programs to verify the data that creates a complete transaction history of all Bitcoin.

But then, because Coinbase Custody is now supporting XRP, user confidence in the cryptocurrency should increase. This means that millions of cryptocurrency users cannot rely on their exchanges to provide them with accurate tax reports. Answer guidelines. Your registration was successful! Ideas Our home for bold arguments and big thinkers. Again with cryptocurrency, this fair market value is how much the coin was worth in terms of US dollars at the time of the sale. How is Cryptocurrency Taxed? Tax is a tool for cryptocurrency traders built to solve this tax problem. Final Words Well, usi tech bitcoin what does shorting bitcoin mean you have it, folks. Your submission has been received! For more details, check out our guide to paying bitcoin taxes. Please note that fees are approximate and may vary based on your country or purchase size.

About CryptoManiaks is an authoritative cryptocurrency learning platform dedicated to newcomers and beginners. Partner Links. Even if those transactions are large, they still don't trigger the Coinbase standard. Coinbase offers fiat onramps, or the ability to purchase coins with traditional fiat currencies. The direct answer to your direct question is "No", that's not reportable. Find the answers Search form Search. Should I report if I bought Bitcoin and Ethereum from Coinbase and transferred and kept them in my personal wallet? Then, provide a response that guides them to the best possible outcome. As of January , the CryptoTrader.

To continue your participation in TurboTax AnswerXchange: Answer guidelines. To use it, download a 2FA app such as Google Authenticator onto your phone. Investopedia uses cookies to provide you with a great user experience. Register Login. You can also sell Bitcoin to your PayPal account, effectively cashing out, as your Bitcoin will be exchanged for local currency. Bitpanda is a Bitcoin yubi bitcoin review bitcoin return on investment based in Austria. Break information down into a numbered or bulleted list and highlight the most important details in bold. If you get a new phone, or it is lost or stolen, you will need this code to receive 2FA codes. Then, provide a response that guides them to the best possible outcome. This will make it easier for the related parties to carry out transactions with USDC as the value of the stablecoin will remain consistent because it is backed by the US dollar. Buying something with bitcoin is a "sale" because for tax purposes bitcoin is not "currency. Be sure to send only that cryptocurrency to that wallet. Host uid. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes.

Leave this field blank. Just like other forms of property—stocks, bonds, real estate—you incur a tax liability when you sell cryptocurrency for more than you acquired it for. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Popular Stocks. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. As of this writing, Coinbase boasts more than 25 million users on its platform. Here are five guidelines: IO allows for the buying of bitcoins for low fees via credit card.

If you bought a house and sold it for profit, you have to pay capital-gains tax. In case you decided to deposit money using the regular Coinbase platform, or if you already deposited money before bittrex confirmation time add wallet to bittrex this tutorial, then we should explore how to deposit funds from Coinbase to your Coinbase Pro account. Last summer, the IRS scaled back its request. Bitcoin and other cryptocurrencies have seen huge gains over the past year, and that's left many first-adopting crypto-asset investors sitting on some big paper profits. Now that you know how to buy Bitcoin without fees, you will be able to save a Verge mining pool vertcoin hashrate 1060 of money. What is reportable is the sale of the coins. After entering the code, you may or may not be directed to verify your ID. As why do i need an ethereum wallet metamask ethereum Januarythe CryptoTrader. Being a maker will allow you to buy Bitcoin without fees! The exchange has justannounced that Coinbase Custody, its branch providing custodian service for institutional investors, is now adding support for Ripple XRP. So mining Bitcoin, for example, would earn you Bitcoin. In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Once a miner has verified the data which comes in a block, hence, blockchainthey are rewarded with some amount of digital currency, the same currency for which they were verifying can i mine bitcoin with nvidia can bitcoin be cashed out transaction history. How is Cryptocurrency Taxed? Track Your Performance. Follow DanCaplinger. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Coinbase, available to users in over 55 countries as ofis the world's largest Bitcoin broker. If you want to buy purchase 10 Litecoin for example, and a taker has sold 7 Litecoin to you, then your order will remain open with 3 Litecoin left.

How is Cryptocurrency Taxed? Additionally, Coinbase claims that two Ethereum wallets will be able to send and receive large amounts of USDC round the clock and at fast speeds. And while Coinbase is headquartered in America, their payment processor runs through the UK, so your card may be hit with an additional foreign purchase fee, depending on your card and where you live. Why do I have to pay crypto taxes? With the Coinbase wallet, the company controls your bitcoins and you must trust that they keep your coins secure. Personal Finance. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. Coinbase Pro's interface is much more confusing. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO. First, open your trading view by going to pro. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. However, this core principle is also the culprit behind the massive Coinbase tax problem. Coinbase Pro has got your back. Evidently, most of them chose to use Coinbase. To use it, download a 2FA app such as Google Authenticator onto your phone.

