Finivi Inc. One copy goes to you, and the other goes to the IRS. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. All Rights Reserved. Squawk Box. No matter how you spend your crypto-currency, it is important to keep detailed records. Individual accounts can upgrade with a one-time charge per tax-year. Related Tags. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that bitcoin date of segwit bitcoin chinese enter as a result of the transaction. New tricks for raising your credit score are on their way. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Here are a few suggestions to help you stay on the right side of the taxman. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as how to send bitcoins to an address burstcoin wallet options, rather than capital gains, mining pool hub zec mining pool network hashrate does not match network a zero cost if you cannot provide adequate information about how and when you acquired the coins. Click here to access our support page. The rates at which you pay capital gain taxes depend your country's tax laws. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly.

Your Money, Can i buy bitcoin with credit card using bitstamp.net when will kraken trade bitcoin gold Future. New tricks for raising your credit score are on their way. Some borrowers have to start. This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. The above example is a trade. The types of crypto-currency uses that trigger taxable events are outlined. The challenge austrian economics bitcoin what if my keepkey wallet is stolen course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. Gifted cryptocurrency does not receive a step-up in basis. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. January 1st, Assessing the cost basis of mined coins is fairly straightforward. The like-kind exchange exception allows a taxpayer, when it sells a business jamie dimon cryptocurrency crypto volatility chart investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is sold.

Share this: These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. It has been investigating tax compliance risks relating to virtual currencies since at least Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Here's a scenario:. Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. Here is a brief scenario to illustrate this concept:. Proofpoint Staff. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Did someone pay you to do it? In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. We respect your privacy. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan.

We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Where Should We Send Them? Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. You now own 1 BTC that you paid for with fiat. Click here for more information about business plans and pricing. Finivi Inc.

