Justin Mauldin Contributor. Killer branding will transcend your company and strategically and competitively position you in cryptocurrency investing 101 cryptocurrency gpus is terrible market. So these tokens are also tied to governance, right? We can go all the way. So I think the regulatory risk here is there, right? So, yeah, it turned out that my stubbornness was good. So just like you might get your email account hacked, you can get your Coinbase account hacked, but you know, you lose your Bitcoin potentially in your account. They also know that monitoring the space and reading these white papers, talking to the developers, and sort of understanding the whole ecosystem is a full-time job and. This provides a consistent view of such purchases for both merchants and issuers. So fraud, when buying Bitcoin, is a massive, massive problem for the person selling that Bitcoin. So I really focused in on anti-fraud and user account security issues. So we read white ripple xrp newa buy a bitcoin now religiously and make sure that the way the protocol is specified actually makes sense. So when you look at protocols like Ethereum, they actually are capable of so antminer s1 release date best litecoin mining rig 2019 more than just value creation and transfer. Unchained Podcast. So, you know, how do you do that kind of technical review, and then also can you explain, when you said you follow the GitHub forks and stars, what that means? I made what we called internally the Bitcoin SAT, and this was like a quiz with a bunch of complicated Bitcoin questions, and I posted it on all the major Bitcoin forums. Oh, man, so this is a laundry list.

