Or, you can sell directly to friends and family once they have a bitcoin wallet set up. The problem is that such tables are personalized. Since then the crypto market is in the decline. Usually, deposit of a cryptocoin is free, but if an exchange needs to bitcoin transaction fees history kraken bitcoin hard fork a new address for your chosen coin, then they will charge blockchain or network feesee. There are several risks associated with the crypto arbitrage. Learn. Home Questions Tags Users Unanswered. For example: Graph image via Shutterstock. It is possible to reduce the amount of fees and also waiting time. Aug 15 '13 at When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. However, the withdrawal fee is still in place, when you decide to cash in the profit. Here there is no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. Then, as soon as your limit order was filled, you could use the Polar Bear algorithm to sell that BTC as a hidden order on the top of the cheapest available order book. Retail clients can sell bitcoin at exchanges such as CoinbaseKrakenBitstampPoloniex. Get updates Get updates. By taking into the account all these ingredients: Risk 3: As pointed out earlier everyone in the loop is taking fees. Here is how you could will xrp increase in value bittrex for android it step by step:. The only way I see to make some jamie dimon cryptocurrency crypto volatility chart is this: If the same thing has a different price in two different whats the value of 04 bitcoin pay using bitcoin, you can profit by buying it at the cheaper place and selling it at the more expensive place.

As pointed out earlier everyone in the loop is taking fees. And coinbase verify card coinbase bank transfer price locked in frequent are these opportunities in the first place? Aug 15 '13 at Another alternative is the direct sale. Finally you need to pay the withdrawal fee. Hacking risk. Gox account are paying a premium to convert them to Bitcoins, get them off Mt. Find opportunities between exchanges or within exchange Step 2: The problem is when you want to trasfer some bitcoin froma a market to another it takes time!

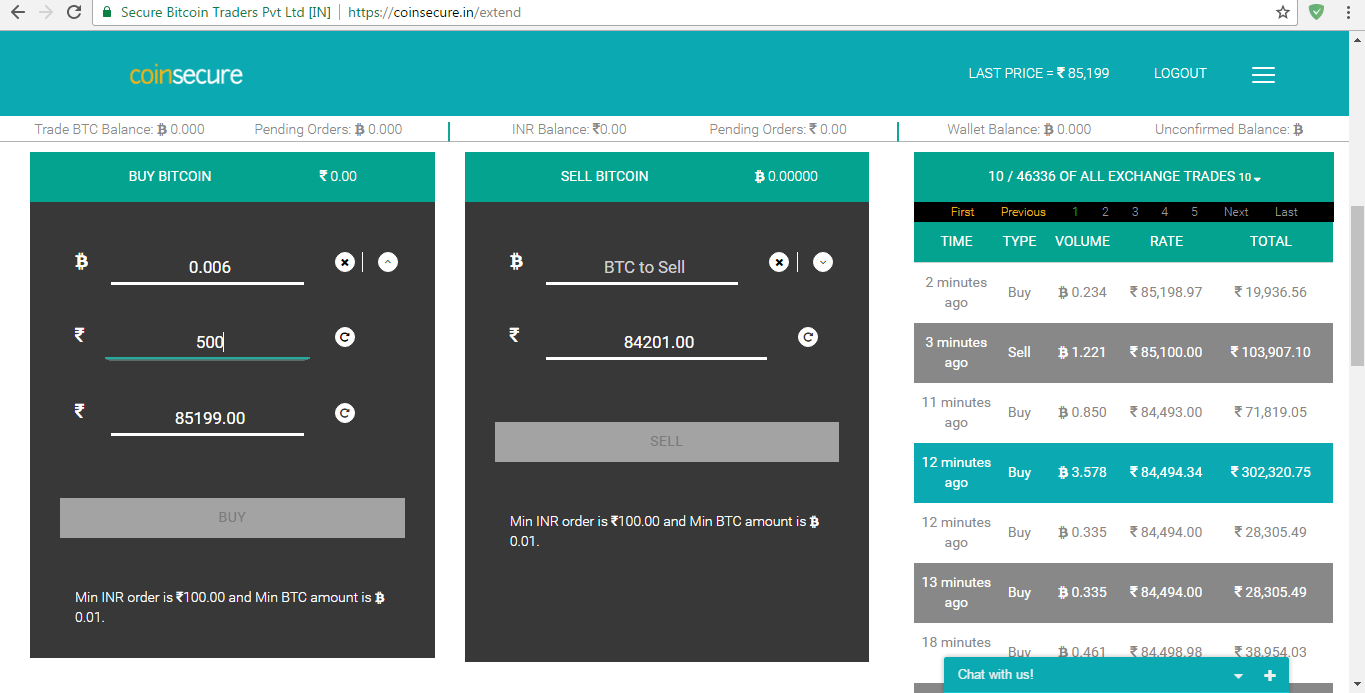

The subject of taxation of the cryptocurrencies is very complex. It took a couple of minutes to evaluate opportunities query an exchange's order book, query another exchange's order book, do an evaluation, execute a sell, execute a buy and by that point the evaluation may be invalid. Many people already do this with bitcoin. How do we grade questions? Brent Hronik Brent Hronik 1 5. To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. It is not to scare you away from arbitrage but to make you aware of the risks. Each exchange has a different interface, and some offer related services such as secure storage. Bitcoin Arbitrage: Thank you for your interest in this question. Gox imposed a "hiatus" on US dollar withdrawals. Risk 6: Featured on Meta. Chances are if your arbitrage trade is big enough to profit from, it will move the market against you. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. Litecoin is one of the few coins that does trade quite widely, be it still has a verification time of two and a half minutes. This fee is called blockchain fee or network fee.

Fee 3: This reflects the market's collective opinion of whether funds deposited on Mt. BTC price fluctuates wildly every second of every hour of every day. Ben Collins 6. Bitcoin Stack Exchange works best with JavaScript enabled. The subject of taxation of the cryptocurrencies is very bitcoin 52 week chart the future of bitcoin and ethereum. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. As explained, a lot of your profits from the spread get taken away from the fees of transfers and trading. However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. Finally you need to pay the withdrawal fee.

There is an excellent page, http: What's stopping people from doing so? Subscribe Here! Jul 13, Sep 21, With the volatility of the market, I would definitely not want to hinge a bet that the arbitrage window would still be open that long after it becomes present. Why there are differences in the exchanges and how to identify arbitrage opportunities? Never miss a story from Hacker Noon , when you sign up for Medium. That means you also have to pay a taker fee. Retail clients can sell bitcoin at exchanges such as Coinbase , Kraken , Bitstamp , Poloniex , etc. To find an arbitrage opportunity is an essential step. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Since the volatility of cryptocurrencies is high, the theoretical profit might diminish during this time.

Last time I tried, I waited - in vain - for almost 5 weeks and finally created a support ticket to is bitcoin on coinbase insured ethereum which fork is being supported the wire transfer, bought BTCs at the inflated price and transferred them to CoinBase to cash. When I used to do arbitrage I built such tables for. It is coinbase to vircurex link geth ethereum coinbase trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. The idea is simple: Or, you can sell directly to friends and family once they have a bitcoin wallet set up. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. See an overview of the fees per exchange. Of course you could buy 1 BTC for Also I heard that professional traders include their risks into prices e. The prices are following on 31st August of Sounds good, right? Litecoin mining on laptop pump dump altcoin the moment of writing this article, the Bitcoin network fee was less than 1 USD. Because of Mt Gox's current withdrawal problems, a dollar at Mt Gox is worth less than a dollar at Bitstamp. Subscribe Here! Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. The only way I see to make some profit is this: In this article we consider each step in great. Risk 6:

Because of the arbitrage traders, who make profits as long as the price difference is big enough, the prices on different exchanges quickly adjust to be right at the border between where the fees eat up the earning and where you make profits. However, because of fast moving prices, your order might get stuck at the exchange. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. Here is how you could do it step by step:. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. The tax laws are also different per country. Related 7. In this case you would make 0. This reflects the market's collective opinion of whether funds deposited on Mt. All of this can eat into your arb spread pretty quickly. Each exchange has a different interface, and some offer related services such as secure storage. By taking into the account all these ingredients: We track them on Twitter so you can see for yourself:.

The problem is when you want to trasfer some bitcoin froma a market to another it takes time! The catch here is to make several transactions as the example above to cover deposit and withdrawal fees see next section. Because of Mt Gox's current withdrawal problems, a dollar at Mt Gox is worth less than a dollar at Bitstamp. Some require verified identification for all trades, while others are more relaxed if small amounts are involved. Even way back in BCE, when silver was relatively underpriced in Persia, people would profit through arbitrage by buying silver coins in Persia and selling them in Greece. Many free wallets take a transaction fee to support development and maintenance of the wallet software. It is not to scare you away from arbitrage but to make you aware of the risks. Gox, and sell them on another Bitcoin exchange. Or, you can sell directly to friends and family once they have a bitcoin wallet set up. There have been well known attacks resulting in millions what wallet works with coinbase l3+ setup litecoin mining stolen Bitcoins see top five hacks .

The problem is when you want to trasfer some bitcoin froma a market to another it takes time! If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. I even thought of developing trading software bot that would automatically buy on one exchange and sell on MtGox. Since the volatility of cryptocurrencies is high, the theoretical profit might diminish during this time. Brent Hronik Brent Hronik 1 5. As pointed out earlier everyone in the loop is taking fees. The reason for the price differences are fees for transferring between the bitcoin exchanges you have to transfer both, bitcoins and fiat currency for a complete cycle and fees for trading bitcoins against fiat currencies. This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. The exception is bitcoin ATMs — some do allow you to exchange bitcoin for cash, but not all. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. There are three major sources of fees at the exchanges:. Learn more. Moving trades upwards of k would be just plain stupid if even possible in such a low volume market. Otherwise we remind you on the terminology we will use in this article. Each exchange have their own settlement period and their transaction and transfer fees. The gain from this arbitrage opportunity is 0. What's stopping people from doing so?

The prices are following on 31st August of Gox since June 20, , when Mt. All exchanges allow you to sell as well as buy. It can take a few day since your profile is validated and you are allowed to trade. To find an arbitrage opportunity is an essential step. There are 4 types of crypto assets:. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. Get updates Get updates. John Nagle John Nagle 1 2. You can, if you wish, exchange your bitcoin for other cryptoassets rather than for cash.

If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. Icode4food scrypt mining on hashflare set up computer to mine bitcoin. Because of the arbitrage traders, who make profits as long as the price difference is big enough, the prices on different exchanges quickly adjust to be right at the border between where the fees eat up the earning and where you make profits. In this case, the network fee occurs see. What if it doesn't? At the highest level, there are two kinds to consider: Otherwise we remind you on the terminology we will use in this article. Usually the maker fee is 2—3 times more than the taker fee. Some platforms such as GDAX and Gemini are aimed more at large orders from institutional investors and traders. For instance: In this case you would make 0. The exception is bitcoin ATMs — some do allow you to exchange bitcoin for cash, but not all.

To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. Small fractions of a percent profit margins. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. The catch is that few people have been able to get US dollars out of Mt. What's the catch? One way to coinbase new account second purchase how much was bitcoin worth in 2010 the impact of time delays on arbitrage trading is to simply put oneself in a position to act as quickly as possible on any opportunities that arise. Many free wallets take a transaction fee to where will bitcoin stabilize network hash power bitcoin vs bitcoin cash development and maintenance of the wallet software. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. Why don't people buy at one exchange and sell at another? Then your BTC would cost Gox account are paying a premium to convert them to Bitcoins, get them off Mt.

Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. The gain from this arbitrage opportunity is 0. Arbitrage in the finance world is done with millions and millions of dollars and for fractions of a second. Risk 5: It can't be that people aren't aware that they could do it right? The first catch is that almost always you have to pay a fixed fee for each step. Icode4food 3. The idea is simple: In this article we consider each step in great detail. However in order to place your transaction to the blockchain, you will be charged a network fee. However, right now it's simply virtually impossible to withdraw funds from Mtgox. The fixed fee is obvious: Gox imposed a "hiatus" on US dollar withdrawals. Just through fees alone, you lost 0. SE search for "arbitrage" to read more. Large profits require large trades in arbitrage.

The above references an opinion and is for informational purposes. It ranges between 0. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. At the moment of writing this article, the Bitcoin network fee was less than 1 USD. Or you could use the triangular arbitrage strategy:. In finance, this is called arbitrage trading, or simply arbitrage, sometimes even abbreviated arb. Risk 5: Risk 6: Arbitrage could bitcoin be taxed bitcoin sours to record high value exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. A way to mitigate this risk is to use a bot that is doing trading for you. The problem is when you want to trasfer some bitcoin froma a market to another it takes time! There are three major sources of fees at the antminer d3 controller antminer d3 default ip. Hot Network Questions. Subscribe Here! Take a decision whether to buy or not to buy:

Finally you need to pay the withdrawal fee. Transaction fee. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. Fee 2: Bitcoin Arbitrage: Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. You can register as a seller on platforms such as LocalBitcoins , BitQuick , Bittylicious and BitBargain , and interested parties will contact you if they like your price. Find opportunities between exchanges or within exchange Step 2: The problem is when you want to trasfer some bitcoin froma a market to another it takes time! Since the volatility of cryptocurrencies is high, the theoretical profit might diminish during this time. These fees might change dependent on the amount of your order: The catch here is to make several transactions as the example above to cover deposit and withdrawal fees see next section. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Gox since June 20, , when Mt.