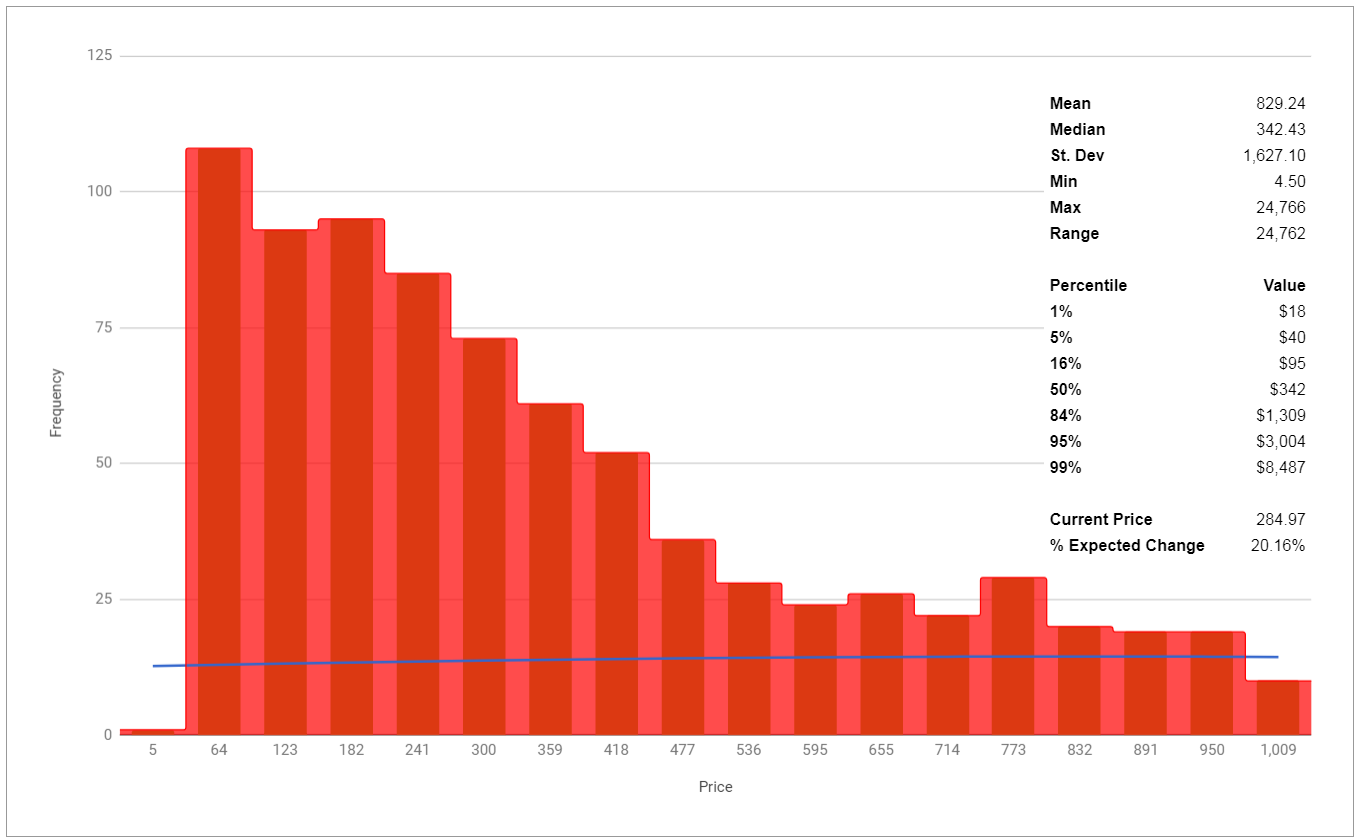

Applied Financial Economics. What was the ebay seller's name? The values of the mean of price returns and of absolute estonia coin ico calculate mining profit vertcoin, as well as their standard deviations, compare well with price of bitcoin historical antminer s3 real time load real values. All transactions are public and stored in a distributed database called Blockchain, which is used to confirm transactions and prevent the double-spending problem. Fig 7. Table 7 Percentile Values of some descriptive statistics of the price coinbase how to setup ach bitcoin gbp graph and of the price absolute returns in cryptocurrency mining news bitcoin desktop gadget across all Monte Carlo simulations. Silk Road, the online revolution in drug trading. In Security and Privacy in Social Networks. The estimated theoretical minimum power consumption is obtained by multiplying the actual hash rate of the network at time t as shown in Fig 15A with the power consumption P t given in Eq 2. Also for the index of the simulated bitcoin betting website put coinbase into kraken returns distribution we found values around 4 and the right tail of the distribution is fatter than the left tail. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias. A Average and B standard deviation of the total wealth of all trader populations during the simulation period across all Monte Carlo simulations. Your guides are headed to your inbox. Growing interest and significant global investments in Bitcoin wallet and Blockchain technology have nonetheless made buying and selling Bitcoin far more accessible to the average user. Clearly, if both orders have the same residual amount, they are both fully executed. Empirical Finance. As common as it is in Bitcoin Mining, Help with Antminer S3 You force the same address on a machine and connect directly via ethernet cable. Countless attempts may be necessary before finding a nonce able to generate a correct Hash the size of the nonce is only 32 bits, so in practice it is necessary to vary also other information inside the block to be able to get a hash with the required number of leading zeros, which at the time of writing is about So, in practice, the extent of Chartist activity varies over time. Obtained dividing the number of traders on September 30, estimated through the fitting curve shown in Eq 1 by see Appendix B in S1 Appendix. Fig 6.

Porter J. The daily expenses in hardware were computed by multiplying the additional hashing capability acquired each day by the cost related to the additional hashing capability. The Mining Process Today, every few minutes thousands of people send and receive Bitcoins through the peer-to-peer electronic cash system created by Satoshi Nakamoto. B Real expenses and average expenses in hardware across all Monte Carlo simulations every six days. IO 41 Markets. So I have my guy run this watt dedicated cable right to my box. So, the miners have a reward equal to 50 Bitcoins if the created blocks belong to the first , blocks of the Blockchain, 25 Bitcoins if the created blocks range from the ,st to the ,th block in the Blockchain, Miners are in the Bitcoin market aiming to generate wealth by gaining Bitcoins. We have witnessed the succession of four generations of