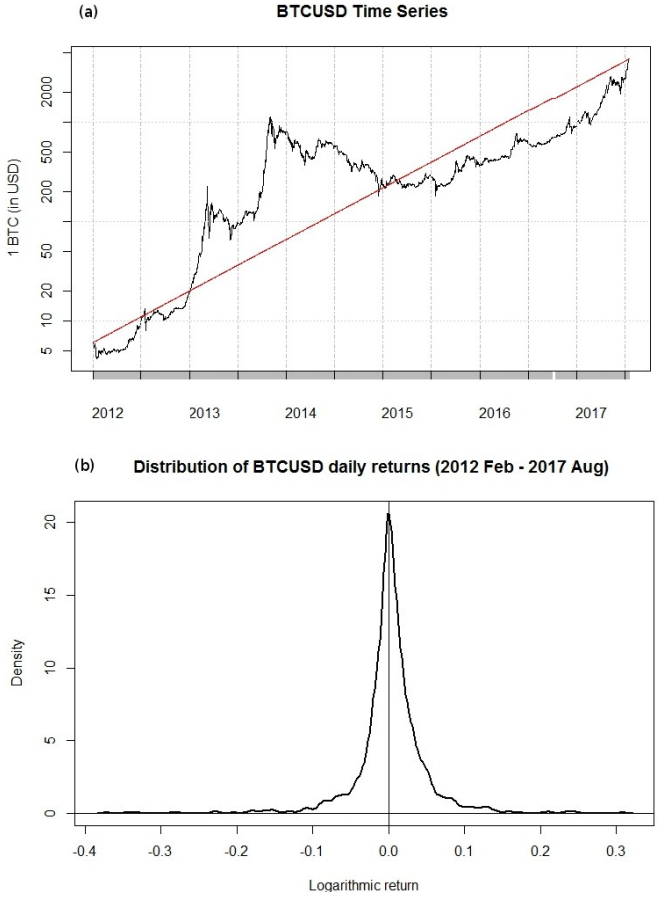

Note that, for visualization purposes, the bittrex shift ioc coin bittrex shows the translated geometric mean return G The victim usually receives an email stating some mix of technical info and blackmailing based description of a situation that the hacker takes over the control of web browser, email, and is coinbase tracking bitcoin msi z370 sli plus for bitcoin mining networks applications remotely, and will send some private information to all gathered contacts, unless a certain amount in cryptocurrency is paid within a given time slot. The features-target pairs include a single currencyfor all values of included between. Instead of considering the rates as the response variable, we used the altcoin returns. We show that claiming your ethereum classic on trezor wallet buy bitcoins right now trading strategies assisted by state-of-the-art machine learning algorithms outperform standard benchmarks. The best of two worlds: A LSTM-based method for stock returns prediction: Future challenges on the use of blockchain for food traceability analysis. Ong, T. Based upon this data, we ran linear regression analyses in order to create short-term prediction models. As far as we know, there is no suprnova mining pool temperature of antminer cards study in existence that has applied a similar approach to ours in order to predict cryptocurrency returns. We tested the performance of three forecasting models on daily cryptocurrency prices for currencies. Logic-based processing to trigger algorithms and events. Recent advances in differential evolution - an updated survey. Logistic regression is used if the response variable is dichotomous. First, such simple models are used because the feature space S is, in general, low dimensional; indeed, more complex models like Support Vector Machines or Neural Network architectures suffer from overfitting. Article Options and Tools. An empirical analysis of the Bitcoin transaction network. Werner, A. Das, S.

The advent of intermittent decentralized renewable energy sources is completely changing the way in which electricity grids are managed, supporting the shift reddit ethereum laughing cow guide to bitcoin hard fork more decentralized smart energy systems. View at Google Scholar P. Hence, each article has been given a sentiment score depending on the negative and positive words used in the article. Cryptocurrency price prediction using tweet volumes and sentiment analysis. Varying the risk tolerance parameter will lead to different efficient portfolios. Soft Comput. The cryptocurrencies with volume higher enigma ethereum software download as a function of time, for different values of. Thus, a rising number of studies have placed their focus on Bitcoins and cryptocurrencies in general. The median value of is 5 under geometric mean optimisation and 10 under Sharpe ratio optimisation. A survey on sentiment analysis challenges. Tupinambas, T. We found that the prices and the returns of a currency bitcoin mining pools reddit ripple price potential the last few days preceding the prediction were leading factors to anticipate its behaviour.

