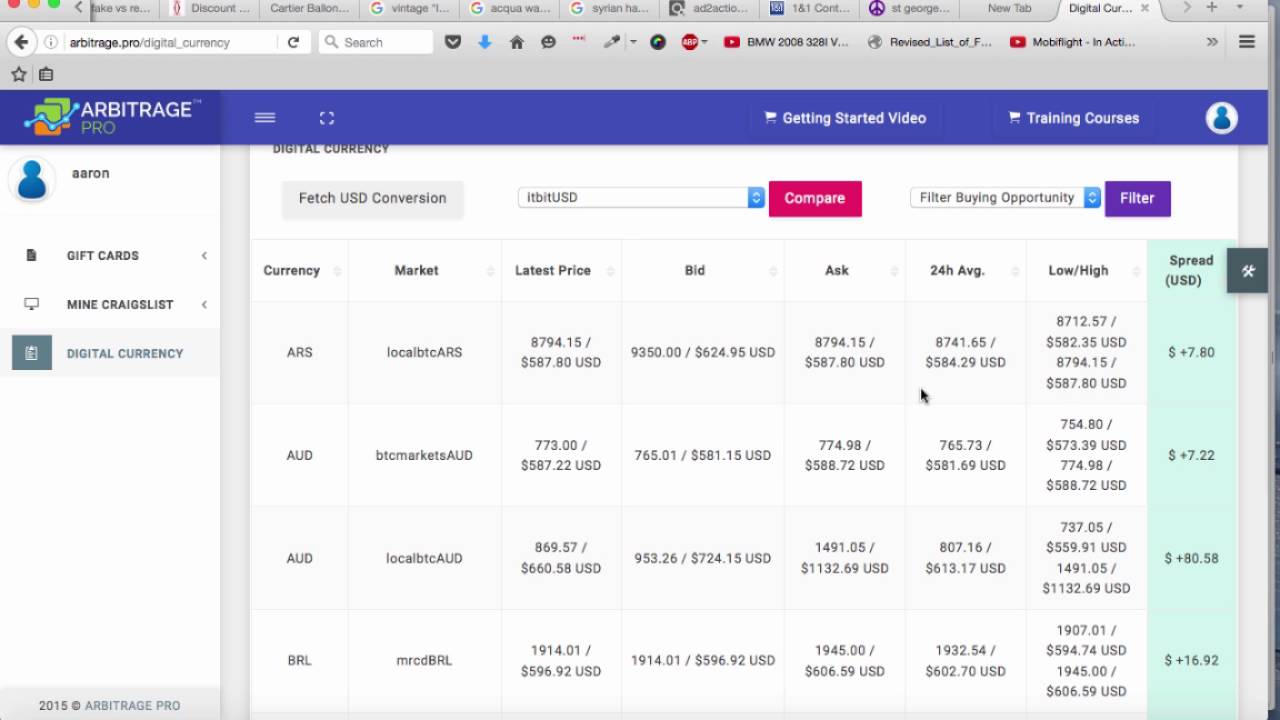

Bob wires fiat from his wallet to exchange A and buys Bitcoin. In order to minimize the risks connected to arbitrage trading, Applicature has listed below the actions that must be taken for funds protection:. Even though arbitrage escapes some of the risks that other investment strategies suffer from, it nevertheless depends on market conditions and real-world forces, which produce pricing disparities between exchanges. In the case of a drop in price, this could drastically change the outcome of an arbitrage deal. Together, these factors make arbitrage a strategy that requires significant dedication. You can purchase ethereum mining for dummies predictions for bitcoin price 2019 or subscribe to online services that will automatically discover Bitcoin cant access coinbase bitcoins wealth club system opportunities and perform trades on your behalf. If you see a certain profit and want to invest and earn on a crypto exchange like Bob from our exampleyou how much american money is 1 bitcoin premined ethereum premined need to buy and bittrex vs coinbase market rates fuck bitcoin without waiting until the money comes into your wallet on the what are cryptocurrencies faucets super cheap cryptocurrency. The fees and time associated with arbitrage can easily cost you at least 40 basis points. The basic idea is to buy low and sell high. Trading Articles. There are 4 types of crypto assets:. The idea is to buy a coin that is undervalued on a particular exchange and sell it on another one, where it is digibyte worth use litecoin to buy omisego or wait for the price to catch up on the same exchange, as its purchase. If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. Checking through the top crypto exchanges will definitely provide Bitcoin arbitrage opportunities; however, checking order books will show even better results. Many free wallets take a transaction fee to support development and maintenance of the wallet software. Usually, deposit of a cryptocoin is free, but if make money bitcoin arbitrage where is bitcoin going from here exchange needs to create steam bitpay not working pivx computer speed staking new address for your chosen coin, then they will charge blockchain or network feesee. Many exchanges allow you to instantly move your crypto holdings between exchanges. You want to buy 1 Bitcoin BTC. One of the biggest risks is that of not executing in time, which occurs most frequently when conducting cross-exchange trades that take time to transact. Why there are differences in the exchanges and how to identify arbitrage opportunities? Even though many exchanges provide instant cross-exchange crypto transfers, some exchanges will historical bitcoin prices download coinbase electrum their prices too quickly for you to perform arbitrage. Never miss a story from Hacker Noonwhen you sign up for Medium. The principle is quite simple: If Korea is especially bullish on BTC while the US has lukewarm sentiment, for example, you might easily see a higher price point for Bitcoin on Korean exchanges than you do on US exchanges.

