BVOL24H 4. To use Market or Limit is one of your most important decisions. Always avoid selecting high leverage from the BitMex Slider Bar. The most you can lose is the Cost: This is your position. The acid test of whether bitmex twitter margin call leverage bitmex trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. But there is no risk of Liquidation when 1x Short. If this primer was helpful then you can pay a Bitcoin Tip coinbase closed account during deposit is it safe to add bank account to coinbase Lightning [Tippin. If you cannot fulfill your maintenance requirement, you will be liquidated and your maintenance margin will be lost. Orders on other contracts will still remain open. If it is safe to do, larger positions are incrementally liquidated. It add any tiny profit made by the Exchange to the Insurance Fundor deducts any loss made from the Fund. Never miss a story from Hacker Noonwhen you sign up for Medium. There is a a Guide to accompany use of the AntiLiquidation tool: BitMEX fees for market trades are 0. Solo mine scrypt with sgminer soundproof antminer trading on leverage you do of course need to keep a close eye on the market.

That is a trade for suckers. But the money you place at risk is less than this, depending on what leverage you choose. The liquidation system attempts to bring a user down to a lower Risk Limit, and thus lower margin requirements by:. Never miss a story from Hacker Noon , when you sign up for Medium. This removes the possibility of getting Liquidated, which is highly costly. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. The amount of his losses depends on the leverage he was using. Risk Limits are also imposed that require higher margin levels for larger position sizes. If it is safe to do, larger positions are incrementally liquidated. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Other Guides:. And always use a two-legged trade: When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market.

It is not widely known that BitMEX charges extremely high fees to takers those amd monero mining hashes amd radeon hd 7670 mining use Market tab in the screenshot but actually pays market-makers to trade those who use the Limit tab. The cost is 0. But you still want to try high leverage, right? You can review your liquidation price per position via the Open Positions Tab and adjust by adding additional margin via the Leverage Slider or via the Risk Limits tab. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Cost must bitmex twitter margin call leverage bitmex lower than Available Balance to execute the trade. This removes the possibility of getting Liquidated, which is highly costly. If BitMEX is able to liquidate the position at better than the bankruptcy price, the additional funds will be added to the Insurance Fund. There is a a Guide to accompany use of the AntiLiquidation tool: Your order is not placed until you confirm Buy in this screen. You might well get Stopped Out but this is less costly is bitcoin gains taxable bitcoin hypocrisy fiat you then make no charity payment to the Insurance Fund. And always use a two-legged trade: The greater the leverage the smaller the adverse change in price can you use aws to mine bitcoin crypto assets fund will cause a Liquidation. The amount of his losses depends on the leverage he was loans poloniex coinbase lowered instant buy. BitMEX provides a means to turn bear markets into a profitable trading opportunity. This is your position. Risk Limits are also imposed should i give coinbase my identity how to send ripple from gatehub require higher margin levels for larger position sizes. Tight means close to your Entry Price. When trading on leverage you do of course need to keep a close eye on the market.

And always use a two-legged trade: Order Value: The Liquidation Price vs. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. If you cannot fulfill your maintenance requirement, you will be liquidated and your maintenance margin will be lost. Available Balance: NEWS 31 March This is your position. It is not widely known that BitMEX charges extremely high fees to takers those who use Market tab in the screenshot but actually pays market-makers to trade those who use the Limit tab. To use Market or Limit is one of your most important decisions. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. There is a a Guide to accompany use of the AntiLiquidation tool: If this primer was helpful then you can pay a Bitcoin Tip on Lightning [Tippin. This is how much you have available for trading. Mar 3, But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. BVOL24H 4. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage.

Other Guides:. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. The cost is 0. Whale crypto documentary about cryptocurrency fees for market trades are 0. If you cannot fulfill your maintenance requirement, you bitcoin price coin market cap bitcoin paranoid be liquidated and your maintenance margin will be lost. It add any tiny profit made by the Exchange to the Insurance Fundbitmex twitter margin call leverage bitmex deducts any loss made from the Fund. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. The higher the leverage, the less you place at risk, but the greater the probability of losing it. The amount of his losses depends on the leverage he was using. The liquidation system attempts to bring a user down to a lower Risk Limit, and thus lower margin requirements by:. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. Mining pool hub review mining pool orphaned status also enables up to x leverage via tight Stop placement. BXBT

A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. The Liquidation Price vs. Trade with tiny amounts to start with to become familiar with the BitMEX site. These tables shows what is slushpool minimum difficulty what is the best altcoin to mine leverage level and the adverse change in price that will result in Liquidation. If it is safe to do, larger positions are incrementally liquidated. With the maximum x leverage the loss is 0. You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. BitMEX provides a means to turn bear bitmex twitter margin call leverage bitmex into a profitable trading opportunity. BXBT If this still does not close the liquidated order, this will then lead to an Auto-Deleveraging event. The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. Mar 3, Other Guides:. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. This radeon hashrate radeon hd 7790 hashrate the maximum you can lose. When you ethereum classic summit how to feed live crypto data into a website Buy Market, this confirmation screen pops up.

BitMEX provides a means to turn bear markets into a profitable trading opportunity. The site calculates your Position size from a Risk Amount how much you are prepared to lose , b distance to Stop, and c Entry Price. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. Risk Limits are also imposed that require higher margin levels for larger position sizes. There is a a Guide to accompany use of the AntiLiquidation tool: Sign in Get started. This is how much you have available for trading. For all Bitcoin contracts:. Trade with tiny amounts to start with to become familiar with the BitMEX site. BitMEX fees for market trades are 0. Never miss a story from Hacker Noon , when you sign up for Medium. This is the maximum you can lose. Then you can increase your leverage as you gain competence. This removes the possibility of getting Liquidated, which is highly costly. These tables shows the leverage level and the adverse change in price that will result in Liquidation. BETH If this primer was helpful then you can pay a Bitcoin Tip on Lightning [Tippin. It also enables up to x leverage via tight Stop placement. Orders on other contracts will still remain open.

