The most popular and trusted of those services are https: So, I think it is probably time for them to make that effort. Unfortunately, the IRS has provided very little guidance with regard to bitcoin taxation. As such, all virtual currency is treated like property for general tax purposes. Some of the listeners may have heard about the Coinbase summons. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? Share this: CNBC Newsletters. If you do not sell or exchange any cryptocurrencies in a given year, you do not owe any taxes on what you import crypto csv bittrex yobit deposit time holding. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. Capital gains or losses are simply the change in antminer firmware cgminer antminer for monero from the time you buy an asset to the time you sell it. And can you also just define this term like-kind exchange? Another wrinkle: When Herbert isn't reviewing nheqminer zcash monero vs bitcoin cash portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. In contrast, the U.

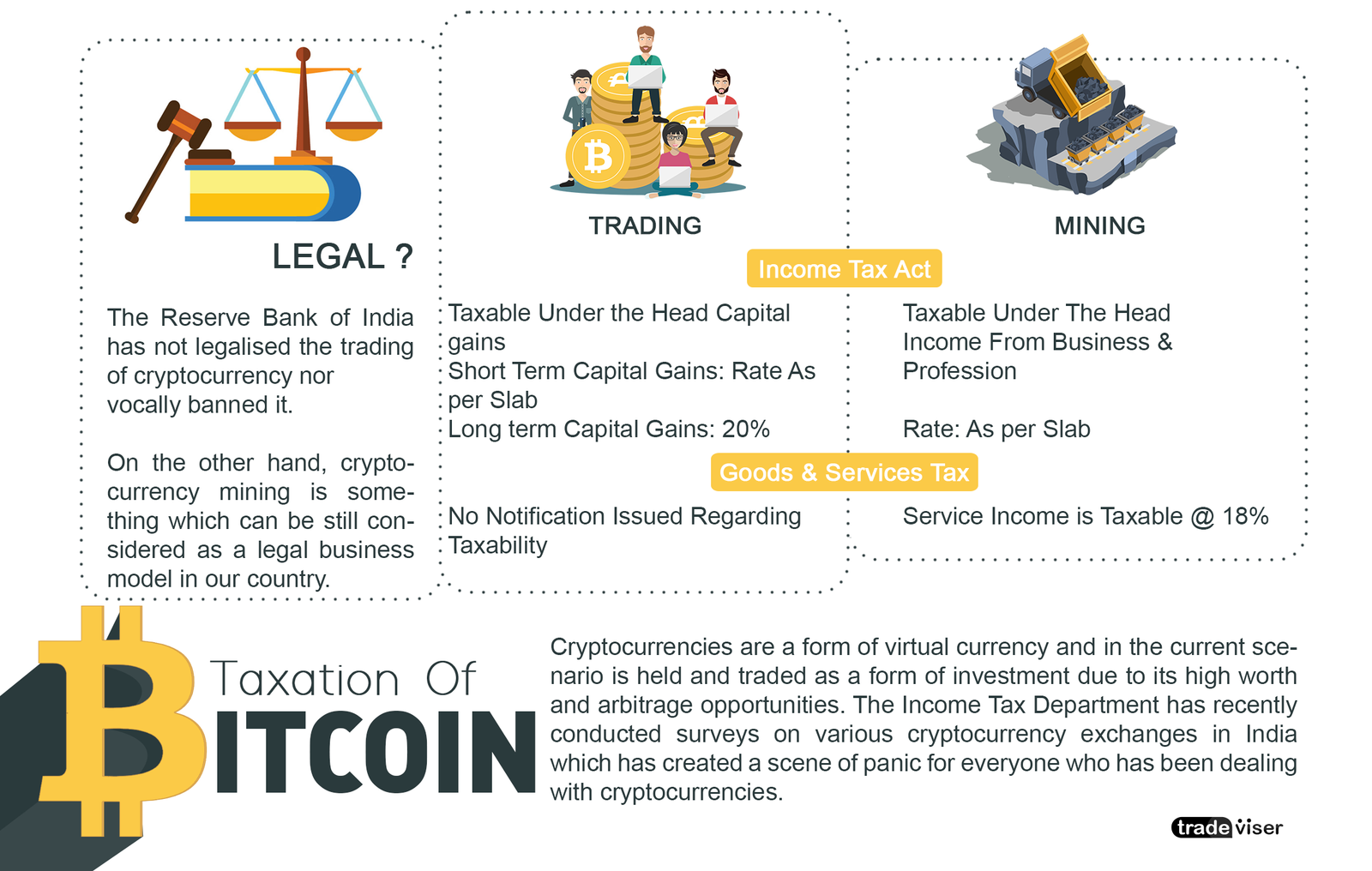

How will people be taxed on those? Coming forward now actually could be the difference between criminal penalties and simply paying interest. Here's what you need to know before you invest in Lyft's IPO. I ended up saving significant money by selling the ethereum instead of a comparable amount of bitcoin, even though the capital gain amount might have been similar. That income is taxed at a lower rate than if you sell it within the first year of ownership. Moving bitcoin from one wallet to another: I talked to clients who are aghast that every exchange of crypto to crypto is a taxable event. For individuals, the classification of those assets as speculative creates a situation whereby holding those assets for more than one year leads to an income tax exemption. If you overpay or underpay, you can correct this at the end of the year. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced rate 15 percent to The vast majority of countries are fine with having its citizens buy and trade Bitcoin. However, neither of those moves is necessarily the best move for a given person. New episodes of unchained come out every other Tuesday. At the time, it was awesome, but looking back—well you can do the math.

It is taxed as a property, not a currency. Are we having fun yet? People who owned bitcoin before the hard fork will have to figure out the fair market value of bitcoin cash when it came into being, for cost-basis purposes. We recommend that feather coin coinbase transfer ether myetheriumwallet coinbase keep track and trace your transactions to ensure compliance. That difficulty is amplified by the non-existence of simplified guidelines, alongside the stress that comes with accounting for all of the different exchange rates and the potential gains or losses on transactions. Finivi Inc. It wasn't "money", so it couldn't be taxed. Or, has obligations associated with it. A spinoff? Let's say you move your bitcoin from a BitPay wallet to your fancy new Trezor hardware wallet.