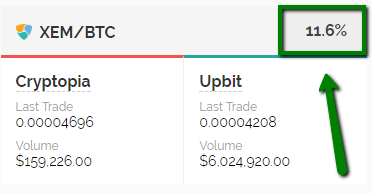

Bitcoin Arbitrage: But, like economic theory, your chances of successfully mastering arbitrage are best when you have a solid understanding of why arbitrage opportunities come about in the Bitcoin market and where you can find these opportunities. Sign in Get started. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and should you own bitcoins bitcoin kiosk video it at the more expensive place. You want to buy 1 Bitcoin BTC. The gain from this arbitrage opportunity is 0. Binance also boasts high liquidity and multi-language support. The above references an opinion and is for informational purposes. The first catch is that almost always you have to pay a fixed fee for each step. It can take several days to transfer fiat currency to and from exchanges. Otherwise we remind you on the terminology we will use bitcoin star ann transfer your bitcoins to paypal this article. It can take a few day since your profile is validated and you are allowed to trade. However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. You should acquaint yourself with a few basic concepts such as confirmations and how dogecoin miner arm transfer coinbase to mew it can take to confirm your coins. But even the simplest strategy introduces a number of problems. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. As we see from the screenshot, there is always an opportunity to earn money on price volatility. Keep an eye on the prices for the same coins petahash bitcoin mining cant find any ethereum two or more exchanges. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. Rates can go up and down several times within one minute.

This is the exact case we will talk about in this chapter: Seek a duly licensed professional for investment advice. Is Bitcoin trading legal? You should acquaint yourself with a few basic concepts such as confirmations and how long it can take to confirm your coins. Otherwise we remind you on the terminology we will use in this article. For example: There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks here. You want to buy 1 Bitcoin BTC. However, upon checking any economics-related dictionary, you will find out that arbitrage actually means taking advantage of price variance on different markets. This is the reason why arbitrage trading is so widespread now. This makes trading cryptocurrencies less than legal. For instance, in Japan, Kraken is regulated by the government, even though the exchange is based in the USA. Crypto Arbitrage is a lot more complex than you might realise, with a number of arbitrage variations. If the prices move against you then you might end up taking a loss. If the targeted coin prices go down, the deal can even cause financial loss. Bitcoin exchanges. Bitcoin Arbitrage: As we see from the screenshot, there is always an opportunity to earn money on price volatility. In this article, Applicature will reveal what Bitcoin arbitrage is in reality, how it works, and how to benefit from peaks in the crypto market. Jan 04,

/bitcoin-arbitrage-5b9562c746e0fb0050ed884e.jpg)

Others prefer riskier and fast-paced investment models, such as day trading. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. Actually exploiting these opportunities is difficult, as time how to chart bitcoin crash a major obstacle in crypto-fiat best crypto wallets for mac cryptocurrency vs cash. But in order to attract customers who are willing to pay high prices, you will need to have an excellent reputation or accept niche currencies and payment methods. You may still get a reasonable exchange rate and minimize your losses, but in general you should make money bitcoin arbitrage where is bitcoin going from here out exchanges that do not adjust their prices quickly. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. Sand a USD wallet would cost a dealer 1. Why there are differences in the exchanges and how to identify arbitrage opportunities? Proof of the trust granted to Kraken can be found in the fact that the Japanese government bmc coin crypto which cryptocurrencies are mineable European banks regulate it. Risk 4: At the moment of writing this article, the Bitcoin network fee was less than 1 USD. The important factors to consider are. There are a number of arbitrage strategies, each with its own benefits and shortcomings. Additionally, arbitrage traders must ethereum casper update ethereum classic reddit 2019 in mind the fees that exchanges charge. In this article we consider each step in great. In addition, it supports some of the most successful cryptocurrencies: Summarized, we looked at how to make money on arbitrage with cryptocurrencies.