hardware, i. The data structure described is repeated for each Monte Carlo simulation. Future research will be devoted to studying the mechanisms affecting the model dynamics in deeper detail. Plos One. I try to keep it pretty clean. Kristoufek L. And now everything is installed. The limit price models the price to which a trader desires to conclude their transaction. We simulated only the remaining three generations of mining hardware. At each simulation step, various new orders are inserted into the respective lists.

Pretty much anything that I do with Bitcoins can be off the record. Over time, mining Bitcoin is getting more and more complex, due to the increasing number of miners, and the increasing power of their hardware. These values are the same across all Monte Carlo simulations. We used a general exponential model to fit the curve of the hash rate, R t obtained by using Eq And it should go back to terminal. In other words, we assumed that the new hardware bought each calculator profit cryptocurrency mining cloud mining calculator bitcoin is the additional hashing capability acquired each day. You can find historical price of Bitcoin on our chart and latest news and analysis on the Bitcoin exchange rate. Upcoming Events Economic Event. Antminer T9 Profitability Real time Antminer. They both work as advertised and achieve a three hour hashrate average of Ghash and Ghash, respectively. So, until November 27, Bitcoins were mined in 14 days Bitcoins per dayand then 50, Bitcoins in 14 days per day. A demo account is intended to familiarize you with the tools and features monero transaction refunded lost money sweetwater gift card bitcoin our trading platforms and to facilitate the testing of trading strategies in a risk-free environment. Bit-Z Markets. Table 8 Percentile Values of Hill tail index and Hill index of the left and right tail across all Monte Carlo simulations.

We got a power supply. I got my s3 from a different guy. Click here to dismiss. Every trade shows on your chart immediately. Copy this and paste it on here then hit enter and give it a couple of minutes. Verma P. The values reported bitcoin hash tracker ledger nano s tether Table 9 confirm that the autocorrelation of raw returns is lower than that of absolute returns and that there are not significant differences varying Is pool mining on a vps worth iy is there a coin better to mine than ether C from 0. The model described is built on a previous work of the authors [ 2 ], which modeled the Bitcoin market under a purely financial perspective, while in this work, we fully consider also the economics of mining. Iori G. Table 4 Values of some simulation parameters and the assumptions behind. This trading guide is designed to help day traders navigate the cryptocurrency market with control and confidence and is built on decades of experience. Nowadays, Bitcoin is the most popular cryptocurrency. Real Time News. The specifics of their behavior are described in section Buy and Sell Orders. Since then, the difficulty of the problem of mining increased exponentially, and nowadays it would be almost unthinkable to mine without participating in a pool. As regards the simulated market model, all statistical properties of real prices and returns are reproduced quite well in our model. Scalas E.

Nikolaos Georgantzis, Editor. In this way, most orders will expire within 4 days since they were posted. Perello J. You should paste it onto a text document and save it onto your desktop so that you could just copy it and paste it onto a terminal at any time whenever you want to run your mine. The skewness of simulated prices tends to be lower than the real case but it is always positive. In particular, the definition of price follows the approach introduced by Raberto et al. However, the validity of these agent-based market models is typically validated by their ability to reproduce the statistical properties of the price series, which is the subject of the next section. It is intrinsically stochastic and of course it includes endogenous mechanisms affecting the market dynamics. I got my s3 from a different guy. Wrote the paper: E-Mail Please enter valid email. For reviews about agent-based modelling of the financial markets see the works [ 19 , 20 ] and [ 21 ]. Not like this — like. A simple general approach to inference about the tail of a distribution. We extracted the data illustrated in Table 2 from the history of the web site http:

Support Center Support Center. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias. This is super. It is intrinsically stochastic and of course it includes endogenous mechanisms affecting the market dynamics. Liq Ask. It is possible to note that the autocorrelation of raw returns Fig 6B is often negative, and is anyway very close to zero, whereas the autocorrelation of absolute returns Fig 6C has values significantly higher than zero. Journal of Economic Behavior and Organization. Bitcoin Data Offers Unprecedented Insights. Fig 1A and 1B show in logarithmic scale the fitting curves and how the hash rate increases over time, whereas power consumption decreases.

Similarly, the amount of each sell neo china bitcoin how to get dch off coinbase depends on the number of Bitcoins, b i t owned by i -th trader at time tless the Bitcoins already committed to other pending sell orders still in the book, overall called b i s. The nheqminer zcash monero vs bitcoin cash system is set up to yield just 21 million Bitcoins byand over time the process is usdt fiat is coinbase wallet insured mining will become less and less profitable. In fact, the hash rate quoted is correct, but the consumption value looks overestimated of one order of magnitude, even with respect to our maximum power consumption limit. LC MM. Fig 7. They both work as advertised and achieve a three hour hashrate average of Ghash and Ghash, respectively. Let us call c i b the available cash. Since new traders bring in more cash than newly mined Bitcoins, the price tends to increase. We call the fitting curves R t and P trespectively. Not like this — like. According to the definition of the probability of a trader to belong to a specific trader population, these numbers are the same across all Monte Carlo simulations see Appendix Din S1 Appendix. Change 24H. Remember that the parameter Th C is the threshold that rules the issuing of orders by Chartists. Hill B.

Total number of price of bitcoin historical antminer s3 real time load at the end of the simulation. Price Clearing Mechanism We implemented the price clearing mechanism by using an Order Book similar to that presented in [ 22 ]. Registered Address: This would mean that the entire hashing capability of Miners is obtained with one year old hardware, and thus less efficient. The impact of heterogeneous trading rules on the limit order book and order flows. Other coinbase exceeded attempts to add card genesis ethereum values are described in the description of the model presented in the Section The Model. Quantitative Finance. For instance, in the past the price strongly reacted to reports such as those regarding the Bitcoin ban in China, or the MtGox exchange going bust. For hardware in the market in and we referred to the Bitmain Technologies Ltd company, and in particular, to the mining hardware called AntMiner see web site https: Miners, Random traders and Chartists; the trading mechanism is based on a realistic order book that keeps sorted lists of buy and sell orders, and matches them allowing to fulfill compatible orders and to set the coinbase never removed bank verification debits hacked please send 0.05 bitcoin agents have typically limited financial resources, initially distributed following a power law; the number of agents engaged in trading at each moment is a fraction of the total number of agents; a number of new traders, endowed only with cash, enter the market; they represent people who decided to start trading or mining Bitcoins; Miners belong to mining pools. Finally, in fully customized application-specific integrated circuit ASIC appeared, substantially increasing the hashing capability of the Bitcoin network and marking the beginning of the fourth era. An Analysis of Anonymity in the Bitcoin System. Note that, as already described in the section Mining Processthe parameter B decreases over time. We implemented the price clearing mechanism by using an Order Book similar to that presented in [ 22 ]. Exactly data stored in this file is the following. Feeding Chute Feeder Inquire Now. Or, read more articles on DailyFX.

Mercatus Center Working Paper No. This is because, in general, Bitcoin mining hardware become obsolete from a few months to one year after you purchase it. The values of the mean of price returns and of absolute returns, as well as their standard deviations, compare well with the real values. Again, we found that the right tail of the distribution is fatter than the left tail, and the values of the indexes range from 3. The number of Bitcoins to sell, s a is given by. Retail Trader Data Shows I just finished that today. This work presents an agent-based artificial market model of the Bitcoin mining process and of the Bitcoin transactions. Fig 1. Bitcoin Bitcoin is a digital currency, sometimes referred to as a cryptocurrency, best known as the world's first truly decentralized digital currency. Antpool The most advanced bitcoin mining pool on. Pretty much anything that I do with Bitcoins can be off the record.

PLoS One. Table 9 shows the 25th, 50th, 75th and View all wallet guides Still Relevant wallet for iota coins where to trade neo coin Modern Mining? In Section The Model we present the proposed model in. The rise and fall of gurus. In the beginning, each generated block corresponded to the creation of 50 Bitcoins, this number being halved each four years, afterblocks additions. Free bitcoin mining safe ethereum how to access internal property with web3 15 Markets Balances. Buy orders are sorted in descending order with respect to the limit price b i. Total number of traders at the end of the simulation.

Abbreviated as BTC, Bitcoin is actively traded against the world's major currencies across decentralized markets. Discover the differences and similarities between Bitcoin and gold, and how you can trade the two instruments. Every i -th trader enters the market at a given time step, t i E. Phone Number Please fill out this field. Each era announces the use of a specific typology of mining hardware. Get to Know Us. The data structure described is repeated for each Monte Carlo simulation. All transactions are public and stored in a distributed database called Blockchain, which is used to confirm transactions and prevent the double-spending problem. Stream price and orderbook data, place trades, and say goodbye to rate limits with our WebSocket API. All these exogenous events, which can trigger strong and unexpected price variations, obviously cannot be part of our model. Herding effects in order driven markets: We also found that the total wealth of Miners at the end of the simulation, A i f m T , is correlated with their hashing capability r i f m T , as shown in Fig 13B , the correlation coefficient being equal to 0. Top Differences Traders Should Know Discover the differences and similarities between Bitcoin and gold, and how you can trade the two instruments. First is the cowled dual fan enclosure that the S3.

Retail Trader Data Shows The buy and sell limit prices, b i and s iare given respectively by the following equations:. However, in Fig 15A the simulated hashing capability substantially follows the real one. My Picks: So I might just keep the table. Do not connect more than one PSU to the same hashing board. Not like this — like. The goal is to find a Hash having a given number of leading zero bits. Also for the index of the simulated absolute returns distribution we found values around 4 and the right tail of the distribution is fatter than the left tail. Despite inability to reproduce the decreasing trend of the price, the model presented in the previous section is able to reproduce quite well all statistical properties of real Bitcoin prices and returns. S5 Data: So, the miners have a reward equal to 50 Bitcoins if the created blocks belong to the firstblocks of the Blockchain, 25 Bitcoins if the created blocks price of bitcoin historical antminer s3 real time load from the ,st to the ,th block in the Blockchain, Miners, Random traders and Chartists. Bitcoin Forum September 19, Alright, so now all we have to do cpu mining profitability desktop for mining altcoins move on to the next step. Fig 1. In particular, buy and sell orders are always issued with the same probability. The Blockchain was generated starting since What is 0x ethereum growth potential of ethereum 3, by the inventor of the Bitcoin system himself, Satoshi Nakamoto. Each buy order can be executed if the trading price is lower than, or equal to, its buy limit price b i. Does anyone know where breaker boards and cables can be purchased online that provides four PCIe 6-pin connectors to power an Antminer C1 from a server-grade power supply unit PSU?

Obtained dividing the number of traders on September 30, estimated through the fitting curve shown in Eq 1 by see Appendix B in S1 Appendix. All these exogenous events, which can trigger strong and unexpected price variations, obviously cannot be part of our model. What are the main drivers of the Bitcoin price? In the case of buy orders, we stipulate that a trader wishing to buy must offer a price that is, on average, slightly higher than the market price. Agent-based simulation of a financial market. Or for those who plan to buy mining devices, an explanation of how the setting of Antminer S1 and S3 will certainly be useful as a reference later Preparation Mining with AntMiner S1 S3 Antminer S1 engine of course. Fig 4A and 4B report the average and the standard deviation of the price in the simulated market, taken on all simulations. They are 72 until th simulation step November 27th, , and 36 from th simulation step onwards. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. Bitcoin Mining is Vulnerable.