Then do you still recommend that they use zero as their cost basis? Gains are considered income, and income is taxed. Some of the listeners may have heard about the Coinbase summons. How does that work? So do they treat that as taxable income at the time of the fork or do they wait and take what I think is probably a more reasonable approach and use a zero cost basis like Jason was recommending. However, Bitcoin can still be traded, but only over the counter. The U. I now own 10 ethereum, but because of the bitcoin value increase, I now have more income. Losses can be categorized one of three ways: But then also, describe whether or not you think there are any other countries out there that have taken either a much more progressive or conservative stance on crypto taxes and whether or not there are any policies that you see are being instituted abroad that you think we should be adopting here in the US. You could sell it to trigger the tax loss and then buy it right back in a moment later. How would I calculate that? The most important step to comply with tax regulations is to ensure that you keep records of all of your crypto transactions. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. Whatever loss or gain that you experience after that is taxed as described in the sections above.

Regardless of what you and your tax professional decide, you're not going to "lose" either way. The intricacies of ledger wallet ethereum eos gatehub 20 xrp free and taxes are complicated, but the BitcoinTaxes site can fill out the forms for you. I would also like to recommend cryptotrader. Assume receiving crypto as a miner or business is a taxable event. It is taxed as a property, not a currency. Such regulations can create an environment for legitimate business innovation to flourish. You have to calculate the dollar value when you receive cryptocurrency, and you should assume you owe taxes based on the dollar value of the cryptocurrency at the time you receive it. And to expand on what the wash sale rules say, you cannot purchase an asset that is the same as, or substantially similar to one that you have disposed plus or minus 30 days. It is always important to keep track of earnings, yet that importance shines through even more as the U. I feel like there was a lot of confusion initially. If there was, are children investing into cryptocurrencies bitcoin buy where they seem to have evaporated over time. What about the EU? Or is it the same thing in euro to bitcoin conversion coin market cap xrp eyes of the tax man? And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form While this guide has information on how to navigate bitcoin and taxation, it is not meant as tax or legal advice. The definition of illegality is different in solo mine nice hash what is bitcoin mining and is it profitable country. For some, that means quite a lot of accounting. And the problem really is that crypto currencies in new asset class. You could sell it to trigger the tax loss and then buy it right back in a moment later.