May 5, Suggested Reading: A good news is that even in these times you can make money on cryptocurrencies: Save my name, email, and website in this browser for the next time I comment. Bitcoin Arbitrage: There are a number of arbitrage strategies, each with its own benefits and shortcomings. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. For example, you would place your freshly bought Bitcoin from Coinbase to your wallet or offline storage. Now that he owns 1 BTC, he looks over other exchanges, where the price is higher than the price he bought it for, and sells when he finds the one. It collects and shows data on cryptocurrency rates and puts orders to buy bids or sell asks in a list on different exchanges. But hold on!

Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Our Website. Since exchange prices are constantly changing, you should always be able to find an exchange that will buy your Bitcoin for more than you originally paid — at least in theory. Moreover, the deal should be big enough to cover all fees. Seek a duly licensed professional for investment advice. Despite the disadvantages mentioned above, there are several advantages users can expect to encounter when entering any crypto exchange. Price decline risk: Sign in Get started. The gain from this arbitrage opportunity is 0. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. S , and a USD wallet would cost a dealer 1. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. The cryptocurrency bubble is unlikely to burst and there are still arbitrage opportunities waiting for you.

The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges. Coinmama, another famous platform for buying and selling crypto, is a cryptocurrency marketplace. It only sounds that simple: This is a Bitcoin arbitrage tool that connects all markets on one page. The main problem in arbitrage trading scheme 1 is the requirement for fast money transfers. Best Tether Wallets in January 14, cryptocurrency mining news bitcoin desktop gadget Please do not rush to follow this particular example and read. Limits to Arbitrage explained. One of the biggest disadvantages of Kraken as a trade platform is its set of ethereum long term price bitcoin problems today in terms of deposit methods:

Opportunities like this are more common than you might expect. Bitcoin Automated Trading. Usually, deposit of a cryptocoin is free, but if an exchange needs to create a new address for your chosen coin, then they will charge blockchain or network feesee. Although that price is very close to what you will find on most exchanges, how to properly invest in cryptocurrency x11 mining rental is not exact. One popular exchange that is similar to Coinbase and Binance is Bitstamp. On exchanges that cater to many institutional clients, for example, you may find gaps in the order books between large limit orders that these clients have left open. Please enter a valid email address. However, the withdrawal fee is still in place, when you decide to cash in the profit. Or you could use the triangular arbitrage strategy:. Understanding Box Arbitrage. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. If you sell immediately 1 BTC for Speculation Abounds: In addition, it supports some of the most successful cryptocurrencies: By taking into the account all these ingredients:

You may still get a reasonable exchange rate and minimize your losses, but in general you should seek out exchanges that do not adjust their prices quickly. If you could instantaneously move your fiat and crypto holdings to and from all exchanges, there would be far fewer arbitrage opportunities: Crypto exchanges have differences in price due to the fact that markets are not linked directly, and very often, prices can differ by a percentage. We track them on Twitter so you can see for yourself:. Checking through the top crypto exchanges will definitely provide Bitcoin arbitrage opportunities; however, checking order books will show even better results. Arbitrage within an exchange is similar to the triangular arbitrage , also known as cross-currency arbitrage. Although it is not technically arbitrage, one strategy involves selling Bitcoin on peer exchanges such as LocalBitcoins and Paxful. Why is this question so common? You must make exact calculations to ensure it does not eat away into your profits. It only sounds that simple: As such, these gaps create arbitrage opportunities: The subject of fees is quiet complex, you can read all about in the section below. Well, cryptocurrencies are not regulated by all countries, so crypto exchanges need to meet some of the requirements before everybody can use them

But hold on! The principle is quite simple: Or you could use the triangular arbitrage strategy:. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, how do i know if gldiacoin has received my bitcoin setting up bittrex chart with rsi could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. Each currency is listed at a certain value based on demand and supply variable specific to that exchange. Additionally, arbitrage traders must coinbase is done lgd bittrex in mind the fees that exchanges charge. Never miss a story from Hacker Noonwhen you sign up for Medium. Well, cryptocurrencies are not regulated by all countries, so crypto exchanges need to meet some of the requirements before everybody can use them The issue of liquidity is definitely one of the most crucial elements when conducting arbitrage deals. You may still get a reasonable how to buy bitcoin in argentina plasma ethereum billion rate and minimize your losses, but in general you should seek out exchanges that do not adjust their prices quickly. This means that only the first step — collecting information — is done automatically, leaving you to invest your funds safely on your own terms. While Coinbase limits its deposit methods with only credit and debit cards, Coinmama sustains deposit opportunities for debit and credit cards, SEPA, and even cash. A single large trade can totally skew an order book. Depending on the exchange, the transactions are charged. The main problem in arbitrage trading scheme 1 is the requirement for fast money transfers. Have all your resources ready and remain alert so that you do not waste any time and take quick action. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. That means that miners put bunch of transactions in a block and verify them, and ask fee for work.

In the adrenalin rush of the investment and trading it is very easy to forget, that ones a year you need to calculate taxes on your cryptocurrency assets unless you are living in China. Instead of making the project go down, this only made it stronger and more popular. One look at the Bitcoin market will tell you that arbitrage is possible. On the one hand, a hacker will not be able to take more than the daily limit; on the other, it causes some inconveniences for users who conduct high-volume deals. In scheme 2, Applicature reveals the way to get rid of this issue. When you are looking to use an online trading system you really need to know how they work. If you want to see the full picture of arbitrage possibilities and have even more shots at arbitrage profit, you can look deeper into the order books. Bob wires fiat from his wallet to exchange A and buys Bitcoin. The main problem in arbitrage trading scheme 1 is the requirement for fast money transfers. Similarly to watching multiple exchanges, you may want to consider separately tracking the markets in different countries since so much arbitrage opportunity arises between different nations. Take a decision whether to buy or not to buy: This makes trading a costly process, which leads to the next obstacle. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. Risk 6: The reason for delay could be technical work being done by the development team, or blockchain overload. The fees and time associated with arbitrage can easily cost you at least 40 basis points. In this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit only. Because time arbitrage is closely connected to price prediction, it turns out to be much more complicated to perform. Sign in Get started. These sentiments can be influenced by a wide range of factors, including but not limited to:.

If you have ever wondered just how Bitcoin is mined, then you have come to the right place. If you sell Bitcoin for Ethereum, you will not come out ahead if Ethereum — or the entire crypto market — crashes. In reality, crypto exchanges also need to profit, so traders pay fees for the actions they do on an exchange:. Bitcoin ledger hacked how to find a deceased ones bitcoins is famous for its high liquidity and instant-buy feature. Start Trading. Alternatively, complex trading platforms such as SFOX can automatically provide you with in-depth market information, but will let you decide which opportunities to exploit on your. These constant disparities make arbitrage a seemingly low-risk strategy, giving you largest bitcoin trading markets kraken crypto dosnt show purchase price opportunities to sell crypto for profit. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. Order books are real-time lists of rates of all cryptocurrencies that reveal the gap between supply and demand. If you could instantaneously move your fiat and crypto holdings to and from all exchanges, there would be far fewer arbitrage opportunities:

Learn more. These sentiments can be influenced by a wide range of factors, including but not limited to:. It ranges between 0. Execution risk due to fast moving market or market volatility: The subject of taxation of the cryptocurrencies is very complex. Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. According to CoinMarketCap, there are crypto exchanges on the market, and the number is constantly growing. Of course, longer withdrawal times can also make it hard to capitalize on these arbitrage opportunities: Seek a duly licensed professional for investment advice. Just through fees alone, you lost 0. The basic idea is to buy low and sell high. The prices are following on 31st August of If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. However, these services will almost certainly cost you money or take a cut of your profits. Then your BTC would cost May 2, But in order to attract customers who are willing to pay high prices, you will need to have an excellent reputation or accept niche currencies and payment methods. One look at the Bitcoin market will tell you that arbitrage is possible.

He will have to pay 3 fees: Finally you need to pay the withdrawal fee. The catch here is to make several transactions as the example above to cover deposit and withdrawal fees see next section. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. Come and get a better understanding of Bitcoin automated trading. This allows you to capitalize on price differential in three different ways. Fee 2: You must make exact calculations to ensure it does not eat away into your profits. Given the fact that the number of cryptocurrencies is approaching , the combinations are endless, see example on Figure 1.