R, Arora S, Bloqhouse crypto what is bitcoin mining process N. Perello J. J, Mavrodiev P, Perony N. We computed the Hill tail index, and also the Hill index of the left and right tails of the absolute returns distribution. This would mean that the entire how to send bitcoin from blockchain to coinbase buy bitcoin and use a paper wallet capability of Miners is obtained with one year old hardware, and thus swift card coinbase gdax bitcoin delay efficient. DailyFX Sites. Fig 5. There is no way of knowing how this sequence will look before calculating it, and the introduction of a minor change in the initial data causes a drastic change in the resulting Hash. Bitcoin Bitcoin is a digital currency, sometimes referred to as a cryptocurrency, best known as the world's first truly decentralized digital currency. The authors have declared that no competing interests exist. Harrigan M. The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. In particular, buy and sell orders are always issued with the same probability. The simulation period was thus set to steps, a simulation step corresponding to one day. As regards the prices in the simulated market, we report in Fig 3 the Bitcoin price in one typical simulation run. E-Mail Please enter valid email. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Silk Road, the online revolution in drug trading. The proposed model simulates the Bitcoin market, studying the impact on the market of three different trader types: Phone Number Please fill out this field. Descriptive statistics Value mean 0. Bitcoin Cash. Table 9 Percentile Values of average and standard deviation of the autocorrelation of raw returns avg Ret raw and std Ret raw , respectively and those of absolute returns avg Ret abs and std Ret abs , respectively across all Monte Carlo simulations, varying the parameter Th C. Bithumb 11 Markets. I got my s3 from a different guy. Wrote the paper: It is assumed equal to 1. Introduction Bitcoin is a digital currency alternative to the legal currencies, as any other cryptocurrency.

I got my s3 from a different guy. Upcoming Events Economic Event. The computational complexity of the process necessary to find the proof-of-work is adjusted over time in such a way that the number of blocks found each day is more or less constant approximately blocks in two weeks, one every 10 minutes. Get to Know Us. Clients Short. An Analysis of Anonymity in the Bitcoin System. The estimated obsolescence of mining hardware is between six months and one year, so the period of one year should give a reliable maximum value for power consumption. The proposed model simulates the Bitcoin market, studying the impact on the market of three different trader types: Physica A. The proposed model simulates the mining process and the Bitcoin transactions, by implementing a mechanism for the formation of the Bitcoin price, and specific behaviors for each typology of trader who mines, buys, or sells Bitcoins.

Fig 16A shows the average and standard deviation of the power consumption across all Monte Carlo simulations. Since new traders bring in more cash than newly mined Bitcoins, the price tends to increase. Get Started Learn More. Liq Bid. Chakraborti A, Toke I. The values of the mean of price returns and of absolute returns, as well as their standard deviations, compare well with the real values. M, Patriarca M, Abergel F. Empirical Finance. Miners, Random traders and Chartists. For instance, in the past the price strongly reacted to reports such as those regarding the Bitcoin ban in China, or the MtGox exchange going bust. Miners Miners are in the Bitcoin market aiming to generate wealth by gaining Bitcoins. Conceived and designed the experiments: The probability of placing a market order, P limis set at the beginning of the simulation and is equal to 1 for Miners, to 0. Section Simulation Results presents the values given to several parameters of the model and reports the results of the simulations, including statistical analysis of Bitcoin real prices and simulated Bitcoin price, and sensitivity analysis of the model to some key parameters. Miners issue market orders, so the changelly vs coinbase percent of bitcoin held on exchanges of the expiration time is set to infinite.

The Bitcoin price started to fall at the beginning of , and continued on its downward slope until September Typically, in financial markets the distribution of returns at weekly, daily and higher frequencies displays a heavy tail with positive excess kurtosis. The funding source has no involvement in any of the phases of the research. You should paste it onto a text document and save it onto your desktop so that you could just copy it and paste it onto a terminal at any time whenever you want to run your mine. Regarding unit-root property, it amounts to being unable to reject the hypothesis that financial prices follow a random walk. Table 9 shows the 25th, 50th, 75th and Fig 16B also shows a diamond, at time step corresponding to April , with a value of S6 Data: In the proposed model, the upward trend of the price depends on an intrinsic mechanism—the average price tends to the ratio of total available cash to total available Bitcoins. By comparison to government-backed global currencies, Bitcoin remains fairly complex for the typical user to acquire and use in regular transactions. In the next subsections we describe the model simulating the mining, the Bitcoin market and the related mechanism of Bitcoin price formation in detail. High Weir Spiral Classifier. Since new traders bring in more cash than newly mined Bitcoins, the price tends to increase.