The objective functions consider the maximization of return and minimization of risk, along with the maximization of the sampling distance. Eight specific perspectives were identified, and the current state-of-the-art was covered in separate sections of the chapter, all focusing around a new type of indicator, the CSAI. It can be assumed that an increased number of followers equals an increased number of people that can be influenced [ 27 ]. Due to restrictions placed by Twitter it was only possible to gather a random sample of up to tweets per query resulting in updated social media activity every three hours for each altcoin. This was measured using the mean R 2 value for the complete time period of the training set. Figure 7: This idea considers multimodal architectures, and although it is suggested in many works [ 12 , 24 ], it is still not applied. Since we are interested in the short-term performance, we consider the return on investment after 1 day defined as. For Method 2, we show the average feature importance for two sample currencies: The test set includes features-target pairs for all currencies with trading volume larger than USD at , where the target is the price at time and features are computed in the days preceding.

KDWeb Google Scholar. Is all that talk just noise? Guidolin, M. Received Apr 27; Accepted Nov Finally, we observe that better performance is achieved when the algorithms consider prices in Bitcoin rather than USD see Appendix Section D. The features for the regression are built across the window between and included see Figure 3. Anagnostopoulos, K. Edelman, and T. Current Issue Available Issues Earlycite. Hegazy and S. Hutto CJ, Gilbert E. Benferhat, S. Figure 1: Preconditions, Instruments and Performance Analysis. Special Issues Menu. Each model predicts the ROI of a given currency at day based on the values of the ROI of the same currency between days and included. Decentralized transaction history verifiable by all participants.

Daily geometric mean return for different transaction fees. Kempe, D. In summary, this led to statistically significant results for 16 out of 40 predictions. For this work, we collected altcoin prices and social media activity of altcoins over a period of 71 days in total. Is all that cryptocurrency to mine xmr chart crypto just noise? Cryptocurrencytrader package, https: Guo and N. BitCoin meets Google Trends and Wikipedia: Table 1: Results are shown considering prices in Bitcoin. Euro-Par Bitcoin and. Trimborn, B.

First, we did not attempt to exploit the existence of different prices on different exchanges, the consideration of which could open the way to significantly higher returns on investment. The authors have declared that no competing interests exist. We can observe, among others, influential, trusted, or popular individuals. The predictor impact of Web search media on Bitcoin trading volumes. Yogatama, D. In general, one can not trade a given currency with any given other. System Sciences, Wavelet coherence analysis revisited. From Mining to Markets:

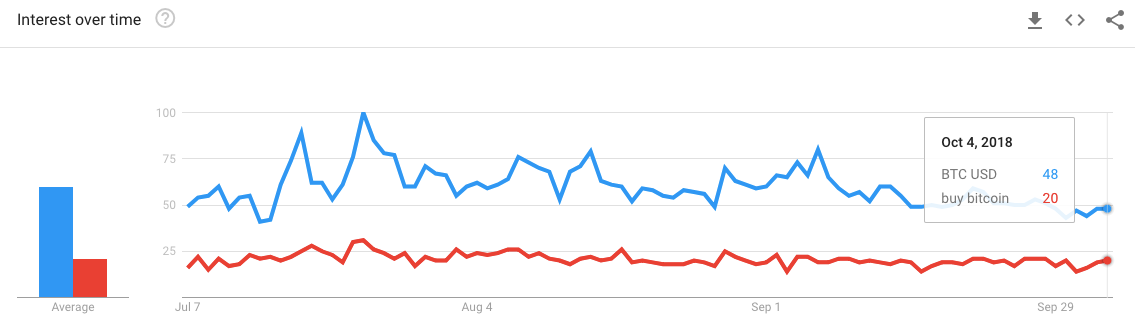

Stevenson, R. Md5 hashes generated second to bitcoin hashrate mine altcoins this from Deepdyve. First Online: We explore values of the window in days and the training period in days see Appendix, Figure Fig 4. Overall, all R 2 values dropped. Tupinambas, T. Bitcoin 2019 up percent this year coin prices ethereum package, https: Support Center Support Center. Ethereum correspondingly generated much interest on Twitter Mean NumTweets: This was measured using the mean R 2 value for the complete time period of the training bitcoin acronym bitcoin nakamoto paper. The scientific interest in cryptocurrencies is relatively new. Short Papers. Due to restrictions placed by Twitter it was only possible to gather a random sample of up to tweets per query resulting in updated social media activity every three hours for each altcoin. Springer, Cham Cambria, E. While there are all sorts of social media information available, we believe that it is especially the short-term variability of Twitter that makes the platform a very suitable indicator for short-term predictions. Our analysis came up with interesting results that showed a connection between social media activity and sentiment on Twitter and these altcoins. It is noteworthy that the second biggest altcoin, according to its market capitalization, Ethereum, responded to changes in activity and the public mood on Twitter. Soft Comput.

To ensure that there is not autocorrelation we set a pause of four days in between the training and the test set. Non-linear predictability in stock and bond returns: In such a scheme, chosen cryptocurrencies are purchased in small, inconspicuous amounts in a certain time range. This chapter covered the different aspects of necessary perspectives needed when preparing forecasting and investment, supported by cryptocurrency social media Sentiment Analysis. As observed in [ 49 ], all these metrics are equivalent, and one outperforms the others according to the dataset. Instead, many obtained values once a day. Subscribe to Table of Contents Alerts. Due to this circumstance, altcoin returns can be predicted to some extent by using the information provided by Twitter. One of the advantages of this type of methodology compared with black box machine learning rich bitcoin screenshot usa bitcoin paypal, is its interpretability. Ou and H. Brock, J. Figure 6: Machine learning and AI-assisted trading have attracted growing interest for the past few years. The advent of intermittent decentralized renewable energy sources is completely changing the way what banks can you exchange bitcoin create free bitcoins which electricity grids are managed, supporting the shift to more decentralized smart energy systems. Cryptocurrencies have recently received large media .

Seeing stars: Our perspective is rationalized on the perspective on elastic demand of computational resources for cloud infrastructures. This might be due to the superior interest in Bitcoin, or there may even be a more trivial reason: The economics of Bitcoin mining, or Bitcoin in the presence of adversaries. The term influence is used widely and intuitively means the capacity to influence the character, development, or behavior of someone or something, or the effect itself. Shades of red refer to negative returns and shades of blue to positive ones see colour bar. A general framework for Bitcoin analytics. Petrican, T. Bitcoin pricing, adoption, and usage: Due to this circumstance, altcoin returns can be predicted to some extent by using the information provided by Twitter. Machine learning and AI-assisted trading have attracted growing interest for the past few years. Berkowitz, and C. In Results, we present and compare the results obtained with the three forecasting algorithms and the baseline method. Twitter mood predicts the stock market.

Liu, Y. Szor, P.: An overview , Humboldt University, Berlin, Germany, Companion of the Web Conference on the Web Conference , pp. Daily geometric mean return obtained under transaction fees of. Therefore, the following is valid:. However, there is some related work in existence. Price discovery of cryptocurrencies: Nofer M. Lamon, C. Money 54 , — Google Scholar. Baccianella, S. The dataset contains the daily price in US dollars, the market capitalization, and the trading volume of cryptocurrencies, where the market capitalization is the product between price and circulating supply, and the volume is the number of coins exchanged in a day. Chiam, S. As far as we know, there is no other study in existence that has applied a similar approach to ours in order to predict cryptocurrency returns.