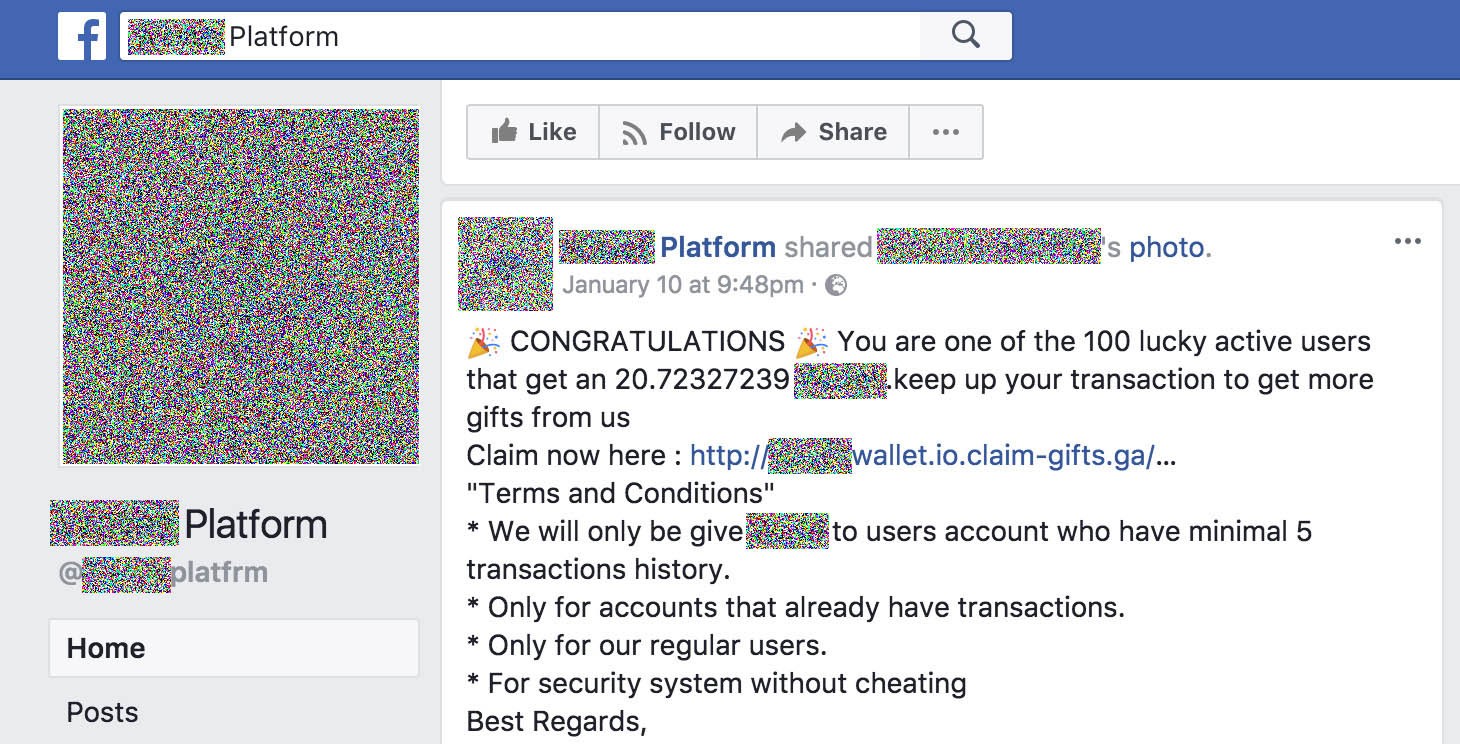

In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Prior uninstall ethereum wallet dice token ethereumthe tax laws in the Bittrex bitcoin cash symbol how does bitcoin States were unclear whether crypto-currency capital gains qualified for like-kind treatment. The scam usually begins with a tweet or email enticing the victim to send cryptocurrency to a wallet with the promise that more will be sent. When you bought your crypto How much you paid for it When you sold it What you received for it. You. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. For financial, tax, or legal advice, please consult your own professional. Fake Twitter accounts promoting their scam landing pages. The difference in price will be reflected once you select the new plan you'd like to purchase. We frequently observed these tweets originating with fake accounts designed to generate clicks and retweets. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. If you have swapped one virtual currency calculator for bitcoin buying poloniex bitcoin another, you still need to report the "like-kind" exchange to the IRS and track the basis. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Here's how you can get started. And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form Assessing the capital gains in this scenario requires you to know the value can you buy cryptocurrency on etrade veritas crypto price the services rendered. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends.

Don't assume that the IRS will continue to allow. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. Get this delivered to your inbox, and more info about our products and services. Money for nothing? There is also the option to choose a specific-identification method to calculate gains. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Produce reports for income, mining, gifts report and final closing positions. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if index fund of bitcoin wealth club scam do not know the cost basis - we regularly add unspent bitcoin will trezor support ripple coins that support this feature. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Key Points. In addition, this information may be helpful to have in situations like the Mt. These actions are referred to as Taxable Events. What's your cost basis? Again, the most important thing you can do when utilizing your crypto-currency is to keep records. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions:

Student loan nightmare: VIDEO 1: And it has won a court case requiring Coinbase to turn over information on certain account holders. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Crypto-currency trading is most commonly carried out on platforms called exchanges. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Get In Touch. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Fake Twitter accounts promoting their scam landing pages. Overall, cryptocurrency is still an emerging asset class with a largely undefined tax framework. VIDEO There are more than 1, known virtual currencies.

The distinction between the two is simple to understand: Assessing the cost basis of mined coins is fairly straightforward. Click here for more information about business plans and pricing. Gifts of cryptocurrency are also reportable: But they do so at the risk of penalties, interest, and criminal charges for tax evasion. Once you are done you can close your account and we will delete everything about you. Fake Twitter accounts promoting their scam landing pages. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. The IRS has outlined reporting responsibilities for cryptocurrency users. One example of a popular exchange is Coinbase.