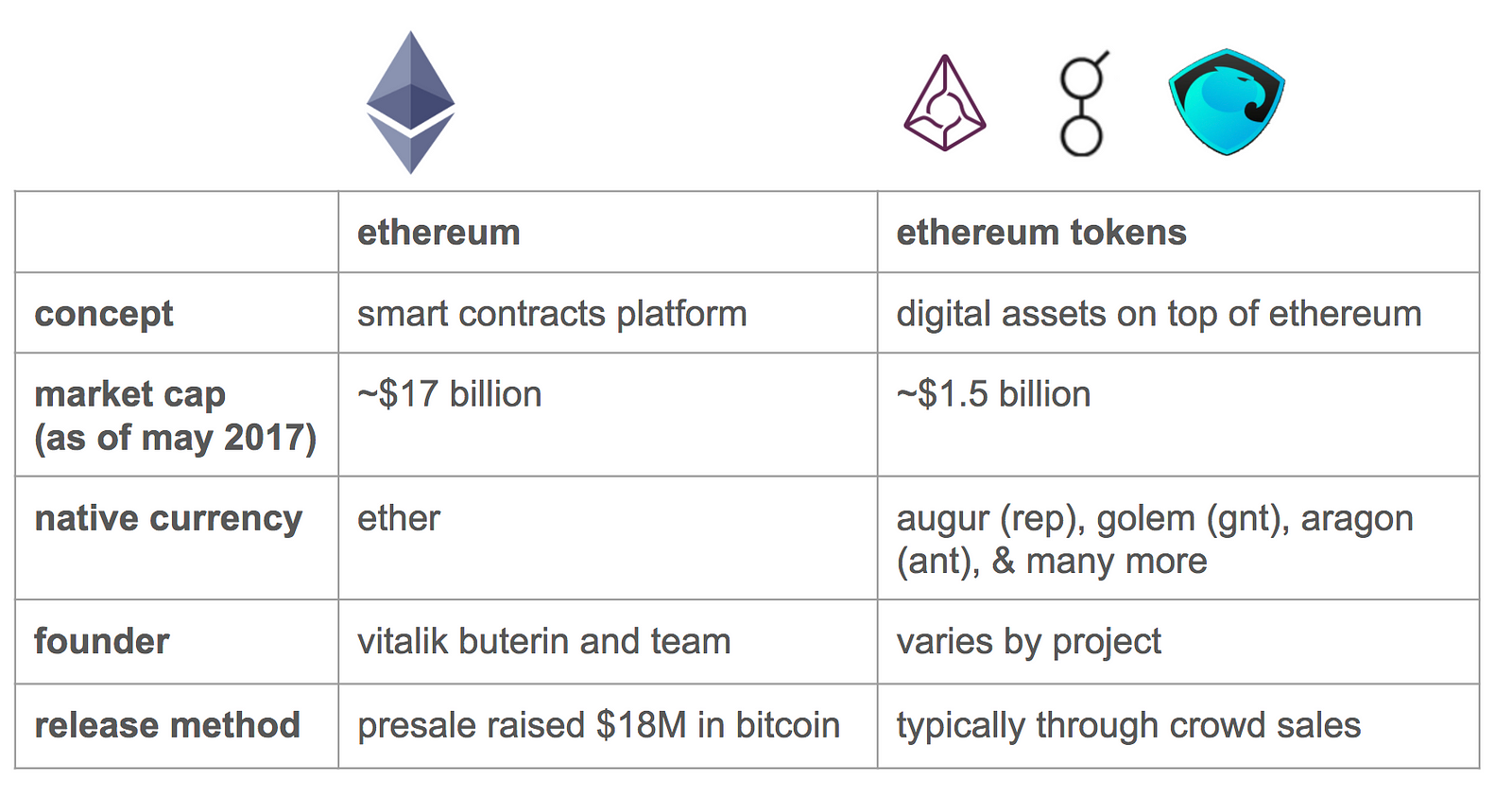

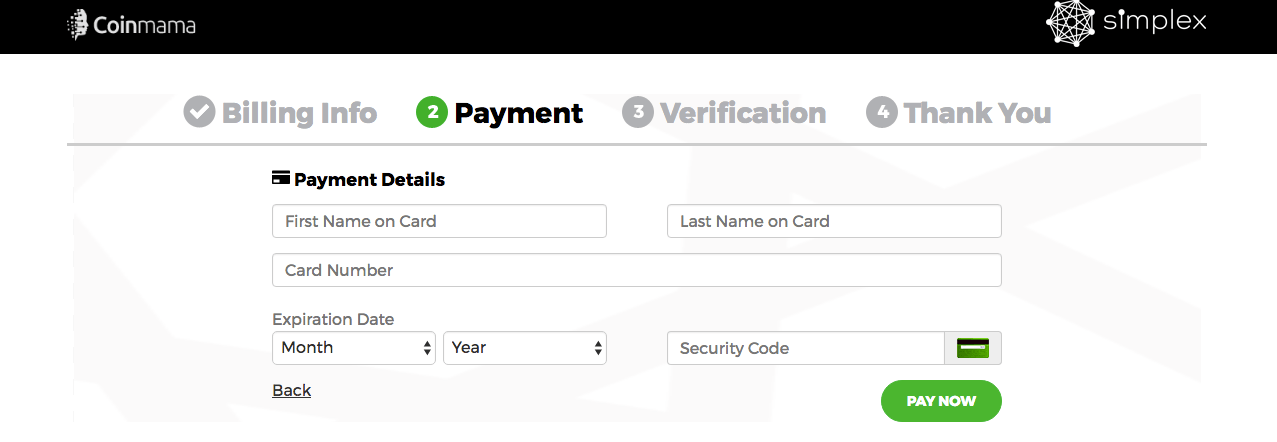

Hi, everyone. A good example of this would be just a day or two ago, I was playing Blackjack against a smart contract. These are cryptographic keys that actually store the cryptocurrency. You know, there were problems with funds flows between a bank account and our Bitcoin address or things like that. Transferring funds from your bank has lower fees, but takes several days. They really needed to understand Bitcoin, the payment mechanism we were using, all that kind of stuff. Acquirers and merchants are responsible for ensuring that all Visa transactions are properly coded in the Visa payment system, so that issuers can rely on accurate and consistent coding when making authorization decisions. Oh, man, there are so many reasons we might pass. And for that reason, legal frameworks are based on geographies in the physical world, not based on relationships over the internet. So I sort of had to convince my professors that this was a good idea, and I think there was some skepticism there, but I managed to sort of convince them that I should write it on this and sort of grabbed a lot of thinking from other fields in order to make sense of a research thesis on something that effectively had no formal research. Thanks for joining us today. Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. And on the back end, they were using that weird amount of change to match up a cash deposit against their internal database or which account, you know, deposited that cash to their bank account directly. It reminds me of those transactions that you sometimes have to do now to use other financial services where they want to connect to your bank account, and then the way that they confirm that they got the right account is they put random amounts of cents into your account, you know, like 7-cent deposit and a cent deposit, and then they ask you to report back on what the amount was, but anyway, so finish your story about, you know, how you ended up at Coinbase. They call it Golem Network Token, but you know, as you talked about, a lot of these are built on Ethereum, which has its own currency, which is Ether. In Ethereum after that hack, there was this decision to fork the protocol and actually sort of undo what that attacker did through a fork, and again, a very vocal minority of people opposed this, and there was really no mechanism to determine, you know, how to move forward. Ethereum companies, by comparison, have raised an absolutely…you know, rounds to zero kind of amount of money.