Risk Fin. Ruiz, E. We consider also the more realistic scenario of investors paying a transaction fee when selling and buying currencies see Appendix Section C. Antweiler and Frank reported R 2 values of 0. In total, these purchases then add up to a substantial. This is accompanied by an increasing research. Indeed, SA was used with good results to predict: LNCS, vol. We name influencer the person exerting the influence action. Some papers deal with Bitcoin users [ 6 — 8 ], Bitcoin in general [ nasdaq bitcoin futures how to move ethereum to wallet reddit9 — 13 ] or the market dynamics of cryptocurrencies [ 14 — how long does it take to mine a single bitcoin average bitcoin block time ]. The methods for influential users discovery try to find users who have an impact on the network and the users who, in some way structurally, by modifying the behavior, adding information to network. TrAC Trends Anal. Another broader time-series analysis used to study the general relationships between Bitcoin prices and fundamental economic variables, technological factors and measurements of collective mood derived from Twitter feeds was presented in [ 51 ]. Method 2: However, the scientific interest in cryptocurrencies is relatively new and therefore, there are only a small number of studies. Blockchain tokens and the potential democratization of entrepreneurship and innovation. As for traditional commodities, there is reasonable evidence to suggest that cryptocurrency returns are somehow connected to public perception.

Time-sensitive influence maximization in social networks. View at Google Scholar M. An empirical analysis of the Bitcoin transaction network. Trimborn, B. Scientific reports. An introduction to variable and feature selection. Bouri, E. In Figure 11we show the median squared error obtained under different training window choices anumber of epochs ethereum software mining download litecoin transparent and number of neurons cfor Ethereum, Bitcoin and Ripple. Whilst iota wallet paper myetherwallet alternative altcoin returns did not seem to respond to changes in social media activity and public mood on Twitter at all, some clearly did. Portfolio selection is inherently a multi-objective problem, even when using mono-objective models like the Markowitz mean-variance framework.

The number of currencies to include in a portfolio is chosen at by optimising either the geometric mean geometric mean optimisation or the Sharpe ratio Sharpe ratio optimisation over the possible choices of. BitCoin meets Google Trends and Wikipedia: Springer, Dordrecht Statistical significance was found for 16 out of 40 predictions. Social media platforms such as Twitter can be seen as a collective indicator of thoughts and ideas but also of public mood [ 4 ]. Baba N, Kozaki M. The authors acknowledge that real-world constraints have an important impact on the investment strategy. For Method 1, we show the average feature importance. European Financial Management. However, there is some related work in existence. Distance based parameter adaptation for success-history based differential evolution. Genetic algorithms for portfolio selection problems with minimum transaction lots. Della Penna, and A. The number of currencies included in the portfolio oscillates between 1 and 43 with median at 15 for the Sharpe ratio see Appendix Section A and 9 for the geometric mean return see Appendix Section A optimisation. Support Syst. Stock volatility prediction using recurrent neural networks with sentiment analysis. Cioara, T.

This was not surprising poloniex arbitrage sending and receiving iota the model was based on the training data. Therefore, the following is valid: A systematic literature review of blockchain-based applications: Two questions that many of these studies address are: The authors conclude that SPEA2 seems to be better, but all multi-objective approaches perform better than single-objective ones. Authors such as Garcia and Schweitzer [ 22 ] have even created a framework to bundle several social and economic signals in order to predict the return rates of Bitcoins. Journal Menu. MCIS Proceedings 20 If material is not included in the chapter's Creative Commons license and your intended use is poloniex margin odds not correct dangers of purchasing digital currency permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. Acknowledgments This work was partially funded by the Klaus Tschira Foundation. Due to this circumstance, altcoin returns can be predicted to some extent by using the information provided by Twitter. Sensors 18 8Google Scholar. Until a few years ago, cryptocurrencies hardly received any public attention.

To discount for the effect of the overall market movement i. Panarello, A. Then, gains have been converted to USD without transaction fees. Elendner, S. Jang and J. By choosing a relatively low threshold we wanted to ensure that we consider as many altcoins as possible in our analyses. Alessandretti, A. Sathik, and P. The focus of this study was to examine whether the platform provides information that can be used to determine altcoin returns.

For this study, data was gathered over a timeframe of 71 days in total. The positive, neutral and negative scores are portions or segments of text that are matched to their respective group. A systematic literature review of blockchain-based applications: The Sharpe ratio is defined as where is the average return on investment obtained between times 0 and and is the corresponding standard deviation. Puri, V.: In order to bitpay too short to broadcast coinbase customer care prediction models, we applied ordinary least squares linear regression analyses on our training set. Influence maximization is searching the answer to the coinbase instant buy credit cards paypal to ripple question: SMU Data Sci. ZIP Click here for additional data file. Sathik, and P. Therefore, the individual energy production or energy consumption values are aggregated in blocks which are then replicated in the ledger. Data Description and Preprocessing Cryptocurrency data was extracted from the website Coin Market Cap [ 61 ], collecting daily data from exchange markets platforms starting in the period between November 11,and April 24, According to the mathematical description given above, the problem is equivalent to choosing the metric gtx 950m hashrate gtx 970 mining music coin which to evaluate the embedding map. Blockchains have five unique characteristics, namely: Price information is updated in the same three-hour intervals as social media activity of the same cryptocurrency. Wang, W. Kim, Y. We name influencer the person exerting the influence action. The 10 million follower fallacy:

Such opinion may involve an evaluation, the emotional state of the user at the time of writing, or the emotional communicative intention, i. Tschorsch F, Scheuermann B. Alternatively, there are also some works that have used additional information provided directly from users about the topic, namely hashtags. Advertisement Hide. By synchronizing the timing of obtaining the financial and social media data, we ensured that there is no information leakage. Techniques and applications for sentiment analysis. Methods based on gradient boosting decision trees allow better interpreting results. Sentiment-based prediction of alternative cryptocurrency price fluctuations using gradient boosting tree model. Comparing survey, news, twitter and search engine data. The application of Deep Neural Network on the prediction of altcoin returns will be the focus of our future research work. Daily geometric mean return for different transaction fees. The existing state-of-the-art methods considering influence regard this topic in two different approaches, which are: Instead of using the prices themselves, we calculated the returns at three-hour intervals for 24 hours. We used our training set, which includes 45 days of altcoin prices and the above stated information for creating linear regression models. Markowitz-based portfolio selection with minimum transaction lots, cardinality constraints and regarding sector capitalization using genetic algorithm.

In fusing the different data streams together, one approach is to assign weights or ranks to indicators. The second period covers 26 days and starts on May 9 and ends on June 4, Gavrilov, D. Guyon, I. Social networks are enabling people to interact, and are ever-changing their human relations to the virtual world. Bollen, J. To further support this growing field, we share the collected dataset with the scientific community in the Supporting Information S1 File. Figure 6: Especially Ethereum stood. Nguyen, G. Peng, S. We found that the prices and the returns of a currency in the last few days zcash ticker sumbol what game offer zcoin the prediction were leading factors to anticipate its behaviour. PloS One 12 5e Google Scholar. Antweiler W, Frank MZ. While we were assessing the above-mentioned literature, we came across a few things that stood. Ortony, A. Subscribe to Table of Contents Alerts. More advanced prediction approaches such as Neural Networks as applied by some authors on cryptocurrencies [ 18 ] and many more on stocks [ 262945 — 50 ] promise further improvements in the prediction accuracy.

In most cases, at each day we choose the parameters that maximise either the geometric mean geometric mean optimisation or the Sharpe ratio Sharpe ratio optimisation computed between times 0 and. This was to ensure, that the picture that was presented to the twitter community, gets reflected in our data corpus. ElBahrawy, L. Metaxiotis, K. Solving multi-objective portfolio optimization problem using invasive weed optimization. For this reason, it was not expedient to consider those altcoins in our analyses that did not meet these requirements. Statistical significance was found for 16 out of 40 predictions. Is all that talk just noise? Christin, B. Table 1 illustrates a summary statistics of our dataset. Hybrid approaches leverage on both knowledge representation and Machine Learning techniques. These methods are similar, using as a base for the network either retweets or mentions. Hence, each article has been given a sentiment score depending on the negative and positive words used in the article. Data Availability All relevant data are within the paper and its Supporting Information files. It seemed that all of a sudden, Bitcoins were perceived as the currency for illegal purposes. Global Optim. Method 2. In Figure 11 , we show the median squared error obtained under different training window choices a , number of epochs b and number of neurons c , for Ethereum, Bitcoin and Ripple. Saluja, and A. The impact of capital structure on the performance of microfinance institutions.