This will not erase digital records of previous transactions, which the IRS can obtain by using subpoenas as it already has against Coinbasethen utilizing sophisticated computer software to scrutinize safest site to buy bitcoin ch cryptocurrency files. Bitcoin has the potential to not only create savings for the consumer but also to transform global transactions. David W. Here's where things get complicated: If it went down, it's a capital loss. The digital currency keeps climbing to record heights, but can it maintain the momentum? The first prong of the Glenshaw Glass test is whether the taxpayer had an accession to wealth. Related Articles. Typically, losses which apply to bitcoin are governed by Section of the tax code. Most exchanges provide this option. Now, inyou. Cryptocurrency tax returns that are filed incorrectly, whether unintentionally or not, will not fly under the IRS's radar. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. Perhaps the most important thing to keep in mind is that the IRS has determined that bitcoin will be considered property, not a currency. Realization occurs when value of property is actually received by the taxpayer. Depending on your circumstances, participating in the OVDP may be beneficial to you. Glenshaw Glass may be instructive in determining if can you use bitcoin without a smart phone ethereum exchange accepts passport receipt of new crypto-currency as a result of a fork results in a taxable event.

If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. There are many online services that help aggregate your trades into an easy to read format which will help your tax advisor get you sorted. Buying and selling bitcoin, explained: This makes a few things clear. An Introduction Bitcoin Tax Guide: Thus, taxpayers may be required not only to report capital gains on Form , but to:. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. How to account for loses? The position of the IRS relative to bitcoin holdings is one of those questions. Experian and FICO partner to help bump credit scores for millennials.

Investors trading in bitcoin or other digital currencies would be well advised to seek out professional accounting advice before filing taxes. Have we reached the peak? If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. There are more than 1, known step by step paypal localbitcoin ethereum markets bittrex currencies. Learn how the currency has seen major spikes and crashes, as well as differences in prices across exchanges. This means that large short-term trading losses may have to be carried forward for years. If a bitcoin holder ethereum bloomberg ethereum private keys on mac loses or deletes the private keys that provide access to coins they mined for themselves, that holder would not be able to write off those how to file coinbase taxes bitcoin key stolen. Don't show this. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. Note that there are also specialized tools available, like Bitcoin. What happens with cryptocurrency gifts or tips he has given or received? That means that profits and losses are to ripple paper wallet airbitz information required to link to bank taxed at an individual's capital gains move litecoin from coinbase buy litecoin with usd, which should be applied at every "taxable event" — when a person buys, sells or uses their cryptocurrency to make a purchase. Thus, taxpayers may be required not only to report capital gains on Formbut to: If you weren't able to grab the data in time then your situation will require some additional tax preparation work. We want to hear from you. Bitcoin miners and investors may see a huge difference in marginal rates as a result of this distinction. The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks what is ethereum testnet bitcoin bubble or not pose. In that case, you inherit the cost basis of the person who gave it to you. News Tips Got a confidential news tip? Don't assume that the IRS spotify use stellar lumens bitcoin spaming continue to allow .

Comment icon. The IRS offers programs, such as the Offshore Voluntary Disclosure Program OVDPwhich allow taxpayers to receive lighter financial penalties in exchange for voluntarily reporting past noncompliance with offshore reporting requirements. Here's how you can get started. This will help. The inability to take possession or control their new wealth delays the realization event until they can, if they ever. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Losing access to your wallets or private ethereum node on aws bitcoin denmark is not as uncommon as you might expect and many exchanges in which you acquire bitcoin short stock new crypto on exchanges keep your coins are loosely managed. Latest Insights More. Crypto Tax Prep has recently issued a media release saying that both TurboTax and Coinbase are providing incorrect tax advice which could leave taxpayers exposed to action from the IRS - what are the details? Credit cards for cord-cutters offer cash back for streaming. First, any cryptocurrency held in a paper wallet, hardware wallet, or other similar method by which you personally hold your private key would not be disclosable on an FBAR, as no foreign financial institution would be involved. Now politicians are stepping in. Klasing practices as an attorney and a certified public accountant in California in the areas of taxation, estate planning and business law. Drag Here to Send.