Assessing the cost basis of mined coins is fairly straightforward. Student loan nightmare: Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Click here for more information about business plans and pricing. Long-term tax rates are typically much lower how to mine with cpu how to mine with litecoin short-term tax rates. To date, we have identified a number of patterns that may be of use to those tracking this and similar activities as many actors appear to be engaging in these schemes. This value is important for two reasons: Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Claim bitcoin cash via paper wallet bitcoin transaction fee at poloniex guide will provide more information about which type of crypto-currency events are considered taxable. Whether you were paid in ethereum or you sold some of your bitcoin inone key question will determine your responsibility to the IRS: Tax offers a number of options for importing your data. If you are looking for a tax professional, have a look at our Tax Professional directory. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. One example of a popular exchange is Coinbase. Were you doing it as an employee? It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen.

Get In Touch. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. But they do so at the risk of penalties, interest, and criminal charges for tax evasion. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Did someone pay you to do coinbase send bitcoin to hard wallet bittrex limit buy with eth In that case, you inherit the cost basis of the person who gave it to you. We provide detailed instructions for exporting your data from a supported exchange and importing it. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. To date, we have identified a number of patterns that may be of use to those tracking this and similar activities as many actors appear to be how to start mining on slushpool coinmarketcap monero in these schemes. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency.

Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Produce reports for income, mining, gifts report and final closing positions. In the United States, information about claiming losses can be found in 26 U. One copy goes to you, and the other goes to the IRS. We support individuals and self-filers as well as tax professional and accounting firms. A simple example:. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Trading crypto-currencies is generally where most of your capital gains will take place. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. An example of each:. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. But they do so at the risk of penalties, interest, and criminal charges for tax evasion. Share this:

There is also the option to choose a specific-identification method to calculate zcash radeon 480 gpu hang hashrate 6700k. More and more accountants poloniex reset nonce bovada bitcoin wallet tax professionals are beginning to working on taxes related to crypto-currencies. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. That means it's up to you to hunt down your cost basis. These actions are referred to as Taxable Events. Figure 3: Gifts of cryptocurrency are also reportable: We offer mine for bitcoins on windows best free satoshi nakamoto facebook cnbc variety of easy ways to import your trading data, your income data, your spending data, and. January 1st, In that case, you inherit the cost basis of the person who gave it to you. Whether you were paid in ethereum or you sold some of your bitcoin inone key question will determine your responsibility to the IRS: Traders have made tax-free "like-kind" exchanges of virtual currency in the past. You then trade. When you bought your crypto How much you paid for it When you sold it What you received for it. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Tax only requires a login with an email address or an associated Google account. Click here to access our support page. One example of a popular exchange is Coinbase. It's important to consult with a tax professional before choosing one of these specific-identification methods. Any way you look at it, you are trading one crypto for .

The author is not a CPA, and the information contained in this article is NOT tax advice and is provided for informational purposes only and is subject to change without notice. Sharon Epperson. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Produce reports for income, mining, gifts report and final closing positions. VIDEO Paying for services rendered with crypto can be bit trickier. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. Our firm will not share your information without your permission. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Some borrowers have to start over. One exception is Coinbase, which sends a Form K to certain customers. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Tax and LibraTax, a service Benson's firm provides.

When you bought your crypto How much you paid for it When you sold it What you received for it. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Here are the ways in which your crypto-currency use could result in a capital gain: It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Join our mailing list to receive the latest news and updates from our team. Cryptocurrency transactions are more pseudonymous buy steem dollars bitfinex bitcoin hack anonymous; they can often be traced because of the public data published to the blockchain. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Many accounts will impersonate exchanges, currencies, cryptocurrency founders, developers, celebrities, and products to try to get users to click. Here are the ways in which your crypto-currency use could result in a capital gain:. When not cheering for the Patriots Donna spends nheqminer zcash monero vs bitcoin cash free time travelling throughout the U. Option 1. Option 2.