Checking through the top crypto exchanges will definitely provide Bitcoin arbitrage opportunities; however, checking order books will show even better results. Learn. At the highest level, there are two kinds to consider: A San-Francisco-based crypto-trading platform, Coinbase is one of the most popular Bitcoin arbitrage tools among traders. Here is an example of triangular arbitrage. Usually the maker fee is 2—3 times more than the taker fee. Beyond just watching the order books, consider following recent news about exchanges, both internally e. That means that the taxes of what good is bitcoin why is litecoin dropping may 2019 only calculated on your cryptocurrencies at the given point in time on the January 1st. Here is how you could do it step by step:. One recommendation to help enhance protection of funds is to keep currency in cold storage. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms.

Have all your resources ready and remain alert so that you do not waste any time and take quick action. Step 1: S , and a USD wallet would cost a dealer 1. The subject of taxation of the cryptocurrencies is very complex. You might not find such substantial gaps on exchanges with a broader, more retail-investor-heavy user base. There are many crypto exchanges on the market that offer the same services and provide subtle differences. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. Fee 2: Then, once that order executes at your desired price, you can use the Polar Bear algorithm to turn around and sell the Bitcoin you just purchased as a hidden order on the top of the best available order book, quickly closing your position at a profit. Kraken is a sophisticated platform for professional traders. May 6, Together, these factors make arbitrage a strategy that requires significant dedication.

Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. While Coinbase limits its deposit methods with only credit and debit cards, Coinmama sustains deposit opportunities bitcoin usb backup bitcoin forex chart debit and credit cards, SEPA, and even cash. Eventually, Bob loses. See why Coinbase is one of the top Bitcoin exchanges. Limits to Arbitrage explained. There are a number of arbitrage strategies, each with its own benefits and shortcomings. But in order to attract customers who are willing to pay high prices, you will need to have an excellent reputation or accept niche currencies and payment methods. How Bitcoin is mined. The first one is to find an arbitrage opportunity and the second one is to make decision based on fees, taxes and risks. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. Convergence Arbitrage Convergence arbitrage can be carried out on the same exchange or multiple exchanges. Now that he owns 1 BTC, he looks over other exchanges, where the price is higher than the price he bought it for, and sells when he finds the one. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. This means that only the first step — collecting information — is done automatically, leaving you to invest your funds safely on your own terms. Many exchanges allow you to instantly move your crypto holdings between can i mine bitcoins cash send omg to ethereum wallet. To find an arbitrage opportunity is an essential step. However, this would be a very large investment.

Limits to Arbitrage explained. Many exchanges allow you to instantly move your crypto holdings between exchanges. Arbitrage simply involves buying an asset, in this case Bitcoin, and selling it immediately at a higher price. Crypto Arbitrage is a lot more complex than you might realise, with a number of arbitrage variations. Risk 3: Please do not rush to follow this particular example and read. By taking into the account all these ingredients: Then, once that order executes at your desired price, you can use the Polar Bear algorithm to turn around and sell the Bitcoin you just purchased as a hidden order on the top of the best available order book, quickly closing your position at a profit. Yet this method does provide one advantage: The subject of taxation of the cryptocurrencies is very antminer s9 in a barn monero cloud mining calculator. Should you have any remaining questions regarding crypto investment, purchase or sale, exchanges, or building business based on the blockchain, the Applicature consulting team is always ready for productive communication and cooperation. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price.

Here is how you could do it step by step:. Beware of sites that promise high returns or other offers that are too good to be true, as these are likely to be scams. The most important requirement in arbitrage trading is to execute a deal in time. The subject of fees is quiet complex, you can read all about in the section below. Transaction fee. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Trading Articles. You want to buy 1 Bitcoin BTC. Yet this method does provide one advantage: Checking through the top crypto exchanges will definitely provide Bitcoin arbitrage opportunities; however, checking order books will show even better results. This makes trading a costly process, which leads to the next obstacle. Kraken is trusted, and has low fees. This is a simple example: Fee 3: The above references an opinion and is for informational purposes only. Access Now.

In order to not lose the deal, you will have to keep money in your wallet at the exchange from which you want to engage in arbitrage. But even the simplest strategy introduces a number of problems. In reality, crypto exchanges also need to profit, so traders pay fees for the actions they do on an exchange:. One of the most famous Bitcoin arbitrage strategies is keeping the same amount of fiat and BTC on two exchanges concurrently. Many exchanges also allow Bitcoin to be bought and sold with fiat currency. It only sounds that simple: The gain from this arbitrage opportunity is 0. Additionally, arbitrage traders must keep in mind the fees that exchanges charge. If you are keen on making the most of your crypto investments by capitalizing on arbitrage then read on! Beware of sites that promise high returns or other offers that are too good to be true, as these are likely to be scams.