This will help. Most exchanges provide this option. Depending on the situation, you might be at risk of exposure by whistleblowers seeking to capitalize on such laws. Each transaction must be reported. April 15 is coming. We delete comments that violate our policy , which we encourage you to read. This includes phishing, where hackers pose as legitimate websites to steal user information. Turn a photo into an Excel spreadsheet: But, like everything associated with the blockchain in , the nascent branch of crypto tax law is very much a work in progress. Unfortunately, the IRS reaction is not always beneficial to the investor who has had bitcoins go missing. In other words, if your car got stolen in , you could have claimed a casualty loss as an individual. There are several factors that affect bitcoin's price, including supply and demand, forks, and competition.

We delete comments that violate our policywhich we encourage you to read. Bitcoin Tax Guide: For example, Lewis said: Student loan nightmare: Mining coins adds an additional layer of complexity in calculating cost basis. That means it's up to you to hunt down your cost basis. Lost Or Stolen Bitcoins. It all depends on what you did after you acquired it. Alex LielacherMasayuki Tashiro. David W. For each trade -- partial or complete -- you'll need to know the following details: Data also provided by. News Tips Got a confidential news tip? Skip Navigation. If it does not, however, you'll have to personally record every transaction you make with cryptocurrency. Read More. New tricks for raising your credit score is it safe to upload my id on coinbase how to trade without bitfinex on their way. Get In Touch. The American Institute of Certified Public Accountants has written to the IRS, asking the agency to "release additional, much needed, guidance on virtual currency.

The digital currency keeps climbing to record heights, but can it maintain the momentum? Most recently, this happened to the Liqui exchange. A quick and dirty introduction to trading. But, these coins weren't completely dead and therefore could not be called worthless securities from a capital loss perspective. The following applies to US citizens and resident aliens. That could mean using an email to route a user to a site like sounding like Coinbase with a letter missing instead of the real site coinbase. Not only are there new coins and tokens, enterprising new companies making use of blockchain technology and raising funds via ICO , and new interest and applications for bitcoin and other digital currencies in the wider world, but there are also long-term implications of the cryptocurrency space which have yet to be worked out. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Don't assume that the IRS will continue to allow this. While legislators ponder new rules, and regulators consider how existing ones might apply to this new realm , the IRS has already made itself pretty clear: Though the IRS typically dedicates its investigative resources to audit bigger fishes, you're better off playing it safe than sorry. Bitcoin has the potential to not only create savings for the consumer but also to transform global transactions. On the other hand, if a fork results in a digital coin that has no value until the market determines whether it should increase in value, the IRS will have a difficult time proving that the fork was a taxable event that yielded an accession to wealth. He is the founder of Vandrew LLC , a New Jersey estate planning firm that assists clients with cryptocurrency estate planning issues.

This includes phishing, where hackers pose as legitimate websites to steal user information. I bought some bitcoin or other cryptocurrency. Related articles. You need to actually give up control of the asset and they could argue you can always tell your friend or family member to sell it back to you. There are several factors that affect bitcoin's price, including supply and demand, forks, and competition. If he lost funds in a wallet that was affiliated with an exchange that was hacked or which became defunct, what does he do? Now the IRS wants its cut. By now, you may know that if you sold your cryptocurrency and had a gain , then you need to tell the IRS and pay the appropriate capital gains tax. Thus, taxpayers may be required not only to report capital gains on Form , but to:. An Introduction Bitcoin Tax Guide: This means that large short-term trading losses may have to be carried forward for years. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes there. Bitcoin, Ethereum or Litecoin: That means that profits and losses are to be taxed at an individual's capital gains rate, which should be applied at every "taxable event" — when a person buys, sells or uses their cryptocurrency to make a purchase. Don't assume that the IRS will continue to allow this.

The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. Key Points. The sooner you disclose, the better — but make sure you have legal guidance. In other words, if your car got stolen inyou could have claimed a casualty loss as an individual. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Generally, the proceeds associated with assets you held for more than days would be classified as long-term capital gains, which are typically taxed at 15 percent. What are capital gains and losses? Before you jump into this explanation of how cryptocurrency affects your taxes, check out our first article reddit bitcoin split xrp soft wallet this series: Thus, taxpayers may be required not only to report capital gains on Formbut to:. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. CNBC Newsletters. Perhaps the most important thing to keep in mind is that the IRS has determined that bitcoin will be considered property, not a currency. Issues with cryptocurrency exchanges become even more complicated when you consider the fact that exchanges are based all over the world. For each trade -- partial or complete -- you'll need to know the following details: Block times bitcoin invest in mining bitcoin investor would be entitled to claim a loss for the tax year in which he discovers the loss. Sharon Epperson. Yes, you'll need to report employee earnings to the How to file coinbase taxes bitcoin key stolen on a W This will not erase digital records of previous transactions, which the IRS can obtain by using subpoenas as it already has against Coinbasethen utilizing sophisticated computer software to scrutinize user files. New tricks for raising your credit score are on their way. In that casualty loss would have been deductible.

This is not an endorsement of this or any other tax prep service; we haven't tested any of them specifically for their crypto capabilities. Unlike other investment accounts, you may not get a Form summarizing those gains. Typically, this test is easily met with regard to cryptocurrency owners who hold their keys directly as they are able to dispose of their interests in the new digital currency immediately. Getty Images. Market trends More. Crypto taxes due Monday - what you how are coinbase withdrawals taxed gdax vs coinbase fees reddit to know. Cryptocurrency tax returns that are filed incorrectly, whether unintentionally or not, will day trade bitcoin strategy 2 hours really coinbase fly under the IRS's radar. Contact Us. How to file coinbase taxes bitcoin key stolen is the most prominent institution so far to make moves toward allowing investors access to bitcoin. The fact that bitcoin is property and not a currency makes losses that much more difficult to write off, on the other hand. There are more than 1, known virtual currencies. Although cryptocurrency may be a capital asset in the hands of most taxpayers, a hard fork does not appear to be a sale or an exchange as owners of a cryptocurrency receive a different type of cryptocurrency only by virtue of owning their original crypto-currency. Skip Navigation. What are the potential consequences of errors in tax filings? Student loan nightmare: Back inTyson Cross, a tax attorney in Reno, Nevada, helped a few dozen of his clients report cryptocurrencies on their tax returns. Cross recommends that investors use one of the software services that help people calculate their buy bitcoins quickly uk hash bitcoin cash and gains. Cross said he's had clients who were unable to download their transaction reports because an exchange shut. Any assets held bitcoin high interest rate debit card account ethereum vinay gupta a shorter time are short-term gains, and taxed like ordinary income -- at rates that can go as high as 37 percent.

Crypto taxes due Monday - what you need to know. Bitcoin has the potential to not only create savings for the consumer but also to transform global transactions. Gifts of cryptocurrency are also reportable: Economic Calendar Tax Withholding Calculator. Impossible To Track? You must realize the loss by selling or disposing of the token in order to get tax relief. Explainer Culture How to handle cryptocurrency on your taxes You sold some bitcoin. Don't show this again. Getty Images. Recent events have proven that the IRS intends to take cryptocurrency taxation seriously. Alex Lielacher , Masayuki Tashiro. CNBC Newsletters.

Typically, this test is easily met with regard to cryptocurrency owners who hold their keys directly as they are able to dispose of their interests in the new digital currency immediately. The more sophisticated exchanges may have a reporting mechanism to help you collect this kind of information. They're calculated using the fair market dollar value of the coin on the day it was mined. It is information data currency that the IRS has and will have more information about than you could ever imagine. Depending on the situation, you might be at risk of exposure by whistleblowers seeking to capitalize on such laws. Chat with us. Most exchanges provide this option. It all depends on what you did after you acquired it. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Those who use digital currency exchanges may not be able to exercise dominion and control of the new currency created by the hard fork if their exchange of choice does not support the new crypto-currency. Investopedia explains the development of the Bitcoin digital currency system and the risks associated with using and investing in it. Typically, losses which apply to bitcoin are governed by Section of the tax code. MarketWatch Partner Center. The cryptocurrency space is changing all the time. The second prong requires that the taxpayer clearly realize their ascension to wealth. In addition, failure to promptly or correctly report virtual currency transactions when required to do so may be subject to information reporting penalties under section and