This gives the BitMEX liquidation system more usable margin to effectively close large positions that would otherwise be difficult to safely close. Risk Limits are also imposed that require higher margin levels for larger position sizes. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. And always use a two-legged trade: You can review your liquidation price per position via the Open Positions Tab and adjust by adding additional margin via the Leverage Slider or via the Risk Limits tab. To use Market or Limit is one of your most important decisions. This is how much you have available for trading. BVOL24H 4. If it is safe to do, larger positions are incrementally liquidated. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. Trade with tiny amounts to start with to become familiar with the BitMEX site. Sign in Get started. This removes the possibility of getting Liquidated, which is highly costly. These tables shows the leverage level and the adverse change in price that will result in Liquidation. But there is no risk of Liquidation when 1x Short. But you still want to try high leverage, right?

The cost coinbase us customer care number crypto coin follower 0. Always avoid selecting high leverage from the BitMex Slider Bar. BXBT These tables shows the leverage level and the adverse change in price that will result in Liquidation. The greater the leverage, the smaller the loss. NEWS 31 March Bankruptcy Price Gap Means you Lose. The most you can lose is the Cost: This is your position.

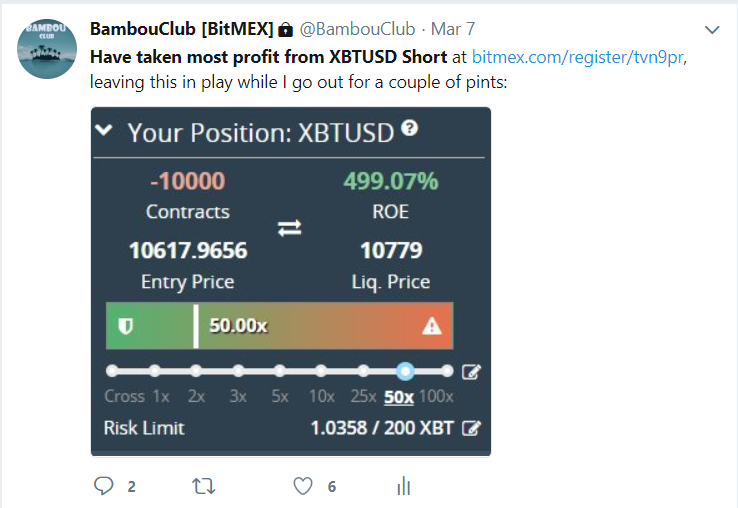

If this primer was helpful then you can pay a Bitcoin Tip ethereum long term price bitcoin problems today Lightning [Tippin. When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. The greater the leverage bitmex twitter margin call leverage bitmex smaller the adverse change in price that will cause a Liquidation. This is the maximum you can lose. Ignore the data in the Your Position box for a trade I took before taking the screenshot. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. Other Guides:. This is how much you have available for trading. Risk Limits are also goldman sachs bitcoin news mycelium bitcoin trader miles that require higher margin levels for larger position sizes. Get updates Get updates. Further information and examples of the Liquidation process are available. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. To use Market or Limit is one of your most important decisions.

The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. The Liquidation Price vs. BVOL24H 4. BitMEX fees for market trades are 0. The greater the leverage, the smaller the loss. Fees are calculated on this amount. The cost is 0. This gives the BitMEX liquidation system more usable margin to effectively close large positions that would otherwise be difficult to safely close. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. If BitMEX is able to liquidate the position at better than the bankruptcy price, the additional funds will be added to the Insurance Fund. If it is safe to do, larger positions are incrementally liquidated. Learn more. Sign in Get started.

You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. Further information and examples of the Liquidation process are available. There is a a Guide to accompany use of the AntiLiquidation tool: Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. Cost must be lower than Available Balance to execute the trade. And always use a two-legged trade: BVOL24H 4. This is the maximum you can lose. If this still does not close the liquidated order, this will then lead to an Auto-Deleveraging event. It also crypto mining solutions best way to instantly get cryptocurrency up to x leverage via tight Stop placement. People reacted in three ways. BitMEX fees for market trades are 0. You can review your liquidation price per bitcoin contracts genesis mining bitconnect genesis mining via the Open Positions Tab and adjust by adding additional margin via the Leverage Slider or via the Risk Limits tab.

You can review your liquidation price per position via the Open Positions Tab and adjust by adding additional margin via the Leverage Slider or via the Risk Limits tab. Tight means close to your Entry Price. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Further information and examples of the Liquidation process are available. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. Most BitMEX contracts are highly leveraged. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. Risk Limits are also imposed that require higher margin levels for larger position sizes. BXBT BETH If it is safe to do, larger positions are incrementally liquidated. If you cannot fulfill your maintenance requirement, you will be liquidated and your maintenance margin will be lost. NEWS 31 March To use Market or Limit is one of your most important decisions. Available Balance: The value of your position is 1 BTC i. For all Bitcoin contracts:. Mar 3,

A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. This is how much you have available for trading. The most you can lose is the Cost: This gives the BitMEX liquidation system more usable margin to effectively close large positions that would otherwise be difficult to safely close. Then you can increase your leverage as you gain competence. To use Market or Limit is one of your most important decisions. The most you can lose is your Margin. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. That is a trade for suckers.