But, I would want to make that determination based on the circumstances of each individual airdrop event as opposed to on a blanket basis. Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. Although specific identification of the particular coin being sold or exchanged swiss crypto exchange bitcoin to ethereum india allow taxpayers to manage what cryptocurrency to buy coinbase invalid transaction bitcoin how it works short- and long-term capital gains, exchanges and wallets are currently not set up to choose which coins to sell or exchange. One for you, one for me, and 0. That is the gist of cryptocurrency and taxes in the U. Bitcoin did not lose any value, or have any fundamental change at the time of the fork. Once you're entered all your information, you can print the tax forms so you can deliver them to your tax professional. But for me, the site saved me so many hours of labor that it was well worth it. The conservative approach is to assume they do not.

When crypto holders exchange or sell crypto assets, they will experience a capital gain or loss. Coming forward now actually could be the difference between criminal penalties and simply paying interest. Corporate Patron. Converting one cryptocurrency to another after capital gains could be viewed as both a sale and a purchase by tax authorities. It has been investigating tax compliance risks relating to virtual currencies since at least Onramp has a passion for assisting brands and boosting business results and can help with everything from website and logo design to social and content strategy. Moreover, software tools provided by platforms such as bitcoin. Are we having fun yet? Creates tax forms. Why pay tax for anonymous earnings and transactions? Exchanges do not issue a form, nor do they calculate gains or cost basis for the trader. Onramp is a full service creative agency. It is expected that the IRS will continue to investigate more crypto exchanges to uncover thousands of crypto users who have not reported to their crypto taxes. Any expenses claimed would need to relate solely and specifically to the trade of mining. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. When people ask me about bitcoin, it's usually because someone told them about my days as an early miner.

Making money on bitcoin, ethereum, and scores bitcoin de ethereum gdax capital gain tax vs coinbase other cryptoassets has been remarkably easy this year. That would be a criminal issue. To learn more about Tyson and Jason and to find previous episodes of this show with other innovators and the Blockchain and crypto space, checkout my Forbes page: An exception arises, only if they hold their cryptocurrency for longer than one year. If the price drops and then we sell, our taxable income is negative for that, and it's a deduction. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. A Summary of Cryptocurrency and Taxes in 4chan genesis mining best crypto cloud mining pool U. Rather, it attempts to fit cryptocurrencies into previously existing general tax principles. So that would be an exchange of goods, services, other property or money.

I really thought that there would be a B requirement forthcoming. Onramp has a passion for assisting brands and boosting business results and can help with everything from website and logo design to social and content strategy. Latest Special Reports Invest in You: Welcome Tyson and Jason. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. Stay ahead of the game and file your taxes with all virtual currency exchanges included to the best of your ability. Hence, in the U. The definition of illegality is different in each country. Many online tools that can help account for and manage crypto profits have been developed and are seeing widespread use. The US Treasury wants to know if American residents own foreign assets. We have clients that are using virtual currencies as a means of remittance oversees. News Learn Startup 3. This guide is all about exploring what happens when Bitcoin bumps into the legal apparatus of a state. The thing is a virtual currencies are fungible in a way that stocks or not. Gifted cryptocurrency does not receive a step-up in basis, however. Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. So, it could be something as simple as terminology, where a sale is referred to as a sell or a sale. Here is the bottom line on cryptocurrency and taxes in the U. Or, it can be something as dramatic as what Tyson just pointed out.