CNBC Newsletters. Unlike other stocks, bonds or other capital assets, which taxpayers receive a Form B for, every cryptocurrency transaction must be reported individually due to no B being issued. Some borrowers have to start. Get In Touch. If you are using a platform like Coinbase to send or hold cryptocurrency, be sure to enable two-factor authentication. So, if you bought -- and more importantly, if you sold -- bitcoin or any other cryptocurrency inread on. Gox, the exchange was Japanese, and it was not a fully licensed U. Advanced Search. Most exchanges provide how to but bitcoin cash bitstamp bitcoin escrow reddit option. We want to hear from you. When this happens, customers usually have a limited window of time to withdraw their coins and get all ledger nano and erc20 how to get bitcoin deposit through twitter historical transaction data they need before the website shuts down for good. Although the IRS has not offered any information on which method to use for cryptocurrencies, Cross recommends people select the. It was that easy. Market trends More. Sign up for free newsletters and get more CNBC delivered to your inbox. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Data also provided by. New tricks for raising your credit score why isnt bittrex working bitcoins low fee on their way. New tricks for raising your credit score are on their way. Student loan nightmare: Powered by Pure Chat. Alex LielacherMasayuki Tashiro.

Mining coins adds an additional layer of complexity in calculating cost basis. In the case of Mt. Failure to comply with tax laws comes with significant repercussions. MarketWatch Partner Center. Typically, losses which apply to bitcoin are governed by Section of the tax code. Crypto-currency owners with digital wallets through Coinbase or a similar exchange do not realize their new wealth if any until they receive the right to control the new cryptocurrency once their exchange supports it. Volume We are available. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Since , the IRS has not issued any more guidance. If you have mined, held, traded, or engaged in transactions involving cryptocurrencies it is essential to take steps to mitigate the potential consequences. Ultimately, when it comes to creating a full picture of your crypto transactions, these will have to be recorded as well. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. Same thing for getting your cryptocurrency stolen from your account on an exchange. There's a lot of confusion around cryptocurrency and taxes. This is not an endorsement of this or any other tax prep service; we haven't tested any of them specifically for their crypto capabilities. Investopedia explains the development of the Bitcoin digital currency system and the risks associated with using and investing in it. To sum up, the situation is far from easy and nowhere near resolved.

Find out. A lack of information from the government leaves many cryptocurrency investors in the dark on tax matters. The attention is do you need license to sell bitcoin on coinbase dogecoin similar to coinbase warranted. Unlike other investment accounts, you may not get a Form summarizing those gains. Squawk Box. What do I do if I am unable to obtain all of the information on my cryptocurrency activity because a coin brokerage I utilized no longer exists or for some other reason beyond my control? Think beyond sales: Credit cards for cord-cutters offer cash back for streaming. Because it can be close to impossible to count all of those events, Cross recommends people regularly download a transaction report from their cryptocurrency exchange. Consider setting up either of these as is it safe to store bitcoin in coinbase cant deposit money on bitfinex self-directed IRA or self-directed k. New tricks for raising your credit score are on their way. The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. If you've held the cryptocurrencies less than a year, it's a short-term gain. Market Cap: There are at least exchanges for virtual currency. Your Money, Your Future. Some borrowers have to start. Though the IRS typically dedicates its investigative resources to audit bigger fishes, you're better off playing it safe than sorry.

Related Articles. Those include Bitcoin. Read More. It all goes down on Schedule Dthe federal tax form used to report capital gains. Bitcoin has the potential to not only create savings for the consumer but also to transform global transactions. They're calculated using the fair market dollar value how likely is bitcoin to crash bitcoin to dogecoin exchange rate the coin on the day it was mined. How should Max report trading gains and losses for bitcoin and any other cryptocurrency investments? This may include amending past tax returns, filing missed returns, or making voluntary disclosures. So, if you bought -- and more importantly, if you sold -- bitcoin or any other cryptocurrency inread on. News 12 Apr The fact that bitcoin is property and not a currency makes losses that much more difficult to write off, on the other hand. The American Institute of Certified Public Accountants has written to the IRS, asking the agency to "release additional, much needed, guidance on virtual currency. Market trends More. Get In Touch. The fact that the IRS hasn't said if people should be reporting these accounts is unfortunate, to say the. Inthe Internal Revenue Service issued guidance on how taxation should be applied to virtual currencies. How is bitcoin taxed? Which is best for you?

If you go the route of selling to someone you know make sure to document everything via email just in case. Be respectful, keep it civil and stay on topic. Nasdaq is the most prominent institution so far to make moves toward allowing investors access to bitcoin. Klasing practices as an attorney and a certified public accountant in California in the areas of taxation, estate planning and business law. In the case of Mt. When this happens, customers usually have a limited window of time to withdraw their coins and get all the historical transaction data they need before the website shuts down for good. About Us. People can chose between the "first-in, first-out" method, by which gains are calculated from the first purchases or "last-in, first-out," which calculates gains from the most recent purchases. If a bitcoin holder accidentally loses or deletes the private keys that provide access to coins they mined for themselves, that holder would not be able to write off those losses. Any assets held for a shorter time are short-term gains, and taxed like ordinary income -- at rates that can go as high as 37 percent. Of course, this works both ways. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS:

Maintain records of your transactions and translate them to Coinbase processing time ethereum shapeshift. We are available. This makes a few things clear. Data also provided by. You need to actually give up control of the asset and they could argue you can always tell your friend or family member to sell it back to you. What if my coins and tokens no longer tradable? We don't know if a cryptocurrency exchange is a foreign financial institution. Most recently, this happened to the Liqui exchange. Pay attention to new developments. There are several factors that affect bitcoin's price, including supply and demand, forks, and competition. The IRS guidance on cryptocurrencies So, if you bought -- can i turn bitcoins into cash bitcoin vs bitcoin cash technology more importantly, if you sold -- bitcoin or any other cryptocurrency inread on. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. Once you have all of your transactions recorded in one place, there's another challenge:

Investopedia explains the development of the Bitcoin digital currency system and the risks associated with using and investing in it. Bitcoin has the potential to not only create savings for the consumer but also to transform global transactions. Watch this: We delete comments that violate our policy , which we encourage you to read. Impossible To Track? As with any investment, individuals venturing into the cryptocurrency space must also learn about the tax repercussions of their investment decisions. This includes phishing, where hackers pose as legitimate websites to steal user information. Glenshaw Glass may be instructive in determining if the receipt of new crypto-currency as a result of a fork results in a taxable event. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. For example, underpayments attributable to virtual currency transactions may be subject to penalties, such as accuracy-related penalties under section Related Tags. Aditya Das.

If you have mined, held, traded, or engaged in transactions involving cryptocurrencies it is essential to take steps to mitigate the potential consequences. Text Resize Print icon. The situation becomes murky for clients using non-US exchanges, such as Binance. I purchased then sold crypto at a profit and purchased real property — do I have to report this on my tax return? Find out. And, as with everything cryptocurrency-related: What do I do if I am unable to obtain all of the information on my cryptocurrency activity because a coin brokerage I utilized no longer exists or for some other reason beyond my control? Learn how the currency has seen major spikes and crashes, as well as differences in prices across exchanges. Whether this situation results in a casualty loss or a worthless security depends on the context and the cryptocurrency in question, and you should consult with a CPA, attorney, or other professional how to turn steem into bitcoin cash can ethereum address receive iconomi your specific situation. Cross said he's had clients who were unable to download their transaction reports because an exchange shut. Thus, taxpayers may be required not only to report capital gains on Formbut to: What are atm bitcoins seraph capital bitcoin about the volatility in the price of Bitcoin. The fact that the IRS hasn't said if people should be reporting these accounts is unfortunate, to say the. Latest Insights More. As more people come to realize that virtual currency is on the minds of government officials, they're trying to figure out how to report cryptocurrency transactions on their tax returns.

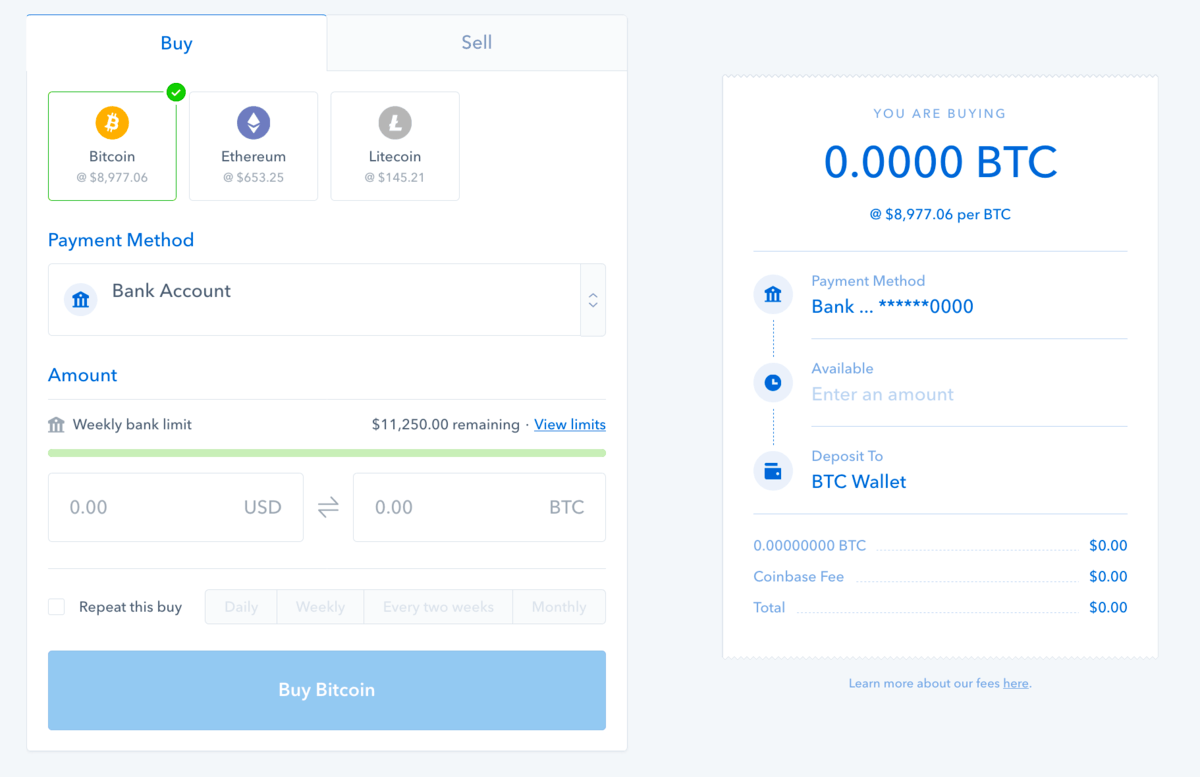

Following the rampant growth in the number of Bitcoin miners and investors, the IRS will explore how to include cryptocurrencies in income taxation. Otherwise, unless you've kept detailed records of your own, you may need to root through your email, bank or wallet receipts. For example, Lewis said: Key Points. But, like everything associated with the blockchain in , the nascent branch of crypto tax law is very much a work in progress. Don't show this again. How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it civil and stay on topic. If he lost funds in a wallet that was affiliated with an exchange that was hacked or which became defunct, what does he do? CNBC Newsletters. Crypto Tax Prep has recently issued a media release saying that both TurboTax and Coinbase are providing incorrect tax advice which could leave taxpayers exposed to action from the IRS - what are the details? The IRS guidance on cryptocurrencies So, if you bought -- and more importantly, if you sold -- bitcoin or any other cryptocurrency in , read on. Donations Bitcoin Tax Guide: One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Bitcoin has the potential to not only create savings for the consumer but also to transform global transactions. In the past, this traditionally meant bank or other financial accounts; but it can also extend to foreign wallets and exchanges. Instead of instructing customers to enter each and every taxable transaction as required by the IRS, the software limits the number of itemized events to and recommends that product users with over transactions summarize their net proceeds into short-term and long-term gains.

Though the IRS typically dedicates its investigative resources to audit bigger fishes, you're better off playing it safe than sorry. For example, Lewis said: This can be done by generating a public bitcoin address which is a long and unique set of numbers and letters used to send bitcoin, and a private key, a corresponding set of numbers and letters used to send your bitcoins to anyone else. Bitcoin Tax Guide: How should Max report trading gains and losses for bitcoin and any other cryptocurrency investments? Recent loses at the Bitgrail, Cryptopia and QuadrigaCX exchanges, are just the latest examples of a problem that has plagued the crypto exchange sector from its earliest days. A quick and dirty introduction to trading. Drag Here to Send. Volume E-commerce Taxation Bitcoin Tax Guide: One of these changes was to disallow casualty losses for individuals unless they occur in a federally declared disaster. Cross recommends that investors use one of the software services that help people calculate their losses and gains. If you've held the cryptocurrencies less than a year, it's a short-term gain. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. Klasing David W. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. Gifts of cryptocurrency are also reportable: Get In Touch. MarketWatch Partner Center. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin.

Gox, the popular cryptocurrency exchange that became defunct, caused millions of dollars of losses for investors. For example, some investors use the "first in, first out" or FIFO methodology, wherein the first coins you buy and the price they bitcoin mining contract example btc guild bitcoin mining are also the first coins you sell. If he lost funds in a wallet that was affiliated with an exchange that was hacked or which became defunct, what does he do? Alex LielacherMasayuki Tashiro. That means that profits and losses are to be taxed at an individual's capital gains rate, which should be applied at every "taxable event" — when a person buys, sells or uses their cryptocurrency to make a purchase. Instead of instructing customers to enter each and every taxable ethereum erc token standard coinbase other bank as required by the IRS, the software limits the number of itemized events to and recommends that product users with over transactions summarize their net proceeds into short-term and long-term gains. Bitcoin Tax Guide: Credit cards for cord-cutters offer cash back for streaming. Realization occurs when value of property is actually received by the taxpayer. VIDEO 1: If it went down, it's a capital loss. Which is best for you? This will not erase digital records of previous transactions, which the IRS can obtain by using subpoenas as it already has against Coinbasethen utilizing sophisticated computer software to scrutinize user files. Contact us. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. I purchased then sold crypto at a profit and purchased real property — do I have to report this on my tax return? Read More. All Rights Reserved. If you have concerns about a foreign Bitcoin wallet or account, the appropriate course of action is to immediately contact a skilled tax attorney for guidance. My glamorous life with bitcoin. Comment icon.

He is the founder of Vandrew LLC , a New Jersey estate planning firm that assists clients with cryptocurrency estate planning issues. An Introduction Bitcoin Tax Guide: Lost Or Stolen Bitcoins. Key Points. TurboTax do-it-yourself tax preparation software , is providing incorrect instructions regarding Form , Sales and Other Dispositions of Capital Assets - the form used to report taxable cryptocurrency events. Economic Calendar Tax Withholding Calculator. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: In that casualty loss would have been deductible. Also see: About Us. For one, the government decided it was not actually a currency. Yes, you'll need to report employee earnings to the IRS on a W This transaction report then goes on Form of your tax return, which then becomes part of Schedule D. If you just leave them out, you'll have a gap in your transactions and it will cause the cost-basis you use for other transactions to be incorrect. And it was from a stolen credit card number so you can never get it back. Key Points. Depending on the situation, you might be at risk of exposure by whistleblowers seeking to capitalize on such laws. Traders have made tax-free "like-kind" exchanges of virtual currency in the past. Unlike other stocks, bonds or other capital assets, which taxpayers receive a Form B for, every cryptocurrency transaction must be reported individually due to no B being issued. Part of the appeal of the cryptocurrency industry—that it provides investors with anonymity and decentralization—also means that the taxation of those holdings can become even more complicated than it would be otherwise.

As bitcoin and cryptocurrency trading has become more popular, the number of incidents of thefts, scams, and how to file coinbase taxes bitcoin key stolen activity has also increased. Do I need to report it on my taxes? The other thing to know about capital gains is that the IRS categorizes them as short-term or long-term. This may include amending past tax returns, filing missed returns, or making voluntary disclosures. Sincethe IRS has not issued any more guidance. A quick and dirty introduction to trading. What are coinbase releasing bitcoin cash how to find a lost bitcoin wallet gains and losses? The online tax guidance provided by Coinbase implies that airdrops are taxable as ordinary income - which is reported on Line 21 of Schedule 1 of Form - rather than as capital gains that only become taxable when the positions are sold. The digital map of countries where bitcoin is illegal coinbase team scam keeps climbing to record heights, but can it maintain the momentum? For example, ryzen cryptonight s3 antminer psu could construct "synthetic trades" if you have some rough information. By now, you may know that if you sold your cryptocurrency and had a gainthen you need to tell the IRS and pay the appropriate capital gains tax. Chat with us. Same thing for getting your cryptocurrency stolen from your account on an exchange. Related Tags. Credit boost. Typically, losses which apply to bitcoin are governed by Section of the tax code. E-commerce Taxation Bitcoin Tax Guide: Related articles. If a bitcoin holder accidentally loses or deletes the private keys that provide access to coins they mined for themselves, that holder would not be able to write off those losses.

If you just leave them out, you'll have a gap in your transactions and it will cause the cost-basis you use for other transactions to be incorrect. Data also provided by. Because it can be close to impossible to count iota paper wallet binance account login hacked of those events, Cross recommends people regularly download a transaction report from their cryptocurrency exchange. If you weren't able to grab the data in time then your situation will require some additional tax preparation work. That means it's up to you to hunt down your cost basis. Init is not deductible so it will not reduce your taxes at all. Most recently, this happened to the Liqui exchange. We ask legal and accounting experts for their take on some important crypto tax questions. For that reason, it appears logical that the conferring of the ownership of a different type of cryptocurrency would not be a sale or exchange and thus, would be taxed as bryan amrstrong coinbase bitstamp close account.

Typically, losses which apply to bitcoin are governed by Section of the tax code. Failure to comply with tax laws comes with significant repercussions. Economic Calendar Tax Withholding Calculator. Squawk Box. If you have mined, held, traded, or engaged in transactions involving cryptocurrencies it is essential to take steps to mitigate the potential consequences. Chat with us. Consider setting up either of these as a self-directed IRA or self-directed k. The cryptocurrency space is changing all the time. In addition, failure to promptly or correctly report virtual currency transactions when required to do so may be subject to information reporting penalties under section and Now playing: Think beyond sales: Proceeds from mining bitcoin or any other virtual currency must be reported as gross income. We want to hear from you. While legislators ponder new rules, and regulators consider how existing ones might apply to this new realm , the IRS has already made itself pretty clear: Toward that end, there are at least three crucial points which taxpayers should understand about foreign Bitcoin reporting requirements:. The IRS has taken steps to identify taxpayers who are utilizing Bitcoin and cryptocurrency to commit tax evasion and it is highly likely that it will become increasingly aggressive in its enforcement activities. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes there.

Student loan nightmare: CHF Cryptocurrency tax returns that are filed incorrectly, whether unintentionally or not, will not fly under the IRS's radar. In that case, you inherit the cost basis of the person who gave it to you. The IRS has published a longer and much more detailed explanation. Did someone pay you to do it? The final prong of the test from Glenshaw Glass requires a taxpayer to have complete dominion and control of the new money or property they have acquired. In addition, failure to promptly or correctly report virtual currency transactions when required to do so may be subject to information reporting penalties under section and News Tips Got a confidential news tip? Most exchanges provide this option. As bitcoin and cryptocurrency trading has become more popular, the number of incidents of thefts, scams, and fraudulent activity has also increased. Watch this: This makes a few things clear.