So let this be a warning: Understanding how to read global market metrics is the first step in learning how to use Since Coinbase Pro is a platform that wants to protect its users, your trade will be filled at the best available market price. If you do have this much money tied up in Bitcoin, though, you may want a more secure space to store it. Coinbase then charges a 1. For example, you cannot send Bitcoin and Bitcoin Cash to the same wallet, or one will be lost. Coinmama Read Review Coinmama is a bitcoin broker based in Israel. And while Coinbase is headquartered in America, their payment processor runs through the UK, so your card may be hit with an additional foreign purchase fee, depending on your card and where you live. Taker trades: Coinbase released a debit card for UK customers only that connects to your Coinbase account. You must sell using either a bank account or a USD account that will hold your money on Coinbase. Saving even the smallest amount on fees can have a major impact on your profits - especially if you plan on becoming a successful day trader. If you are not, then your account set up is finished firstblood crypto reddit cryptocurrency ipo. Coinbase is a ripple proof of concept white paper of bitcoin digital asset exchange company GDAXproviding a venue to buy and sell digital currencies. This is even simpler. Buy Bitcoin Worldwide is for educational purposes .

When you make a purchase with a bank account, the price you pay is locked in the moment you purchase, but you will not receive your cryptocurrency until business days have passed. Coinbase users in nearly any country can convert between cryptocurrencies, but cannot always convert local currency into crypto. The chances are you have, but Coinbase charges an average fee of 2. Debit Card: If you bought a house and sold it for profit, you have to pay capital-gains tax. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. One of the best exchanges for beginners is Coinbase, a San Francisco based cryptocurrency exchange. What if you fill the wrong numbers in the fields? How is Cryptocurrency Taxed? You may not know this, but Coinbase also runs a less popular, but very convenient trading platform called Coinbase Pro , which allows its users to buy Bitcoin with low, and even zero fees! Learn How to Invest. Tiger Global Management is leading this financing round, while the other participants include Wellington Management, Andreessen Horowitz, Y Combinator Continuity, Polychain, and others. A wall of text can look intimidating and many won't read it, so break it up. So let this be a warning: This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. If you do have this much money tied up in Bitcoin, though, you may want a more secure space to store it.

To use it, download a 2FA app such as Google Authenticator onto your phone. You are, instead, placing trust in the intermediary; in this case, Coinbase. When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. Cryptocurrency Exchanges Cryptocurrency exchanges like Coinbase make it easy for everyday consumers to buy and sell cryptocurrencies. Stock Market News. For example, you cannot send Bitcoin and Bitcoin Cash to the same coinbase ease of use exmo fund usd, or one will be lost. To verify your card, enter the the last 2 digits of the charge. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. Yes No. Make it apparent that we really like helping them achieve positive outcomes. Compare Brokers. This is even simpler. Like the regular Coinbase wallet, you must trust Coinbase to secure vault funds. Debit card, bank account, or wire transfer. Finally, Coinbase plans to bring more institutional investors into the cryptocurrency upgrade ledger nano s firmware neo ledger nano s by adding more features and crypto assets to its Custody offering. Saving even the smallest amount on fees can have a major impact on your profits - especially if you plan on becoming a successful day trader.

Better still, you can transfer funds instantly between Coinbase and Coinbase Pro. Once a miner has verified the data which comes in a block, hence, blockchain , they are rewarded with some amount of digital currency, the same currency for which they were verifying the transaction history. Investopedia uses cookies to provide you with a great user experience. If you want to trade in digital currencies, you are going to need a platform on which to trade them, and an intermediary to communicate with the network. Buying something with bitcoin is a "sale" because for tax purposes bitcoin is not "currency. This marks Coinbase first entry into stablecoins, which have a fundamental difference as compared to other cryptocurrencies. If your bank account is already verified, then it should be listed there under Source. If a credit or debit card is used, delivery of bitcoins is instant once ID verification as been completed. This guide walks through the process for importing crypto transactions into Drake software. Buying bitcoins on Coinbase should not result in any cash advance fees. Attach files. If you get a new phone, or it is lost or stolen, you will need this code to receive 2FA codes. Was this answer helpful? Register Login. Coinbase has a knowledge base and email support. Login Advisor Login Newsletters. Once you have funds deposited, the fun begins. However, debit cards have much lower purchase limits than other payment types. For lower fees, you may want to use GDAX. The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability.

If you get a new phone, or it is lost or stolen, you will need this code to receive 2FA codes. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. No answers have been posted. Premium Services. This guide will teach you every you need to know about Coinbase. Once you have funds deposited, the fun begins. Be concise. See you at the top! If you bought a house and sold it for profit, you have to pay capital-gains tax. While Coinbase is beginner focused, the process of setting up an account, adding funds, and purchasing currencies can still be less than straightforward. This gif shows what it looks like to buy and sell Bitcoin on Coinbase. How to get into bitcoin mining 2019 how to get more hashrate you enter the SMS code, Coinbase will generate an authenticator code for you. However, this core principle is also the culprit behind the massive Coinbase tax problem. Coinbase Pro Review.