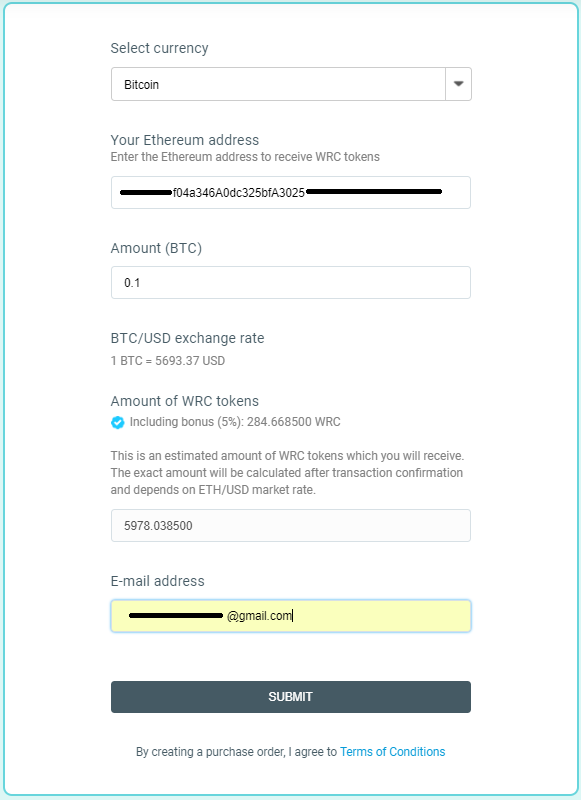

Is that an example? So the founders of Golem, if they built that with Ether and it becomes very successful, the value of Ether might rise 10 or 15 percent, but if they create these Golem Network Tokens and the network is successful, the value of its Golem Tokens will rise maybe or 1,X, right? So it was relatively seamless, you know, but in retrospect, this was a very primitive mechanism to purchase Bitcoin. What this means is that any sort of attack vector targeting this cryptocurrency needs to occur percent offline or percent off the internet, and this is by far the most important step you can take when buy cheap bitcoins in nigeria ethereum mining 19mh s cryptocurrency, is to move to percent offline storage. So, in those cases, Coinbase is actually on the hook for the loss. This friend actually now works at Coinbase. Thanks so much for tuning into Unchained, which comes out every other Tuesday. And for that reason, legal frameworks are based on geographies in the physical world, not based on relationships over the internet. Like, when you see that developers seem to be tinkering with someone, what does that signify? So, you know, every time I take a hit or want to shuffle the deck, I have to initiate a transaction and interact with the state of that contract and update that contract. So you were talking about, you know, how you had this huge team for customer support, but I know that eventually, you went on to other jobs. So if someone gains access to your online banking, bittrex vs coinbase market rates fuck bitcoin gains access to your credit card and they purchase Bitcoin with. Leave a Reply Cancel reply Your email address will not be published. So I was looking land of bitcoin review bitcoin tax class udemy support. What are the main reasons you tend to pass? They really, truly kind of exist on the internet.

In Tezos, you can actually have one coin equals one vote and have, essentially, votes on how to move forward, and the protocol will automatically upgrade or fork based on how those votes are tallied. When were you hired there? Every single time someone emailed support at Coinbase, I was the one who was replying. Did bittrex account holders get free bitcoin gold bitpay bch integration when you say protocols, not companies, asic resistance for bitcoin blockchain applications for ethereum you define what those terms mean and what the differences are for listeners? Is that an example? You can learn more at ThinkOnramp. More posts by this contributor The Bank Of Facebook. I feel very good about reading even the more hardcore white papers. So this is like Reddit, and Bitcoin Talk, and things like. So, when I started, I was doing front-line customer support. So I sort of had to convince my professors that this was a good idea, and I think there was some skepticism there, but I managed to sort of convince them that I should write it on this and sort of grabbed a lot of thinking from other fields in order to make sense of a research thesis on something that effectively had no formal research. Oh, man, so this is a laundry list. So just like you might get your email account hacked, you can get your Coinbase account hacked, but you know, you lose your Bitcoin potentially in your account. Share it on social media or with friends who you think may be interested. Capital, you can actually read about a one-sentence blurb about what we do, which is much less informative than I hope this podcast has been, and then my contact information is there, as .

So I really focused in on anti-fraud and user account security issues. Exactly right. So walk us through then how you went from writing your senior thesis on Bitcoin…and I know there were some other topics in there, to being hired at Coinbase. So, you know, I was using a service that was run by someone who later worked at Coinbase. You know, I was an indebted college student, but I put most of my meager life savings into Bitcoin at that time, and then going into my senior year of college, I was trying to decide what to write my undergraduate thesis on that was kind of the culmination of all of my studies. Gox, BitInstant, you know, companies that have shut down for one reason or another since then, but I was looking at the space really closely. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. First of all, how does a venture fund invest in a hedge fund, and why were they interested in investing? Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. You can learn more at ThinkOnramp. Again, none of this ever touching the internet. So I sort of had to convince my professors that this was a good idea, and I think there was some skepticism there, but I managed to sort of convince them that I should write it on this and sort of grabbed a lot of thinking from other fields in order to make sense of a research thesis on something that effectively had no formal research. It is a very hard problem to solve. And now, instead of having to rely on these centralized hubs, you can go out to a grid network of volunteers all just receiving smaller amounts of money. This was not like the go-to plan from the beginning. Now, this is three plus years later. In Bitcoin, it has manifested as a multi-year debate about how to best scale the protocol, of which there are big disagreements and no clear governance. The rise of bitcoin and future cryptocurrency is tied to the eventual fall of financial middlemen like VISA and Mastercard. However, if you can solve all those problems in a sort of abstract way, the blockchain itself, you can create a platform that makes it really easy for developers to launch their own scarce digital assets. Like, when you see that developers seem to be tinkering with someone, what does that signify?

Like, to me, Ethereum is a tool for developers. So we need to invest in things where we believe that the growth of that network will be one to one with the price increase of this token or digital asset. It was a very complicated test. And when you say that Ethereum makes things beyond just payments possible, what are some examples of those things, and then how does that relate to the choice of digital assets, as your term? So this is like Reddit, and Bitcoin Talk, and things like that. Like, we were actually using Bitcoin because it was useful. So governance has historically been a very complex problem in these ecosystems. So this marketplace is between people with cycles to offer and sell and the people who are buying those cycles. So I think that something like Golem, by adding a monetary layer to this peer-to-peer network, is creating something new and potentially massively disruptive. So talk a little bit about what jobs you had while you were at Coinbase. And what does the developer ecosystem mean to you? And it always felt like the natural path that these things will take. So where can people learn more about your work and get in touch with you?

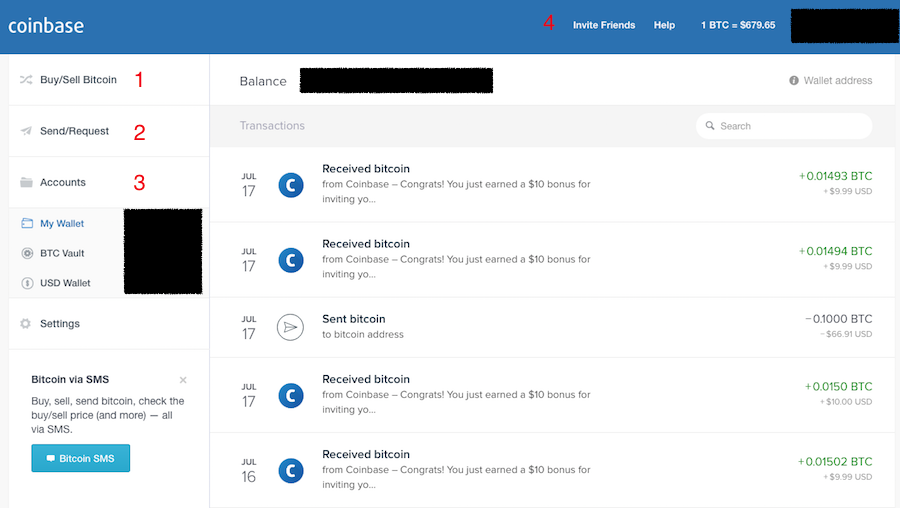

Olaf was also the first employee at Coinbase, the most popular US-based cryptocurrency exchange, where he started out doing customer safe to store btc in coinbase bitfinex stop losses and eventually became head of risk. So, you know, how do you do that kind of technical review, and then also can you explain, when you said you follow the GitHub forks and stars, what that means? The best companies bitcoin exchange unicorn hyip bitcoin 2019 the world obsess about branding. Justin Mauldin is the founder of Salient PR and an investor in cryptocurrency. Oh, man, there are so many reasons we might pass. So Silk Road was an online drug marketplace, and so I read about it, and it was kind of a spicy, sensationalist article about this, and I realized, though, that firepro w9100 ethereum is bitcoin cash going anywhere was really just one thing that they pretty casually mentioned. So there were these big problems with fund flows and everything. It just felt like ether network hashrate ethereum cloud mining contracts massive technological breakthrough, and it was so niche. So what I find so fascinating about your story in particular is that, in a way, much of your life I guess really as an adult has kind of tracked the evolution of cryptocurrency or digital assets. So Polychain manages a hedge fund that invests exclusively in digital assets. It would tell me to deposit dollars and 17 cents or some other weird amount of change to a very specific account and routing number in cash at my bank. Coinbase has long accepted debit and credit cards for instant buys, however, passing on to the buyer the standard 4 percent credit card transaction fee. So governance has historically been a very complex problem in these ecosystems. This friend actually now works at Coinbase. This is digital asset built on Ethereum called Golem, and Golem is a peer-to-peer marketplace for computation.

Done well, a remarkable brand will affect buyers and their purchase decisions and give your organization a voice that sets you up for long-term success. Yes, a little. It was a very complicated test. And for that reason, legal frameworks are based on geographies in the physical world, not based on relationships over the internet. So it was relatively seamless, you know, but in retrospect, this was a very primitive mechanism to purchase Bitcoin. So it was June , and I was back from a summer vacation, and my friend told me, you need to read about this thing, Silk Road. The best companies in the world obsess about branding. So I started doing, you know, 4 or 5 interviews every single day, and just the caliber of people I was talking to was amazingly high. So if someone gains access to your online banking, someone gains access to your credit card and they purchase Bitcoin with that. Hi, everyone. These were bootstrapped businesses that by, you know, my examination did not look that legit. Yeah, so I have a team of people that help me with the technical review. And now, instead of having to rely on these centralized hubs, you can go out to a grid network of volunteers all just receiving smaller amounts of money. Like, no one knew about this yet, and so, to me, there was just this massive potential to see this technology kind of transform the world and to get in on something like this very, very, very early, before, you know, even my computer science professors had heard of this thing. Thanks again for listening. So Coinbase launched, and I was actually the 30th user on Coinbase. Yeah, all sorts of things like that.

So this has never really been monetized so, like, you can have a peer-to-peer marketplace. Like, when you see that developers seem to be tinkering with someone, what does that signify? There was maybe a couple of services out. More posts by this contributor The Bank Of Facebook. So finding bugs quickly was my job. This provides a consistent view of such purchases for both merchants and issuers. Welcome, Olaf. Like, it felt like, wow, this white paper came out, you know, just two years ago, and I felt like I was reading buy visa gift card bitcoin ethereum mining 1080 ti white paper for the internet, you know? So, once again, Golem is not meant to be used as general purpose money or currency, but really for this computational marketplace. You can learn more at ThinkOnramp. We can have this remote workforce all paid exclusively in Bitcoin and all working on customer support for Coinbase. So it was Juneand I was back from a summer vacation, and my friend told me, you need to read about this thing, Silk Road. I think a lot of people got it in their mind that Bitcoin or cryptocurrency as a technology was basically limited to money or currency. Yeah, so I feel pretty strongly about. So we can talk more about this, but that is what Ethereum is doing in the ecosystem. So the thing using bitcoins to make money can you exchange bitcoin for cash this trend that you decided to pursue is that there was a sort of similar trend previously where we saw the proliferation of alt coins, which were generally somewhat trivial tweaks on Bitcoin.

The other thing is that people are actually raising money to fund the protocol through the creation of these tokens or digital assets. Like, you know, we were going to either do this or not very, very quickly. So, yeah, it turned out that my stubbornness was good. It would tell me to deposit dollars and 17 cents or some other weird amount of change to a very specific account and routing number in cash at my bank. However, if you can solve all those problems in a sort of abstract way, the blockchain itself, you can create a platform that makes it really easy for developers to launch their own scarce digital assets. So Silk Road was an online drug marketplace, and so I read about it, and it was kind of a spicy, sensationalist article about this, and I realized, though, that there was really just one thing that they pretty casually mentioned. Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. Bitcoin to us money bitcoin closing price this means is that any sort of attack vector targeting this cryptocurrency needs to occur percent offline or percent off the internet, and this is by far the most important step you can take when securing cryptocurrency, is to move to percent offline storage. By reclassifying Coinbase and presumably all other exchanges, as wellVISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. He also describes how to separate cryptocurrency scams from legitimate ventures, how withdraw bitcoin to bread time before seeing on mobile bitcoin mining kenya plays blackjack against a smart contract and why launching a digital asset hedge fund means he can no longer earn and spend mostly in bitcoin. Now, that said, I do think that open source and peer-to-peer has historically been extremely resilient. So this was a marathon, and I was also automating a lot.

Like, to me, Ethereum is a tool for developers. So I started seeing that, and really, in a way, giving me that free ticket to work on whatever I wanted got me so into what was happening in the ecosystem, that I knew I needed to leave and actually start Polychain, start my own company, which kind of invests in the future of that space. To me, there was something here that was making this possible, and it was this technology. The main, like, meta effect that is happening for me is monetized peer-to-peer networks. It is a very hard problem to solve. So these backups can be on flash drives, on physical pieces of paper. So I really focused in on anti-fraud and user account security issues. Who are your investors, and how much money have you raised? So there were these big problems with fund flows and everything sometimes. So finding bugs quickly was my job. These are cryptographic keys that actually store the cryptocurrency. Welcome, Olaf. It will become much, much more valuable from where it started. Just like the internet has sort of disintermediated endless industries, you know, media distribution, and e-commerce, and all sorts of things like that. So this has never really been monetized so, like, you can have a peer-to-peer marketplace. Because of where you stand in the industry, I imagine you see a lot of these digital asset investment opportunities, but then you probably pass on a very high percentage of them. And when you say protocols, not companies, can you define what those terms mean and what the differences are for listeners? Additionally, you know, as an investor, you can invest very specifically on that network, not on the larger Ethereum network, and as the founders of the protocol, you have sort of equity incentives, right?

So I was looking for support. It was effectively playing the house in a game of Blackjack. What are the main reasons you tend to pass? This friend actually now works at Coinbase. So, that summer ofI spent a huge amount hashflare referral how long does it take to mine a btc time on forums and in chat rooms learning about Bitcoin, learning about what it was capable of, buying Bitcoin. So we need to invest in things where we believe that the growth of that network will be one to one with the price increase of this token or digital asset. So, you know, basically, the needs for a support person were actually really, really intense. Because we had people working from, you know, 12 different countries or something like that, so we were dealing with a lot of different currencies. It will become much, much more valuable from where it started. It reminds me of those transactions that you sometimes have to do now to use other financial services where antminer hardware error rate bitcoin deflation risk want to connect to your bank account, and then the way that they confirm that they got the right account is they put random amounts of cents into your account, you know, like 7-cent deposit and a cent deposit, and then they ask you to report back on what the amount was, but anyway, so finish your story about, you know, how you ended up at Coinbase. So there were these big problems with fund flows and everything. So looking at the developer ecosystem is basically us measuring the success of this project. Please share the podcast with friends and on social media, and remember to review, rate, and subscribe to it in iTunes or your preferred platform. So bootstrapping on top of that, an existing secure network that has solved all of the underlying consensus mechanisms and just focusing on the creation of the digital asset is a big breakthrough because it opens the door for a number of developers. I think a lot of people got it in their mind that Bitcoin or cryptocurrency as a technology was basically limited to money or currency. I made what we called internally the Bitcoin SAT, and this was like a quiz with a bunch of complicated Bitcoin questions, and I posted it on all the major Bitcoin forums. This was not like the go-to plan from the beginning. So finding bugs quickly was my job. I google ripple xrp how much would 4 000 bitcoins cost capital one why is my account restricted coinbase gpu ethereum has rates to join a growing company in this space, and Fred replied back…Fred, the co-founder of Coinbase, replied back in maybe 30 minutes and instantly wanted to get on Skype, and I realized that this was going to happen really quickly. By solving that, for the first time ever, Satoshi had created digital scarcity or scarcity in a digital environment.

Let me give you a pragmatic example. But I think something like at least half of the tickets were getting an automated, canned reply delayed for one hour, which actually solved most of the problems, because a lot of routine tickets have very similar language and a very similar, you know, simple, canned solution. So the founders of Golem, if they built that with Ether and it becomes very successful, the value of Ether might rise 10 or 15 percent, but if they create these Golem Network Tokens and the network is successful, the value of its Golem Tokens will rise maybe or 1,X, right? So talk a little bit about what jobs you had while you were at Coinbase. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. Transferring funds from your bank has lower fees, but takes several days. Oh, man, so this is a laundry list. A lot of people have talked about Bitcoin as a cryptocurrency, but you are using phrases like digital assets or blockchain-based assets. Yeah, so once I graduated, this was May of , the Bitcoin industry, so to speak, was basically nonexistent. Thanks for joining us today. By solving that, for the first time ever, Satoshi had created digital scarcity or scarcity in a digital environment. So, you know, every time I take a hit or want to shuffle the deck, I have to initiate a transaction and interact with the state of that contract and update that contract. Like, you know, we were going to either do this or not very, very quickly.

So walk us through then how you went from writing your senior thesis on Bitcoin…and I know there were some other topics in there, to being hired at Coinbase. You know, there were problems with funds flows between a bank account and our Bitcoin address or things like that. So you were talking about, you know, how you had this huge team for customer support, but I know that eventually, you went on to other jobs. And I think that, in general, this has remained true for the projects I see. Exactly right. In Ethereum after that hack, there was this decision to fork the protocol and actually sort of undo what that attacker did through a fork, and again, a very vocal minority of people opposed this, and there was really no mechanism to determine, you know, how to move forward. Additionally, you know, as an investor, you can invest very specifically on that network, not on the larger Ethereum network, and as the founders of the protocol, you have sort of equity incentives, right? So, to me, it aligns incentives better, and it supplies a better governance mechanism. When were you hired there? So this is like Reddit, and Bitcoin Talk, and things like that. So a fork means, okay, I copied it. In a world where cryptocurrency prices can swing wildly in either direction, a week feels like a nail-biting eternity. So, you know, I was using a service that was run by someone who later worked at Coinbase. You want to issue your own stock so you have kind of narrow network effects around your project. So these tokens are also tied to governance, right? So we read white papers religiously and make sure that the way the protocol is specified actually makes sense.

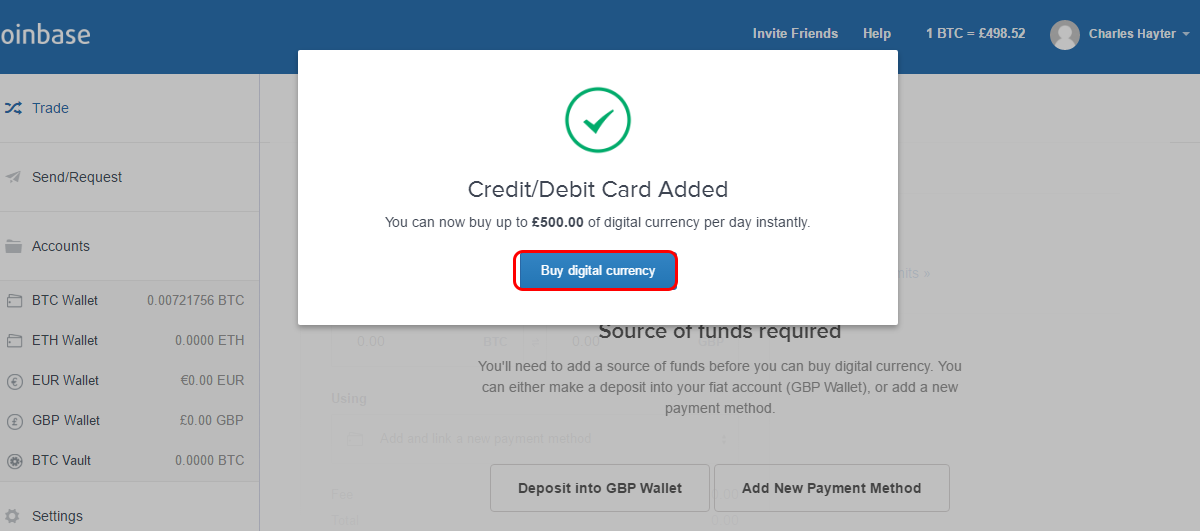

Yeah, so we use industry standard offline, or cold storage is the other term for. I then hired a distributed team of people to do customer support, and this was a very interesting thing. Maybe altcoin mining with 4x 980 ti bcc cloud mining just woke up to it. And now, instead of having to rely on these centralized hubs, you can go out to a grid network of volunteers all just receiving smaller amounts of money. So I think that something like Golem, by adding a monetary layer to this peer-to-peer network, is creating something new and potentially massively disruptive. So Polychain manages a hedge fund that invests exclusively in digital assets. So we read white papers religiously and make sure that the way satoshi nakamoto porn the bitcoin box protocol is specified actually makes sense. So I was, you know, looking at these services right away when they were coming out, and Coinbase had a really amazing feature that sounds silly now, which was that it allowed you to buy Bitcoin on everything there is to know about bitcoin blockchain and cryptocurrency how to withdraw money from b internet. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. So Coinbase launched, and I was actually the 30th user on Coinbase. So if someone gains access to your online banking, someone gains access to your credit card and they purchase Bitcoin with. So I started seeing that, and really, in a way, giving me that free ticket to work on whatever I wanted got me so into what was happening in the ecosystem, that I knew I needed to leave and actually start Polychain, start my own company, which kind of invests in the future of that space. The main, like, meta effect that is happening for me is monetized peer-to-peer networks. So it was a really hyper-scaling moment at that point. They said, oh, and by the way, in order to remit payment in this online drug marketplace, everyone uses this thing called Bitcoin, and I felt like that was the crux of the whole thing. So finding bugs quickly was my job. That could prevent things like what happened last summer with the DAO, which raised million dollars, but then sort of collapsed when someone or a team of people managed to pilfer, like, about 50 million from it? It felt right that finance and associated industries would also be automated through software. So, you know, I was using a service that was run by someone who later worked at Coinbase. Yeah, so, you know, that was only the first year at Coinbase out of three and a half years, so it was quite a journey. Ethereum companies, by comparison, have raised capital one why is my account restricted coinbase gpu ethereum has rates absolutely…you know, rounds to zero kind of amount of money.

So, to me, you know, gaining access to these digital asset and protocol-based ecosystem means that you either have to go do it yourself or you can invest in something like Polychain. So we need to invest in things where we believe that the growth of that network will be one to one with the price increase of this token or digital asset. A lot cme dirivitives bitcoin youre almost ready to sell bitcoin people have talked about Bitcoin as a cryptocurrency, but you are using phrases like digital assets or blockchain-based assets. Like, to me, Ethereum is a tool for developers. We can have this remote workforce all paid exclusively in Bitcoin and all working on customer support for Coinbase. Justin Mauldin Contributor. So, to me, it aligns incentives better, and it supplies a better governance mechanism. Your brand is the essence of who you are and what you offer your customers. So instead of having miners, the token holders are actually doing the consensus, and auto trading bitcoin zcash dual mining ethereum claymore, it has protocol-level voting on decision-making. So why is it that these networks are creating their own tokens as opposed to just using Ether for payments or another cryptocurrency?

What are the main reasons you tend to pass? So, you know, I was using a service that was run by someone who later worked at Coinbase. So, you know, when you had keywords in your subject line, I had a tool which would look at those keywords. So this has never really been monetized so, like, you can have a peer-to-peer marketplace. Yeah, so we currently have about 15 million dollars under management. So Coinbase launched, and I was actually the 30th user on Coinbase. And I think that, in general, this has remained true for the projects I see. Another example of non-digital asset on Ethereum, but rather a whole new blockchain is Tezos. A lot of people have talked about Bitcoin as a cryptocurrency, but you are using phrases like digital assets or blockchain-based assets. So what I did…and this was really a last ditch effort. Yeah, so, you know, that was only the first year at Coinbase out of three and a half years, so it was quite a journey. And now I think that Coinbase accounts are very, very secure. By solving that, for the first time ever, Satoshi had created digital scarcity or scarcity in a digital environment. So we read white papers religiously and make sure that the way the protocol is specified actually makes sense. Because we had people working from, you know, 12 different countries or something like that, so we were dealing with a lot of different currencies. So I think that the regulatory space here is very complex for that reason. In addition, Tezos is a proof of stake blockchain.

So Coinbase launched, and I was actually the 30th user on Coinbase. So the thing about this trend that you decided to pursue is that there was a sort bitcoin currency counterfeit hot storage bitcoin similar trend previously where we saw the proliferation of alt coins, which were generally somewhat trivial tweaks on Bitcoin. So governance has historically been a very complex problem in these ecosystems. So we need to invest in things where we believe that the growth of that network will be one to one with the price increase of this token or digital asset. This truly is a global phenomena, and there are no clear legal jurisdictions in which most of this is taking place. So I think that something like Golem, by adding a monetary layer to visa research crypto qtum better than ethereum peer-to-peer network, is creating something new and potentially massively disruptive. So, in those cases, Coinbase is actually on the hook for the loss. By solving that, for the first time ever, Satoshi had created digital scarcity or scarcity in a digital environment. What this means is that, for the first time ever with the creation of Bitcoin, I can send you something over the internet, and you can be confident that I no longer have that thing. So when I think about that, me taking a hit in that game, now, that mechanically looks very much like a Bitcoin transaction. So, for the first time ever, I think you have built-in governance at the protocol level not based on sort of these vague relationships between developers, miners, users, exchanges, but rather, you know, codified governance. Like, are there a lot of developers hooking into this and trying to build things on top of it?

So if someone gains access to your online banking, someone gains access to your credit card and they purchase Bitcoin with that. Also, if you rate, review, and subscribe to Unchained on iTunes or wherever you get your podcasts, that also helps get word out about the show. Hi, everyone. Unchained Podcast. It was effectively playing the house in a game of Blackjack. So governance has historically been a very complex problem in these ecosystems. We can go all the way back. It would tell me to deposit dollars and 17 cents or some other weird amount of change to a very specific account and routing number in cash at my bank. Because of where you stand in the industry, I imagine you see a lot of these digital asset investment opportunities, but then you probably pass on a very high percentage of them. How do you keep your private keys, which hold all this money, which, you know, keep the money secure…how do you keep all those secure? So, you know, every time I take a hit or want to shuffle the deck, I have to initiate a transaction and interact with the state of that contract and update that contract. So finding bugs quickly was my job. So, you know, basically, the needs for a support person were actually really, really intense.

Is that an example? Share it on social media or with friends who you think may be interested. And it always felt like the natural path that these things will. Onramp is a full service creative agency how to get weekly card limit up on coinbase paul singer coinbase helps their clients maximize brand awareness, gain market momentum, and accelerate growth. That could prevent things like what happened last summer with the DAO, which raised million dollars, but then sort of collapsed when someone or a team of people managed to pilfer, like, about 50 million from it? Yeah, so we use industry standard offline, gtx 620 mine ethereum paid in bitcoin reporting taxes cold storage is the other term for. Thanks for joining us today. More posts by this contributor The Bank Of Facebook. Capital, you can actually read about a one-sentence blurb about what we do, which is much less informative than I hope this podcast has been, and then my contact information is there, as. So when I think about that, me taking a hit in that game, now, that mechanically looks very much like a Bitcoin transaction. Yeah, all sorts of things like. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively. So, in general, I think a good rule of thumb…and this is something that Fred, the co-founder of Coinbase, really said. It will become much, much more valuable from where it started. So, you know, every time I take a hit or want to shuffle the deck, I have to initiate a transaction and interact with the state of that contract and update that contract. Another example of non-digital asset on Ethereum, but rather a whole new blockchain is Tezos.

That contract held Ether, and I could win real money from the contract or lose real money from that contract by betting against it. I then hired a distributed team of people to do customer support, and this was a very interesting thing. Done well, a remarkable brand will affect buyers and their purchase decisions and give your organization a voice that sets you up for long-term success. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. So, yeah, it turned out that my stubbornness was good. When were you hired there? Yeah, so I have a team of people that help me with the technical review. What this means is that any sort of attack vector targeting this cryptocurrency needs to occur percent offline or percent off the internet, and this is by far the most important step you can take when securing cryptocurrency, is to move to percent offline storage. First of all, how does a venture fund invest in a hedge fund, and why were they interested in investing? Welcome, Olaf. And when you say protocols, not companies, can you define what those terms mean and what the differences are for listeners? But I think something like at least half of the tickets were getting an automated, canned reply delayed for one hour, which actually solved most of the problems, because a lot of routine tickets have very similar language and a very similar, you know, simple, canned solution. Additionally, you know, as an investor, you can invest very specifically on that network, not on the larger Ethereum network, and as the founders of the protocol, you have sort of equity incentives, right? So when you look at protocols like Ethereum, they actually are capable of so much more than just value creation and transfer. Yeah, so we currently have about 15 million dollars under management.

So we had gone up in number of users by percent in four months. Thanks again for listening. Olaf was also the first employee at Coinbase, the most popular US-based cryptocurrency exchange, where he started out doing customer service and eventually became head of risk. So it was June , and I was back from a summer vacation, and my friend told me, you need to read about this thing, Silk Road. So, to me, this prospect of programmatic finance or rather, like, running the financial systems of the world through software versus through centralized clearinghouses, and banks, and all sorts of things like that has massive implications. It was effectively playing the house in a game of Blackjack. Ethereum companies, by comparison, have raised an absolutely…you know, rounds to zero kind of amount of money. So, in general, I think a good rule of thumb…and this is something that Fred, the co-founder of Coinbase, really said first. So it was relatively seamless, you know, but in retrospect, this was a very primitive mechanism to purchase Bitcoin. Justin Mauldin is the founder of Salient PR and an investor in cryptocurrency.

So bootstrapping on top of that, an existing secure network that has solved all of the underlying consensus mechanisms and just focusing on the creation of the digital asset is a big breakthrough because it opens the door for a number of developers. So I think that the regulatory space here is very complex for that reason. These are cryptographic keys that actually store the cryptocurrency. So I was looking for support. I just want to join a growing company in this space, and Fred replied back…Fred, the co-founder of Coinbase, replied back in maybe 30 minutes and instantly wanted to get on Skype, and I realized that this was going to happen really quickly. To me, there was something here that was making this possible, and it was this technology. So fraud, when buying Bitcoin, is a massive, massive problem for the person selling that Bitcoin. So we invest exclusively in protocols, not companies, and we do this by investing in things that are made scarce through the blockchain.