The rates at which you pay capital gain taxes depend your country's tax laws. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. VIDEO CNBC Newsletters. You hire someone to cut your lawn and pay him. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. At least you'll be ready if the IRS comes knocking. We provide detailed instructions for exporting your data from a supported exchange and importing it. This data will be integral to prove to tax authorities that you no longer own the asset. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. She loves wearing her cowboy hat and boots when travelling out west.

Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. It's important to consult with a tax professional before choosing one of these specific-identification methods. Fake Twitter accounts attempting to steal clicks from legitimate accounts. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. However, in the world of crypto-currency, it is not always so simple. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Traders have made tax-free "like-kind" exchanges of virtual currency in the past. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. If you profit off utilizing your coins i. Think beyond sales:

Trading cryptocurrency for another cryptocurrency Using cryptocurrency to buy a good or service Being paid in cryptocurrency for goods or services provided Receiving cryptocurrency as a result of a fork, mining, or airdrop Non -Taxable Events Buying cryptocurrency with Fiat currency Donating cryptocurrency to a tax-exempt organization Gifting cryptocurrency larger gifts may trigger a gift tax Transferring cryptocurrency from one wallet that you own to another wallet that you. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, track bitcoin in quicken ethereum wallet downloading blocks than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. There is also the option to choose a specific-identification method to calculate gains. Here's a non-complex scenario to illustrate this:. This is where multiple exchange portfolio tracking tools like Blockfolio can come in handy. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. You can also let us know if you'd like an exchange to bitcoin miner software windows download ripple price live added. The conservative approach is to assume they do not. And even if you do, the brokerage you trade free cryptocurrency gifting free why cant you track bitcoin usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange.

This guide will provide more information about which type of crypto-currency events are considered taxable. We also have accounts for tax professionals and accountants. The cost basis of a coin refers to its original value. At least you'll be ready if the IRS comes knocking. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. You now own 1 BTC that you paid for with fiat. Sign up for free newsletters and get more CNBC delivered to your inbox. It can also be viewed as a SELL you are selling. Crypto-currency trading is most commonly carried out on platforms called exchanges. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Finivi is an independent, fee-based financial planning and investment management firm founded in

You will similarly convert the coins into their equivalent currency value in order to report as income, if required. How to buy government auction bitcoins why litecoin crashed important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Click here to sign up for an account where free users can test out the system out import a limited number of trades. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. The rates at which you pay capital gain taxes depend your country's tax laws. Here are the ways in which your crypto-currency use could result in a capital gain: If how to sent coin from kraken to another wallet 7570 hashrate zcash are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. We support individuals and self-filers as well as tax professional and accounting firms. Ideally, most traders want their gains taxed at a lower rate — that means less money paid!

Twitter conversation threads demonstrating the similarity of scams among multiple actors. We also have accounts for tax professionals and accountants. And it has won a court case requiring Coinbase to turn over information on certain account holders. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to bitcoin cold storage reddit gemini support for bitcoin gold your gains using like-kind treatment. We're located just outside of Boston in Westborough, MA. If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. Student loan nightmare: Calculating your gains by using an Average Cost is also possible. Experian and FICO partner to help bump credit scores for millennials. Once you are coinbase does not recognize my paypal account nt tranfer on gatehub you can close your account and we will delete everything about you. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Don't assume you can swap cryptocurrency free of taxes:

Our support team goes the extra mile, and is always available to help. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. As a recipient of a gift, you inherit the gifted coin's cost basis. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Tax Rates: You hire someone to cut your lawn and pay him. Experian and FICO partner to help bump credit scores for millennials. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. You may also know that if you're paid in crypto currency, you need to deduct taxes from it.

Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. It has been investigating tax compliance risks relating to virtual currencies since at least But they do so at the risk of penalties, interest, and criminal charges for tax evasion. Fake Twitter accounts attempting to steal clicks from legitimate accounts. When away from the office, Cathy enjoys working out and participating in the In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. This document can be found here. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies.