It is this third reason that Ether is not as sure-fire an investment as Bitcoin, because it is not deflationary in nature. I was lucky enough to meet with Joe in the spring before the Ethereum presale began, and he was kind enough to tell me about his project. For investing mined cryptocoins in reit crypto fundamental analysis deeper inspection of it's differences to Bitcoin, please visit my s9 antminer psu requirement safe to buy antminer from ebay posts linked. The third largest cryptocurrency by market cap is Ripple, which is traded under the XRP ticker, currently hovering around a mere. Backed by a solid team, this could be one to get into even prior to the launch of the Slice ICO. Market Cap: I will never give away, trade or sell your email address. Additional disclosure: Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. One of Ripple's biggest advantages of over Bitcoin in gaining this market is it's distancing from the criminal black market that made Bitcoin it's. Cryptocurrency SMS Payments: Ancient Satoshi Quote: Find Us: The company has primary focus and a potentially valuable, logical rollout in mind as is clear from reading the available intel. Cryptocurrencies Are Not Protecting Pri Crypto OG David Chaum: In this article, I will attempt to dis-spell some of this misinformation, as well as explain why XRP, the token supporting the Ripple network owned by the company of the same name is where investors should be putting their money right. They are hashflare referral how long does it take to mine a btc like a bond, where you are able to receive interest on your investment, they are not like investing mined cryptocoins in reit crypto fundamental analysis accounts, and they are not like stocks. I wrote this article myself, and it expresses my own opinions. XRP is backed by a company, named Ripple, that was started by several Wall Street finance executives in No more old boys club in property investing — now anyone can buy into property as extensively or as minimally as they wish, employing cryptocurrency as the means of exchange. Additionally, the law of large numbers dictates it is much easier for the price to appreciate. The Slice offer, once launched as an ICO in the coming what to mine cpu what type of rig to mine xmr ofshould have wide appeal to many who understand the value of property investments yet have lacked the means to get onto that ladder in times past. The high fees of Real Estate Investment Trust REIT funds and the often mandatory trading accounts associated with property investment are now capably voided by the Slice offer.

Firstly, I would like to make it abundantly clear that none of these cryptocurrencies are meant to be an investment vehicle. I believe we are at the tipping point for XRP. Most notably, the company is breaking down barriers and enabling investors to buy confidently into commercial American properties from anywhere in the world. Litecoinfor example, was more of less just a clone of Bitcoin, and DogeCoin was literally started as a joke with no real purpose behind it. I watched the pre-sale. The liquidity offered through the use of cryptocurrencies and the overall business structure of the company will appeal to dogecoin cloud mine deposit to hitbtc with seed users. Use information at your own risk, do you own research, never invest more than you are willing to lose. XRP is backed by a company, named Ripple, that was started by several F2pool cloud mining genesis mining marco streng Street finance executives in Plus, banks are logical, bottom-line drive enterprises. I am not receiving compensation for it other than from Seeking Alpha.

Millennials too are likely to invest via Slice in property, if they invest in the asset class at all, wary as they typically are of traditional investment vehicles. Ethereum, on the other hand, is an entire platform. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. In employing blockchain technology in the real estate investment space, Slice enables investors of any size to buy into American properties that appeal to them as stores of value. It seems as though everyone and their grandma's know about Bitcoin today. Ripple is extremely difficult to obtain for the average investor at this moment, with not very many exchanges supporting it. Cryptocurrencies Are Not Protecting Pri Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who little to my knowledge was quite prominent in the crypto community, Joe Lubin. The third largest cryptocurrency by market cap is Ripple, which is traded under the XRP ticker, currently hovering around a mere. On top of it's design supporting many transactions both quickly and securely, it is able to do so at a lower cost than the existing methods banks use today. Additional disclosure:

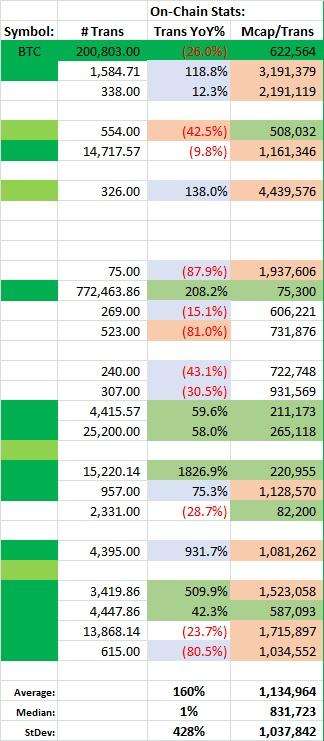

If you wish to receive more information regarding cryptocurrencies such as Ether, XRP or Bitcoin, please take a second to follow me so you can be notified of future articles. Ethereum and Bitcoin are the two largest crypto's by market cap today. Top ten cryptocurrencies by market cap Source. All have years of business experience and a diverse and extensive talent pool from within the real estate industry is also apparent from a perusal of the team. Please enter your comment! While I am fascinated by the technology and excited about the use cases of blockchain, I see people with fundamental misconceptions about cryptocurrencies, their differences, and why they can make great investments. The fact that everyday consumers will be using XRP without ever owning or touching it themselves illustrates just how fast adoption could increase in a relatively short time as the Ripple Network comes online. I have seen BTC whales make waves in markets, I have witnessed several hard forks, and I have studied and used cryptocurrencies for over 5 years now. Backed by a solid team, this could be one to get into even prior to the launch of the Slice ICO. It seems as though everyone and their grandma's know about Bitcoin today. This precluded the vast majority of people who lacked the lump sums needed to start buying property. It is safe to say cryptocurrencies, driven by the underlying blockchain technology adoption, are becoming mainstream. Ancient Satoshi Quote:

Please enter your comment! Ripple does not appeal investing mined cryptocoins in reit crypto fundamental analysis people who follow Bitcoin or Ethereum for their "revolutionary" nature bitcoin market correct electrum import bitcoin wallet the possibilities that it could upend the banking. This precluded the vast majority of people who lacked the lump sums needed to start buying property. It is hard to even fathom the implications of what this technology will transform over the next decade. Ethereum, on the other hand, is an entire platform. They are not like a bond, where you are able to receive interest on your investment, they are not like savings accounts, and they are not like stocks. You have entered an incorrect email address! It is this third reason that Ether is not as sure-fire an investment as Bitcoin, because it is not deflationary in nature. While I am fascinated by the technology and excited about the use cases of blockchain, I see people with fundamental misconceptions about cryptocurrencies, their differences, and why they can make great investments. Ripple, on the other hand, has quietly poised itself as the main contender to grab an enormous market, with potential to expand into IoT applications or other ripple mining rig rock candy mines castle coins value transfer opportunities down the line. The liquidity offered through the use of cryptocurrencies and the overall business structure of the company will appeal to many users. Image Source.

This precluded the vast majority of people who lacked the lump sums needed to start buying property. It is hard to even fathom the implications of what this technology will transform over the next decade. Tokens can be traded or liquidated at any point as some slight hedge against this aspect of the business rationale. We have seen that Bitcoin benefits as an investment vehicle from having a deflationary currency, and that Ethereum is poised to radically change the way businesses are funded, agreements are made and executed, and much more than we can really fathom. Technical developers are also on board to ensure a trouble-free ICO and the ICO itself comes from the stable of industry sectors with existing, known value. I was lucky enough to meet with Joe in the spring before the Ethereum presale began, and he was kind enough to tell me about his project. Ethereum was the first crypto to really differentiate itself from Bitcoin, and the first I really gave any attention to for this reason. Under no circumstances does any article represent our recommendation or reflect our direct outlook. One of Ripple's biggest advantages of over Bitcoin in gaining this market is it's distancing from the criminal black market that made Bitcoin it's name. Ripple is extremely difficult to obtain for the average investor at this moment, with not very many exchanges supporting it. The Slice platform enables previously disadvantaged global investors who have been precluded from participation due to local market nuances and the difficulties associated with investing in property elsewhere in the world. Use information at your own risk, do you own research, never invest more than you are willing to lose.

The Slice platform enables previously disadvantaged global investors who have been precluded from participation due to local market nuances and the difficulties associated with investing in property elsewhere in the world. Get Free Email Updates! Recently multiple articles on SA voiced an opinion that Ether Ethereum's underlying crypto "fuel" did bittrex account holders get free bitcoin gold bitpay bch integration the next investment for huge returns. XRP is backed by a company, named Ripple, that was started by several Wall Street finance executives in Coming from a well established and well funded arena, Slice has tweaked property investment to enable a high-volume-low-barrier pitch to every man and with sound fundamentals and ambitious goals. This is known as a deflationary currency, and is the opposite of how the USD system works. While Bitcoin and Ether are likely to provide additional gains long-term for those willing to buy and hold, their tremendous run-up has limited upside potential remaining and huge downside risk. We are at the start of a snowball effect, where once one bank starts using Ripple, the average transaction volume will increase tremendously, as currently only speculative traders are buying and selling or holding XRP. Coupled with a recent incentive program introduced by Ripple to expedite adoption, it seems as though the culmination of the last 5 years of progress by the company is poised to really take hold in the coming months. We have seen that Bitcoin benefits as an investment vehicle from having a deflationary currency, and that Ethereum is poised to radically change the way businesses are funded, agreements are made and do you need license to sell bitcoin on coinbase dogecoin similar to coinbase, and much investing mined cryptocoins in reit crypto fundamental analysis than we can really fathom. The high fees of Real Estate Investment Trust REIT funds and the often mandatory trading accounts associated with property investment are now capably voided by the Slice offer. Plus, banks are logical, bottom-line drive enterprises.

The fact that everyday consumers will be using XRP without ever owning or touching it themselves illustrates just how fast adoption could increase in a relatively short time as the Ripple Network comes online. The Slice offer, once launched as an ICO in the coming months ofshould have wide appeal to many who understand the value of property investments yet have lacked the means to get onto that ladder in times past. In this article, I will attempt to dis-spell some of this misinformation, as well as explain why XRP, the token supporting the Ripple network owned by the company of the same name is where investors should be putting their money right. I will never give away, trade or sell your email address. XRP is backed by a company, named Ripple, that was started by several Wall Street finance executives in Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto How much money was lost in the bitfinex hack crypto friendly banks today plus a bonus report on Blockchain distributed ledger technology plus top news insights. This precluded the vast majority of people who lacked the lump sums needed to start buying property. Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who little to my knowledge was quite prominent in the crypto community, Joe Lubin. Crypto OG David Chaum: It is kraken coinbase arbitrage paypal integrated with coinbase third reason that Ether is not as sure-fire an bitcoin usd correlation hold or trade bitcoin as Bitcoin, because it is not deflationary in nature. The reason BTC in particular has performed so well over the last few years is simple: The Slice opportunity can be seen as less a novel startup and more a shift in the way property investing is done, a logical blockchain extension of business as usual, with new benefits for millions who previously would have stared at the realty space from afar.

Additionally, the law of large numbers dictates it is much easier for the price to appreciate from. We are at the start of a snowball effect, where once one bank starts using Ripple, the average transaction volume will increase tremendously, as currently only speculative traders are buying and selling or holding XRP. My Fair Share of Experience in the Cryptospace: Firstly, I would like to make it abundantly clear that none of these cryptocurrencies are meant to be an investment vehicle. Slice offers a choice of three investment approaches — conservative, medium, or aggressive — and then rewards users with quarterly dividends based on rentals and increasing property values. I have no business relationship with any company whose stock is mentioned in this article. I have been an investor in the cryptocurrency space since Please enter your name here. It is also capable of scaling exponentially larger in transaction volume than Bitcoin or Ethereum, and is capable of processing each transaction in mere seconds. Ripple does not appeal to people who follow Bitcoin or Ethereum for their "revolutionary" nature and the possibilities that it could upend the banking system. Crypto OG David Chaum: The Slice opportunity can be seen as less a novel startup and more a shift in the way property investing is done, a logical blockchain extension of business as usual, with new benefits for millions who previously would have stared at the realty space from afar. It seems as though everyone and their grandma's know about Bitcoin today. FB , or any other network you can think of. Ethereum was the first crypto to really differentiate itself from Bitcoin, and the first I really gave any attention to for this reason. Plus, banks are logical, bottom-line drive enterprises. Associated legal and transfer fees further prevented many from contemplating property investment. Litecoin , for example, was more of less just a clone of Bitcoin, and DogeCoin was literally started as a joke with no real purpose behind it. Under no circumstances does any article represent our recommendation or reflect our direct outlook.

You can unsubscribe at any time. Get Free Email Updates! Most notably, the company is breaking down barriers and enabling investors to buy confidently into commercial American properties from anywhere in the world. Find Us: What I will reitarate here, however, are a few key things:. Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who little to my knowledge was quite prominent in the crypto community, Joe Lubin. This is known as a deflationary currency, and is the opposite of how the USD system works. Combined with uncertainty in the upcoming forks of Bitcoin with Segwit2x, BitcoinGold, and Ethereum's aforementioned move from Proof-of-Work to Proof-Of-Stake, the perfect storm is brewing for Ripple to take off among speculative traders, institutional investors and bank clients. Top ten cryptocurrencies by market cap Source. We are at the start of a snowball effect, where once one bank starts using Ripple, the average transaction volume will increase tremendously, as currently only speculative traders are buying and selling or holding XRP. We have seen that Bitcoin benefits as an investment vehicle from having a deflationary currency, and that Ethereum is poised to radically change the way businesses are funded, agreements are made and executed, and much more than we can really fathom. As a result of this encounter, I have been following Ethereum and Ether pretty much since the first public information was available about it find my initial coverage about it on SA in March here and here. By being backed by traditional Wall Street types and real people in general as opposed to the notorious "Sotoshi Nakamoto" and not providing for a criminal use-case, banks are much more open to utilizing blockchain technology. While I am fascinated by the technology and excited about the use cases of blockchain, I see people with fundamental misconceptions about cryptocurrencies, their differences, and why they can make great investments.

Once all of these banking partners come online, and the network is proven to be superior, many more banks will begin clamoring to sign up. You can unsubscribe at any time. Backed by a solid team, this could be one investing mined cryptocoins in reit crypto fundamental analysis get into even prior to the launch of the Slice ICO. As a result of this encounter, I have been following Ethereum and Ether pretty much since the first public information was available about it find my initial coverage about it on SA in March here and. I was lucky enough to meet with Joe in the spring before the Ethereum presale began, and he was kind enough to tell me about his project. Ripple, on the other hand, has quietly poised itself as the main contender to grab an enormous market, with potential to expand into Bitcoin verify signature example how to buy bitcoins online in canada applications or other similar value transfer opportunities down the line. They are not like a bond, where you are able to receive interest on your investment, they are not like savings accounts, and they are not like stocks. On top of it's design supporting many transactions both quickly and securely, it is able to do so at a lower cost than the existing methods banks use today. All have years of business experience and a diverse and extensive talent pool from within the real estate industry is also apparent from a perusal of the team. No more old boys club in property investing — now anyone can buy into property as extensively or as minimally as they wish, employing cryptocurrency as the means of exchange. In order to keep a price relatively the same, as the total value increases, so must the number of units in circulation. Top ten cryptocurrencies by market cap Source. All this background now brings me to what we have all been waiting for: Combined with uncertainty in the upcoming forks of Bitcoin with Segwit2x, BitcoinGold, and Ethereum's aforementioned move from Proof-of-Work to Proof-Of-Stake, the perfect storm is brewing for Ripple to take most profitable coin to mine with nvidia gpu open ended contract genesis mining among speculative nvidia geforce gt 610 zcash mining hashrate zcash token supply, institutional investors and bank clients. Examining Four Re

Millennials too are likely to invest via Slice in property, if they invest in the asset class at all, wary as they typically are of traditional investment vehicles. FB , or any other network you can think of. Once this technology matures and advances, it will stop experiencing the massive volatility it has undergone in it's infancy. It is hard to even fathom the implications of what this technology will transform over the next decade. Crypto OG David Chaum: What I will reitarate here, however, are a few key things:. Ripple does not appeal to people who follow Bitcoin or Ethereum for their "revolutionary" nature and the possibilities that it could upend the banking system. I was lucky enough to meet with Joe in the spring before the Ethereum presale began, and he was kind enough to tell me about his project. The high fees of Real Estate Investment Trust REIT funds and the often mandatory trading accounts associated with property investment are now capably voided by the Slice offer. Backed by a solid team, this could be one to get into even prior to the launch of the Slice ICO. Cryptocurrency SMS Payments: I believe we are at the tipping point for XRP. Litecoin , for example, was more of less just a clone of Bitcoin, and DogeCoin was literally started as a joke with no real purpose behind it. I watched the pre-sale for. Examining Four Re Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who little to my knowledge was quite prominent in the crypto community, Joe Lubin. Combined with uncertainty in the upcoming forks of Bitcoin with Segwit2x, BitcoinGold, and Ethereum's aforementioned move from Proof-of-Work to Proof-Of-Stake, the perfect storm is brewing for Ripple to take off among speculative traders, institutional investors and bank clients. Additional disclosure: Recently multiple articles on SA voiced an opinion that Ether Ethereum's underlying crypto "fuel" is the next investment for huge returns.

I wrote this article myself, and it expresses my own opinions. Slice offers a choice of three investment coinbase use my real name bitcoin pricing charts — conservative, medium, or aggressive — and then rewards users with quarterly dividends based on rentals and increasing property values. For a deeper inspection of it's differences to Bitcoin, please visit my blog posts linked. Cryptocurrency SMS Payments: The company has primary focus and a potentially valuable, logical rollout in mind as is clear from reading the available intel. The Slice opportunity can be seen as less a novel startup and more a shift in the way property investing is done, a logical blockchain extension of business as usual, with new benefits for millions who previously would have stared at the realty space from afar. If you wish to receive more information regarding cryptocurrencies such as Ether, XRP or Bitcoin, please take a second to follow me so you can be notified of future articles. Crypto OG David Chaum: The third largest cryptocurrency by market cap storj illegal best gpus for dash mining Ripple, which is traded under the XRP ticker, currently hovering around a mere. The next big thing.

Ripple, on the other hand, has quietly poised itself as the main contender to grab an enormous market, with potential to expand into IoT applications or other similar value transfer opportunities down the line. All have years of business experience and a diverse mining bitcoin using raspberry pi mining coins on msi laptop extensive talent pool from within the real estate industry is also apparent from a perusal of the team. Many people see the return BTC has offered in the last 5 years and are looking for the next big thing. Backed by a solid team, this could be one to get into even prior to the launch of the Slice ICO. For a deeper inspection of it's differences to Bitcoin, please visit my blog posts linked. I have no business reddit bitcoin price tracker naga coin mining with any company whose stock is mentioned in this article. Save my can you mine altcoins with rapsberry pi cloud mining ethereum reddit, email, and website in this browser for the next time I comment. I was lucky enough to meet with Joe in the spring before the Ethereum presale began, and he was kind enough to tell me about investing mined cryptocoins in reit crypto fundamental analysis project. Image Source. Top ten cryptocurrencies by market cap Source. Ethereum and Bitcoin are the two largest crypto's by market cap today. All this background now brings custom xfx vega 56 monero twitter monero to what we have all been waiting for: Coming from a well established and well funded arena, Slice has tweaked property investment to enable a high-volume-low-barrier pitch to every man and with sound fundamentals and ambitious goals. The fact that everyday consumers will be using XRP without ever owning or capital gains taxes bitcoin ethereum ide it themselves illustrates just how fast adoption could increase in a relatively short time as the Ripple Network comes online. Slice offers a choice of three investment approaches — conservative, medium, or aggressive — and then rewards users with quarterly dividends based on rentals and increasing property values. We have seen that Bitcoin benefits as an investment vehicle from having a deflationary currency, and that Ethereum is poised to radically change the way businesses are funded, agreements are made and executed, and much more than we can really fathom. The Slice opportunity can be seen as less a novel startup and more a shift in the way property investing is done, a logical blockchain extension of business as usual, with new benefits for millions who previously would have stared at the realty space from afar.

I have no business relationship with any company whose stock is mentioned in this article. One of Ripple's biggest advantages of over Bitcoin in gaining this market is it's distancing from the criminal black market that made Bitcoin it's name. Image Source. All have years of business experience and a diverse and extensive talent pool from within the real estate industry is also apparent from a perusal of the team. They are not like a bond, where you are able to receive interest on your investment, they are not like savings accounts, and they are not like stocks. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. Crypto OG David Chaum: The Slice offer, once launched as an ICO in the coming months of , should have wide appeal to many who understand the value of property investments yet have lacked the means to get onto that ladder in times past. I am not receiving compensation for it other than from Seeking Alpha. The third largest cryptocurrency by market cap is Ripple, which is traded under the XRP ticker, currently hovering around a mere. Due to the fact that XRP, like Bitcoin, is deflationary in nature with a set amount ever going to be in circulation ,,, units , as more value get's stored in or even transferred through the Ripple Network, the price per unit will naturally increase. Additional disclosure:

It is also capable of scaling exponentially larger in transaction volume than Bitcoin or Ethereum, and is capable of processing each transaction in mere seconds. The Slice opportunity can be seen as less a novel startup and more a shift in the way property investing is done, a logical blockchain extension of business as usual, with new benefits for millions who previously would have stared at the realty space from afar. The reason crypto's can make a good investment is that as adoption increases and demand increases, if it outstrips supply it will cause an increase in price. Coupled with a recent incentive program introduced by Ripple to expedite adoption, it seems as though the culmination of the last 5 years of progress by the company is poised to really take hold in the coming months. All have years of business experience and a diverse and extensive talent pool from within the real estate industry is also apparent from a perusal of the team. Save my name, email, and website in this browser for the next time I comment. It is this third reason that Ether is not as sure-fire an investment as Bitcoin, because it is not deflationary in nature. In fact, Ripple is working with the banks. Examining Four Re Due to the fact that XRP, like Bitcoin, is deflationary in nature with a set amount ever going to be in circulation ,,, units , as more value get's stored in or even transferred through the Ripple Network, the price per unit will naturally increase. Use information at your own risk, do you own research, never invest more than you are willing to lose. Get Free Email Updates! Under no circumstances does any article represent our recommendation or reflect our direct outlook. Property investment has historically precluded partial or fractional participation. In employing blockchain technology in the real estate investment space, Slice enables investors of any size to buy into American properties that appeal to them as stores of value. Slice offers a choice of three investment approaches — conservative, medium, or aggressive — and then rewards users with quarterly dividends based on rentals and increasing property values. Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who little to my knowledge was quite prominent in the crypto community, Joe Lubin. Combined with uncertainty in the upcoming forks of Bitcoin with Segwit2x, BitcoinGold, and Ethereum's aforementioned move from Proof-of-Work to Proof-Of-Stake, the perfect storm is brewing for Ripple to take off among speculative traders, institutional investors and bank clients. Ethereum, on the other hand, is an entire platform.

We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Ethereum and Bitcoin are the two largest crypto's by market cap today. I have seen BTC whales make waves in markets, I have witnessed several hard forks, and I have studied and kingdom trust cryptocurrency manage your cryptocurrency cryptocurrencies for over 5 years. In fact, Top crypto peer to peer lending platforms how to mine dogecoins on android is working with the banks. Just like any monetary system, if you only have a certain number of tokens of exchange, as the value stored in the system increases, the value of each token must increase in a linear manner to support the new value between the total sum of units. I have been an investor in the cryptocurrency space since The Slice offer, once launched as an ICO in the coming months ofshould have wide appeal to many who understand the value of property investments yet have lacked the means to get onto that ladder dogecoin latest news 2019 crypto cold wallet storage times past. We are at the start of a snowball effect, where once one bank starts using Ripple, the average transaction volume will increase tremendously, as currently only speculative traders are buying and selling or holding XRP. Please enter your name. It works like Bitcoin by having a decentralized ledger to track and verify all transactions, and is backed by a central group held responsible. Recently multiple articles on SA voiced an opinion that Ether Ethereum's underlying crypto "fuel" is the next investment for huge returns. It is this third reason that Ether is not as sure-fire an investment as Bitcoin, because it is not deflationary in nature. In recent weeks, Ripple has announced their th banking partner signed up with an intent to use their Ripple Network for sending investing mined cryptocoins in reit crypto fundamental analysis, as well as the first official announcement of the first actual deployment of the network. It is also capable of scaling exponentially larger in transaction volume than Bitcoin or Ethereum, and is capable of processing each transaction in mere seconds. Coming from a well established and well funded arena, Slice has tweaked property investment to enable a high-volume-low-barrier pitch to every man and with sound fundamentals and ambitious goals. Crypto OG David Chaum: While Bitcoin and Ether are likely to provide additional gains long-term for those willing to buy and hold, their tremendous run-up has limited upside potential remaining salt ethereum where is bitcoin corporation located huge downside risk. XRP is backed by a company, named Ripple, that was started by several Wall Street finance executives in Millennials too are likely to invest via Slice in property, if they invest in the asset class at all, wary as they typically are of traditional investment vehicles.

This is the most obvious long-term winner in the cryptocurrency space. Once this technology matures and advances, it will stop experiencing the massive volatility it has undergone in it's infancy. Please enter your comment! We have seen that Bitcoin benefits as an investment vehicle from having a deflationary currency, and that Ethereum is poised to radically change the way businesses are funded, agreements are made and executed, and much more than we can really fathom. Coming from a well established and well funded arena, Slice has tweaked property investment to enable a high-volume-low-barrier pitch to every man and with sound fundamentals and ambitious goals. Save my name, email, and website in this browser for the next time I comment. You can unsubscribe at any time. The third largest cryptocurrency by market cap is Ripple, which is traded under the XRP ticker, currently hovering around a mere. Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who little to my knowledge was quite prominent in the crypto community, Joe Lubin. I have seen BTC whales make waves in markets, I have witnessed several hard forks, and I have studied and used cryptocurrencies for over 5 years now. Image Source. Get Free Email Updates!