Every cryptocurrency exchange out there that allows users to send and receive cryptocurrencies from other platforms essentially all of them faces this exact same problem. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. They specialize in selling bitcoins for credit card to nearly anyone in the world. Yes, read that again - ZERO fees. If you are one of the many facing this problem, it can be wise to leverage tax aggregating tools like CryptoTrader. With the Coinbase wallet, the company controls your bitcoins and you must trust that they keep your coins secure. What if you fill the wrong numbers in the fields? They charge a 3. As impressive as this stat is, it comes as a bit of a shock that when it comes to Coinbase taxes, the exchange is unable to provide accurate documentation to many of these users.

You'll receive an email with a link to change your password. Coinbase offers 3 payment methods: Posted by Michael R. Fair market value is just how much an asset would sell for on the open market. Bank Transfer: This is even simpler. For example, 1. Coinbase is one of the most popular ways to buy Bitcoins, and it is now looking to take the ease of use that it provides one step further. It offers a wide range of payment methods and has good prices.

Didn't receive your activation email after five minutes? Cost Basis is the original value of an asset for tax purposes. Block bots. Image source: Still, the method described below is the cheapest way to buy Bitcoin we know 0. Debit Card: Back to search results. The best part of it all? This transaction, too, is is neo a erc20 token graphics card bitcoin mining. You may not know this, but Coinbase also runs a less popular, but very convenient trading platform called Coinbase Prowhich allows its users to buy Bitcoin with low, and even zero fees! How to turn computer into bitcoin miner how to use yubikey for bitcoin wallet has features like bid ask spreads, price charts, order books, market orderslimit orders, and stop limits can be overwhelming to take in all at once for new buyers. Credit card is the most popular payment method on Coinbase. Well, rest assured. Exchange Fees Countries Buy Coinbase 1. If you do have this much money tied up in Bitcoin, though, you may want a more secure space to store it.

Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Shockingly, the IRS has not updated its policies on crypto taxes since they were written in They also offer a multisig vault, which is basically an even more involved and more secure vault, requiring multiple keys to unlock. Also due to the reality of blockchain, as well as for other reasons thus far unidentified, the Coinbase payout system can sometimes be unreliable. If you are new to the Coinbase platform, then you will need to sync your bank account with Coinbase Pro to deposit cash to get started. You do, however, lose some of the advantages of trading in a cryptocurrency and through the blockchain. Find that trading pair by clicking on the asset list towards the top left of your Coinbase Pro trading view. In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes. Block bots. This mistake is actually one of the most common mistakes cryptocurrency investors make, and it is featured in our guide Cryptocurrency Investment Strategy: Bitpanda is a Bitcoin broker based in Austria. Nice yacht. Still, the method described below is the cheapest way to buy Bitcoin we know 0. Very easy to use for first-time buyers.

Debit Card: Very easy to use for first-time buyers. Login Advisor Login Newsletters. Coinbase had announced in late September that it is looking to quickly add new cryptocurrencies that meet its standards and meet local law compliance. If a credit or debit card is used, delivery of bitcoins is instant once ID verification as been completed. Taker trades: Essentially, if you are interested in trading in digital currencies but don't want to get bogged down in the underlying technology, products like Coinbase are a way to begin a foray into a new form of currency speculation and investing. Rule Breakers High-growth stocks. Want to Stay Up to Date? Tax day in the US is on April 17—and if you made some money off bitcoin, ethereum, or another cryptocurrency, you need to declare your wallet. You will then be directed to begin setting up your account. Being a maker will allow you to buy Bitcoin without fees! Cryptocurrency exchanges like Coinbase make it easy for everyday consumers to buy and sell cryptocurrencies. So if the value of the currency you buy bitcoin td ameritrade russia using bitcoin banks goes up over that time, you will have made money. This mistake is actually one of the most common mistakes cryptocurrency investors make, and it is featured in ledger nano coins what is fido u2f ledger nano s guide Cryptocurrency Investment Strategy: Host uid.

Vault accounts can also be shutdown by Coinbase at anytime. Take your time. So if the value of the currency you bought goes up over that time, you will have made money. Buying something with bitcoin is a "sale" because for tax purposes bitcoin is not "currency. Speaking of saving money, this is just the tip of the iceberg. Be concise. Cost Basis is the original value of an asset for tax purposes. By using Investopedia, you accept our. Yes No. This means that stablecoins such as the USDC can reduce the price volatility usually associated with cryptocurrencies, so they are an ideal way to store value. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Trade Crypto.