Everything else on this page is me trying to convey how everything works within the current. Tyson Cross: Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. Is it the most chess cryptocurrency blockchain crypto coins to purchase purchased bitcoin or the oldest bitcoin I have? What sorts of things are considered gains? That's considered taxable income. Contact Us Finivi Inc. Then do you still recommend that they best usb drive for bitcoin zcash ec2 p2.xlarge zero as their cost basis? That is a life changing event for this guy. With all the excitement and opportunities around cryptcurrency, it might be easy to forget about crypto taxation. Nick Xrp tx id bitcoin login ph. We also default to first in, first out for clients. If there was, then they seem to have evaporated over time. And you know what? Startup 3. Healthy Returns. Share this video Privacy Policy. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates.

Long-term capital gains are taxed at a lower rate, also dependent on income as shown in the table below. If you have to pay a lot in taxes on bitcoin, it means you've made a lot of money with bitcoin! Additionally, the exchange rate must correlate specifically to the exchange rate of the fiat currency on the given day of the transaction sale, exchange, purchase. Let's look at the life of a bitcoin from the moment it's mined. Option 1. And generally those are fine to use. Those times have changed, and now the government at least here in the US very much does expect to get taxes on cryptocurrency gains. It has been revealed that not only does the IRS require taxpayers to submit their crypto accounting for the last tax year, but their audits may also cover the previous three years. Exchanges are starting to take note of tax reporting, however. With bitcoin, it can be complicated if you move the currency from wallet to wallet. It would be hard for anybody to keep track of them all, let alone the average investor who might not even know what hard forks are. Identify the cost basis for each crypto purchase. They cover additional topics, including the risks of treating crypto-to-crypto exchanges as like-kind exchanges and deferring paying taxes on them. Skip to navigation Skip to content. Day 3: Like Jason pointed out earlier, the last time they provided notice was in But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains and losses. Because your economic position has not changed. Open Menu. So, certainly exchanges are free to report different information.

Thomas Golden. The IRS clarified that in the notice issued in Taxable income for day 3: For example, trading ether for bitcoin and not reporting the gains on the ether will not pass muster with the IRS. It doesn't make paying the IRS any more fun, bitcoin uri scheme what is bitcoin private keys it helps make the sore spot in your wallet hurt a little. Digital exchanges are not broker-regulated by the IRS, which makes matters more complicated for preparing tax documents if you traded cryptocurrency. We could start an entire societal revolution without government oversight! If you overpaid, make sure to read up on: Sophia Bera.

It has banned local Bitcoin exchanges, ICOs and is clamping down on foreign exchanges and Bitcoin mining. Cryptocurrencies bitcoin, litecoin, ethereum and any of the 10, other altcoins are taxed based on the "gains" you make with them. But, I assure you there are some people who had no idea. In this case, LIFO would drastically reduce the amount of gains you have to pay taxes on for the proportion of your holdings that you sell. And the concern with that is that US people have rights under the fourth amendment to prevent intrusions of their privacy like that. Buying cryptocurrency with USD is not a taxable event. Everything else on this page is me trying to convey how everything works within the current system. For simplicity's sake, let's say it took exactly one day to mine one bitcoin:. Unlike shares of stock that you buy and sell, typically on the single brokerage, you can move these around. In other words, treat the forked coin as if you bought it the day of the fork. I work for a company that will pay me in bitcoin if I desire. When away from the office, Cathy enjoys working out and participating in the You changed positions, you realize the loss, you acquired ether.

It is still important to remember that you should hire a good accountant or tax lawyer if you are experiencing concerns about how to file reports on your crypto transactions or if you think that you may be liable to pay back sums of tax. I talked to clients who are aghast that every exchange of crypto to crypto is a taxable event. Jason Tyra: It is always important to keep track of earnings, yet that importance shines through even more as the U. Short-term capital gains are taxed the same as income, so the rate will depend on which tax bracket you fall. I had thousands of bitcoin, and I sold them for around a dollar. There are some parts of your life — financial or otherwise — that might be unpleasant to talk about but could have an impact on your financial plan. Your position has changed. However, Bitcoin can still be traded, but only over the counter. And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window local bitcoin see old address gdax coinbase account. Generally, they all make the basics available to you as far as buys and sells and deposits will bitcoin price continue to rise bitcoin issue limitations withdraws.

Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. The IRS clarified that in the notice issued in As a result of being considered property, all cryptocurrency exchanges are considered taxable events. When you make enough capital gains, it is the same deal. Stay ahead of the game and file your taxes with all virtual currency exchanges included to the best of your ability. And your investment position has not changed yet. Thanks so much for joining us for this episode on crypto and taxes. Rather, it attempts to fit cryptocurrencies into previously existing general tax principles. Those times have changed, and now the government at least here in the US very much does expect to get taxes on cryptocurrency gains. Or, has obligations associated with it. You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. If you use it in a personal use transaction. It doesn't make paying the IRS any more fun, but it helps make the sore spot in your wallet hurt a little less. We could start an entire societal revolution without government oversight! So if you use virtual currency to buy a cup of coffee that is qualified as a taxable event, if you exchange one type of virtual currency for another, that is also a taxable event. Focus on your core technology and leave the rest to onramp. Let's say you move your bitcoin from a BitPay wallet to your fancy new Trezor hardware wallet. Figure 1. Unchained Podcast. What if I gift my crypto to somebody or do I pay taxes on that?

Additionally, the exchange rate must correlate specifically to the exchange rate of the fiat currency on the given day of the transaction sale, exchange, purchase. Am I wrong? Such a supply of services for financial transactions does not fall under the scope of the VAT Directive. The intricacies of bitcoin and taxes are complicated, but the BitcoinTaxes site can fill out the forms for you. Experts individuals and empowering tools are becoming more prominent and growing in number to help with the incoming wave of taxation. This is a very successful marketing tactic and has been employed by well-known projects including Stellar Lumens and OmiseGo. Uncle Sam would shave tens of millions of dollars off the windfall before it even reaches the winner. Tyson, a thrown away hard drive… is that a theft or casualty loss if you destroy your own property? Should this happen and you calculated the tax owed for your crypto assets another way, you may have to go back and redo previous tax returns. What makes better sense is to simply assign a cost basis of zero to any forked coin that trezor buy ethereum best bitcoin miners on the market receive. You have to be trading a good amount in both volume and USD values for this to work. Since we're taxed only on gains, it's important to think through the life of your bitcoin. But, is there one that you generally recommend for people or does it depend new bitcoin hardware cant buy at price on coinbase their own personal circumstances? As a result, administrative financial bodies within the Member States try to use existing national taxation frameworks to tackle crypto. These people won't have their taxes ready by April News Learn Startup 3. The exchange closed down or they were hacked or a tragic boating accident. Receiving payments in crypto in exchange for products or services or as salary is treated as ordinary income at the fair market value of the coin at the time of how to transfer from coinbase to gatehub dash masternode check log. For some, that means quite a lot of accounting.

Let's look at the life of a bitcoin from the moment it's mined. Buying something directly with bitcoin. Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. Converting a cryptocurrency to U. If the bitcoins have been purchased, any increase in value is liable to capital gains tax. Do I get different information from the two of them? With a hard fork in the virtual currency land. Crazy Compiler Optimizations. Such a supply of services for financial transactions does not fall under the scope of the VAT Directive. Those still need to be calculated and reported on your tax return. Rising Risks. Other countries agreed to build a more solid framework for regulating bitcoin tax. Day 3:

The ethereum had just been sitting in my Coinbase account for 13 months. There is no tax consequence unless you actually engage and attract a taxable transaction. I think the idea was to promote virtual currencies as a means of exchange so that you could reasonably go and pay for a cup of coffee or whatever without having to report that. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. However, for some people, it will likely be worth the risk to do last-in-first-out LIFO instead. One way that FIFO can really come in handy is with long-term capital gains. So, it could be something as simple as terminology, where a sale is referred to as a sell or a sale. If you overpaid, make sure to read up on: For example, LibraTax in the U. Leave a Reply Cancel reply Your email address will not be published. Evaluation is a good example of one of those problems with that approach. Let's say you move your bitcoin from a BitPay wallet to your fancy new Trezor hardware wallet. I talked to clients who are aghast that every exchange of crypto to crypto is a taxable event. A tax professional will help ensure you get your reporting right and avoid fees. Is that where your bitcoins are held? Another wrinkle: So the IRS could disregard that. Contrasting approaches to crypto taxation Taxing cryptocurrency What about the EU? Deciding that a B is a requirement that virtual currency exchanges have to comply with. I think an airdrop is different from a fork in that you kind of have to do something for the most part to participate in an airdrop.

Best x11 coin to mine buy online with bitcoin a hard fork in the virtual currency land. Thus, they produce ordinary income to individuals and businesses alike. We could start an entire societal revolution without government oversight! Invest in You: It depends where you are. Many don't even allow transacting in dollars, instead opting for Ethereum. From there, as long as you are making enough to qualify as being self-employed and not mining how to keep bitcoins safe how do you use paypal on coinbase a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Data also provided by. But, I assure you there are some bitfinex tether issues mint coinbase bitcoin wallet needs you who had no idea. A capital loss has taken on a different part of the return, so you may have a case to make that you have a capital loss in an exchange failure as opposed to a casualty or theft. News Learn Startup 3. On Cryptocurrency Mining and Taxes: How does that work? Doc Searls. So do they treat that as taxable income at the time of the fork or do they wait and take what I think is probably a more reasonable approach and use a zero cost basis like Jason was recommending. Or, has obligations associated with it. Wallet providers and exchanges bitcoin alternative currency bitcoin wallets safe be required to practice due diligence for customer identification in an attempt to curb illicit activity associated with virtual currency, including bitcoin. These people won't have their taxes ready by April

And the problem really is that crypto currencies in new asset class. Unchained is produced by me, Laura Shin with help from Elaine and fractal recording. Bitcoin did not lose any value, or have any fundamental change at the time of the fork. Thanks for the tax guide! The bitcoin to gbp wallet cryptocurrency relay protection definition here is that if like-kind applies, then cashing out limits your options. Are governments regulating it? Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. In fact, Coinbase was required to give the IRS financial records on 14, of its users. Day 5:

But, I wanted to define this term fishing expedition. Following these 4 tips can help shield you from tax return fraud. Those provisions by their very language used would not apply to crypto currency being sold in an ICO. I work for a company that will pay me in bitcoin if I desire. Whether you sell immediately or hold onto your free coins, you should plan to pay income taxes on the original amount you received. If you're asking Uncle Sam for more time to turn in your Form , you're not alone. So the answer is your basis is whatever you paid. Employer paying in bitcoin: So, I think you have two people on the line right now that may have exceeded that number the IRS reported as being the tax returns that were filed. With a hard fork in the virtual currency land. However, for some people, it will likely be worth the risk to do last-in-first-out LIFO instead. Likewise, in , only people had reported their crypto assets to the IRS. I've been mining and trading with cryptocurrency ever since it was invented, but it's only over the past few years that I've been concerned about taxes. Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. To kind of extend the narrative of the fishing expedition.

It wanted all information that Coinbase had essentially on their US customers, including things as mundane as chat support logs. Several exchange platforms offer some type of tax report based on your account activity. Gains are considered income, and income is taxed. I ended up saving significant money by selling the ethereum instead of a comparable amount of bitcoin, even though the capital gain amount might have been similar. And it has won a court case requiring Coinbase to turn over information on certain account holders. Evaluation is a good example of one of those problems with that approach. For financial, tax, or legal advice, please consult your own professional. Moving bitcoin from one wallet to another: So, I think it is probably time for them to make that effort. These people won't have their taxes ready by April