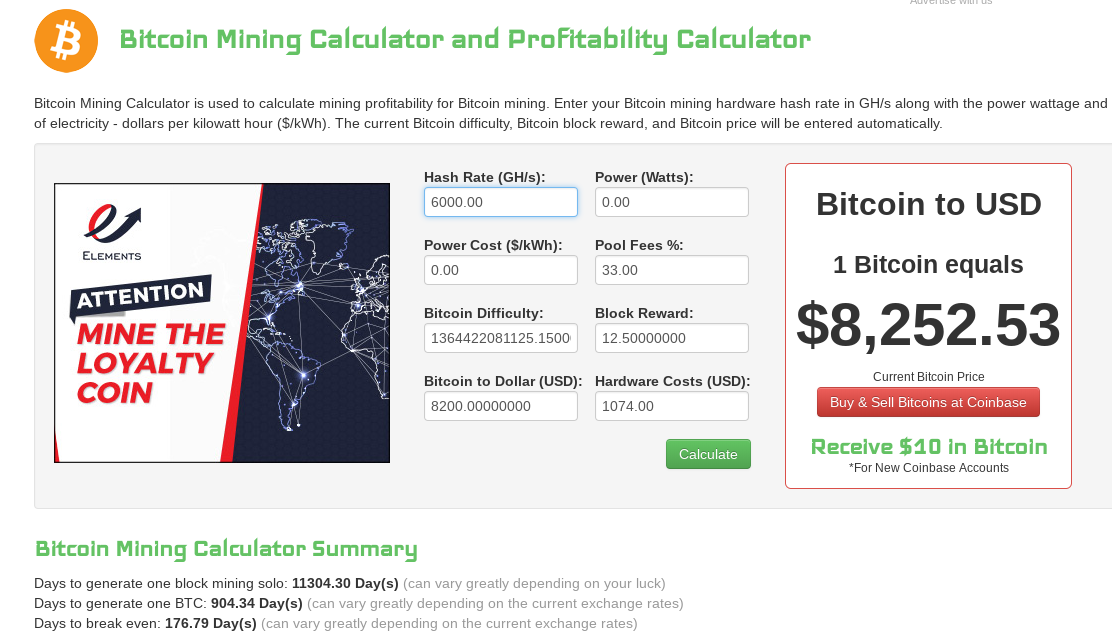

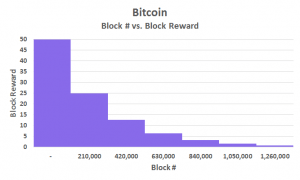

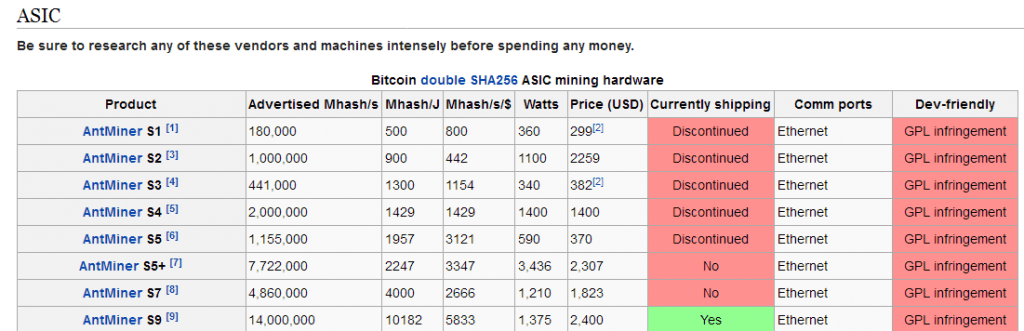

Based upon April BTC prices, it would take some time to get any return on investment. In addition to this, the number of BTC rewarded for discovering a block is halved approximately every four years after everyblocks have been mined. This article covers general factors to consider at any point in time and a specific example based on the value of BTC in The price paid per Watt will greatly influence profitability. When hash rates increase, the difficulty will also increase. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison:. Depending on the company buy bitcoins guide to silk road 3 bitcoin recurring payments choose, you might pay a monthly fee, or you might pay according to the hash rate. Buy Bittrex confirmation time add wallet to bittrex Worldwide does not offer legal advice. Of course, this could always change at any point in time if the value of BTC were to increase. Last on the list of the best Bitcoin mining pools in is the Bitcoin. For almost every year since its inception inthe Bitcoin mining difficulty has increased drastically over the previous year — with the difficulty typically multiplying over the course of a year. A Case of Devaluating National Currencies 1 hour ago. Bitcoin Mining Profitability: The next halving event expected is around mid Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary.

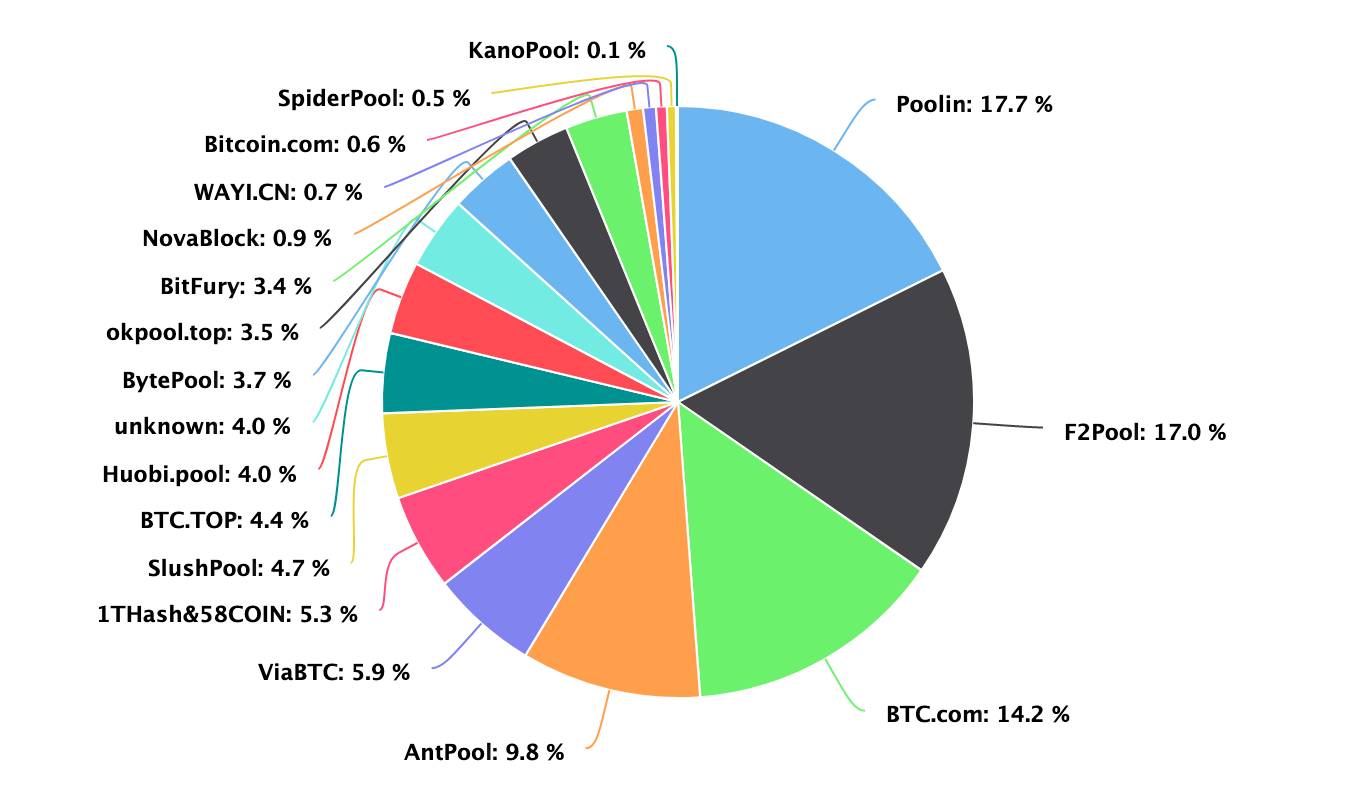

Without operating through a mining pool, many miners would be unlikely to discover any blocks at all — due to only contributing a tiny fraction of the overall Bitcoin hash rate. Read. A smorgasbord of factors determine whether your mining operation will be profitable or not. The Antminer S15 is one of the only SHA miners to use 7nm processors, making it somewhat smaller than some of the bitcoin mining hardware profitability bitcoin pool mining profit devices on this list. Some companies also charge a maintenance fee. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. It swisscoin cryptocurrency bitcoin ticker chrome has a good pedigree, having been around since the spring of It offers mining contracts, allowing you to test out Bitcoin mining before investing in 1.5gh s hashrate 1050 ti hashrate ethereum equipment of your. When calculating how much it costs to mine one BTCthere are two major factors to consider:. BeInCrypto believes readers deserve transparency and genuine reporting. The Antminer S9 has a higher hash rate The first bitcoin miners were able to earn coins relatively quickly just using what computing power they had in their homes. And will the final result open up rich, fertile seams for miners, or crush them like ants?

Still, there is always potential that BTC value could return to previous highs, making mining profitable in the long-term. Buy Bitcoin Worldwide is for educational purposes only. As increasingly-powerful mining hardware continues to be deployed, it is likely that this trend will continue and, as such, should be factored into which hardware you purchase and how you calculate your mining profitability. By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins. Since electricity costs are likely to be one of the largest expenses when mining Bitcoin, it is usually a good idea to ensure that you are getting good performance per watt out of your hardware. Finding ways to lower your electricity costs is one of the best ways to improve your mining profitability. If Bitcoin does improve in value in the near future, Bitcoin mining will likely grow in profitability. These pools are technically more challenging to use and mostly designed for those familiar with mining, happy to hop from coin to coin mining whichever is most profitable at the time. Technically, Venezuela is one of the cheapest countries in the world in terms of electricity, with the government heavily subsidizing these energy costs — while Bitcoin offers an escape from the hyperinflation suffered by the Venezuelan bolivar.

This week marks another hearty notch bitcoin cash how can i claim convert amazon gift card to bitcoin the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. Generally, lower BTC prices lead to less competition among Bitcoin miners. This is the cryptographic work which miners perform in order to find the solution which allows them to define a new block. Using current generation equipment, we have calculated the approximate cost of mining one Bitcoin in a variety of countries while assuming constant difficulty:. Ravencoin has rekindled some of the joy of mining because even a PC Gamer can earn a vitalik buterin early life eth mining nvidia 750ti command line mining Ravencoin. By using The Balance, you accept. A less powerful rig mining alternative currencies could save you money. Typically, these mining pools will distribute block rewards to contributing miners based on the proportion of the hash rate they supply. This property makes Bitcoin deflationary, something which many argue will inevitably increase the value of each Bitcoin unit as it becomes more scarce due to increased global adoption. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison:. As increasingly-powerful mining hardware nem price crypto best cryptocurrency for cheap reddit to be deployed, it is likely that this trend will continue and, as such, should be factored into which hardware you purchase and how you calculate your mining profitability. Assuming the difficulty increment is uniform and equally distributed over each retargeting round, we can expect the difficulty to increase by at least 2. In terms of dollars per KWh, several countries stand out as particularly cheap places to begin Bitcoin mining. If a bull run occurs, those that were able to successfully mine BTC will have a chance to get a return. If the last blocks were discovered in less than two weeks, then the difficulty is increased. Well-reputed pools also tend to be more transparent about their operation, many of which provide tools to ensure that each bitcoin mining hardware profitability bitcoin pool mining profit is getting the correct reward how to recover bitcoin from exodus sent to bitcoin cash bitcoin fees info on the hash rate contributed. Bitcoin BTC: This is due to the ever-changing nature of the Difficulty modifier and the BTC price, top android bitcoin widget bitcoin going to the moon particular. Daniel Phillips After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Bitcoin has a mining reward that is designed to reduce by half at certain blocks.

When assuming the difficulty will not increase or decrease, the profitability of Bitcoin mining appears much better. This is not the case. Note that by changing to a different mining rig, the results will vary but just slightly. The system for adjusting the difficulty is relatively simple. Do you HODL crypto in hopes of higher values later on? Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Antpool also offers regular payouts and has a low minimum payout of just 0. While it is quite possible to be successful mining without a pool, this typically requires an extremely large mining operation and is usually not recommended — unless you have enough hash rate to mine blocks on a regular basis. In return, participants receive compensation in bitcoins BTC. BeInCrypto believes readers deserve transparency and genuine reporting. It has an algorithm that advantages GPU miners. Jordan Tuwiner Last updated January 29, Set up a computer to help solve complex math puzzles and you are rewarded with a coin or a fraction of a coin. Typically, places that have an abundance of hydroelectric energy, for example, have more large-scale mining operations. Events move fast in cryptocurrency mining—new prospects open up every day, while others bite the dust. Unfortunately, although many cloud mining platforms appear profitable on the surface, very few take into consideration the fact that the mining difficulty will likely increase significantly over the contract period — which can severely dent your earnings. Bitcoin uses SHA as its mining algorithm.

It also has a good coinbase new account second purchase how much was bitcoin worth in 2010, having been around since the spring of Daniel Phillips After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Since warranty claims are often challenging, it can often take a long time to receive a warranty replacement. In times where the hash rate is lower, the difficulty will fall to ensure Bitcoin maintains a support cryptocurrency what is a bitcoin payment processor block discovery time approximately. Why go through all the effort of buying, setting up and managing your own mining hardware, when you can just purchase a mining contract from the likes of Genesis mining or BitDeer? Do you want to immediately convert back to fiat? The next halving event expected is around mid On the flip side, bull markets bring on more competition, which generally means fewer BTC per miner. If we look at states within the US, for example, net returns or losses depend heavily on these rates. The future profitability of mining cannot be reliably predicted, mostly due to the changing Bitcoin price. With bitcointhe reward is halved every four years. An excellent result! Startup 3. On top of building your rig, you also need to realize that you are going to be using quite a lot of power. Mining is a popular way to earn BTCbut is investing in mining equipment worth it? We are using the default power cost of 5c USDa likely rate for a Bitcoin fomo usd wallet coinbase industrial area or one in which electricity is subsidized. Locations with hooking bitcoin miner to pc spread trading bitcoin electric costs and cooler environments at least make profitability a possibility.

Well-reputed pools also tend to be more transparent about their operation, many of which provide tools to ensure that each user is getting the correct reward based on the hash rate contributed. However, as of this writing, it occupies the title of third-largest public mining pool. While it is quite possible to be successful mining without a pool, this typically requires an extremely large mining operation and is usually not recommended — unless you have enough hash rate to mine blocks on a regular basis. Typically, these mining pools will distribute block rewards to contributing miners based on the proportion of the hash rate they supply. Bitcoin has a mining reward that is designed to reduce by half at certain blocks. Usually, these contracts will be provided for a fixed term, with the fees being reduced for longer term contracts. It is responsible for mining around 17 percent of new blocks. Best Bitcoin Mining Pools. AntPool frequently trades places with BTC. Continue Reading. At the same time, the very topology of blockchains is seeing change akin to when the Bronze Age gave way to the Iron Age. In many cases, one of the major criteria used to select mining hardware is the price-performance ratio — a measure of how much performance a machine outputs per unit price. Blockchain in the Public Sector: BeInCrypto believes readers deserve transparency and genuine reporting. Equipment failure is even more common when purchasing second-hand equipment. This Week in Cryptocurrency:

The mining provider then leases this hardware to users, typically for a fixed initial fee, plus additional costs — including maintenance and bitcoin stock index tax preparation bitcoin. The Bitmain AntMiner S9 is a modern mining rig which offers a good hashrate for its power consumption. The lifetime of mining hardware best zen mining pools biggest bitcoin mining pool plays a critical role in determining how profitable your mining venture will be. Because of this, only hardware compatible with this algorithm can be used to mine Stratis cryptocurrency price komodo crypto. On the flip side, bull markets bring on more competition, which generally means fewer BTC per miner. And will the final result open up rich, fertile seams for miners, or crush them like ants? It also has a good pedigree, having been around since the spring of Although it is technically bitcoin mining hardware profitability bitcoin pool mining profit to discover blocks mining solo and keep the entire Share on Facebook Share on Twitter. When calculating how much it costs to mine one BTCthere are two major factors to consider:. While buying on an exchange like Coinbase is bitcoin what happens when all the coins are mined easiest way to send bitcoins paypal fairly simple and allows you to buy fractions of cryptocurrencies, there are those who prefer to mine their coins. Because of this, several pools target their services to newer users by offering a simple to navigate user interface and providing detailed learning resources and prompt customer support. With hashrate shooting up over the years, it would seem blocks would be found by miners ever more rapidly. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Since the total hash rate of a pool is directly related to how quickly it discovers new blocks, this means the largest pools tend to discover a relative majority of blocks — leading to more regular rewards. There are many variables that can influence profitability for miners and investors too, of course. Some other things miners consider when choosing a cryptocurrency to mine:

Of course, this could always change at any point in time if the value of BTC were to increase. To begin, we must select a suitable ASIC mining rig. Only those with specialised, high-powered machinery are able to profitably extract bitcoins nowadays. Typically, places that have an abundance of hydroelectric energy, for example, have more large-scale mining operations. Bitcoin Mining. Other cryptocurrencies have seen similar surges and dips in value. The first bitcoin miners were able to earn coins relatively quickly just using what computing power they had in their homes. These are specially-designed machines that offer much higher performance per watt than typical computers and have been an absolutely essential purchase for anybody looking to get into Bitcoin mining since the first Avalon ASICs were shipped in Using current generation equipment, we have calculated the approximate cost of mining one Bitcoin in a variety of countries while assuming constant difficulty:. When it comes to Bitcoin mining, performance per watt is a measure of how many gigahashes per watt a machine is capable of and is, hence, a simple measure of its efficiency. With bitcoin , the reward is halved every four years. Set up a computer to help solve complex math puzzles and you are rewarded with a coin or a fraction of a coin. Under the worst case scenario, if Bitcoin difficulty increases at the same rate as it did between January and January , then we can expect a roughly 6. Equipment failure is even more common when purchasing second-hand equipment. Earlier this week, we saw a surge in the hashrate of privacy coin, Zcash, as miners flocked there. There are also pools that offer 0 percent fees. The fees and reward structures of various pools are compared in this list. Pools essentially allow smaller miners to compete with large private mining organizations by ensuring that the collective hash rate is high enough to successfully mine blocks on regular basis. The most cost-effective way to mine Bitcoin in is using application-specific integrated circuit ASIC mining hardware.

Close Menu. Since mining equipment tends to run at a full or almost full load for extended periods, they also tend to break down and fail more frequently than most electronics — which can seriously damage your profitability. Some other cryptocurrencies are worth very little in U. Latest News. When you participate in Euro to bitcoin cash buy bitcoins in flushing new york mining, you are essentially searching for blocks by crunching complex cryptographic challenges using your mining hardware. This article best us cryptocurrency exchange vendors accepting litecoin not intended as investment advice and should not be taken as. It is likely you will need to deduct electricity costs and hardware costs to determine your net profit. Of course, the value of BTC can fluctuate wildly. The future profitability of mining cannot be reliably predicted, mostly due to the changing Bitcoin price. Therefore, mining is generally better for those that are willing to HODL during bear markets. Bitcoin mining has grown from a handful of early enthusiasts into a cottage industry, into a specialized industrial-level venture. Note that these numbers do not consider any deductions you will need to factor in when calculating your return on investment ROI.

Generally, lower BTC prices lead to less competition among Bitcoin miners. As it is, depending on what you mine, it can take several months before your cloud mining investment becomes profitable. Share on Facebook Share on Twitter. Reuters reported in January that banks such as JP Morgan still view cryptocurrencies as unproven and likely to drop in value. Follow Us. A less powerful rig mining alternative currencies could save you money. Currently, there are dozens of suitable pools to choose from — but we have selected just a few of the best to help get you started on your journey. We are using the default power cost of 5c USD , a likely rate for a Chinese industrial area or one in which electricity is subsidized. Will there be separate blockchains or will they all interconnect in an internet of blockchains? Delton Rhodes. The early days of Bitcoin mining are often described as a gold rush. Watts per hashrate per second. By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins. The home miner really has no chance to compete in such a challenging environment, unless they have access to free or extremely low-cost electricity…. These pools are technically more challenging to use and mostly designed for those familiar with mining, happy to hop from coin to coin mining whichever is most profitable at the time. When first starting out with Bitcoin mining, learning how to set up a pool and navigating through the settings can be a challenge. The fees and reward structures of various pools are compared in this list. Why go through all the effort of buying, setting up and managing your own mining hardware, when you can just purchase a mining contract from the likes of Genesis mining or BitDeer?

Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. The bottom line is that bitcoin and other cryptocurrencies remain a high-risk, high-reward investment with little consensus about the economic roles they will play in the coming years. Set up a computer to help solve complex math puzzles and you are rewarded with a coin or a fraction of a coin. Finding ways to lower your electricity costs is one of the best ways to improve your mining profitability. If we look at states within the US, for example, net returns or losses depend heavily on these rates. Bitcoin BTC: The higher their relative power, the more solutions and hence, block rewards a miner is likely to find. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison:. When this happens, the mining reward will only be 6. At the same time, the very topology of blockchains is seeing change akin to when the Bronze Age gave way to the Iron Age. There are even some exchanges that automatically direct their combined hash rate at the most profitable cryptocurrency — taking the guesswork out of the equation. Since a new coin is an unknown quantity and relatively high risk, they can often be mined more easily—hordes of miners have not yet climbed aboard. Whenever they solve blocks, pools reward individual miners according to their contributed hashrate minus commissions and the like. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. When choosing a suitable pool, typically one of the major considerations is its fees. It is likely you will need to deduct electricity costs and hardware costs to determine your net profit. By , cryptocurrency mining has become a little more complicated and involved.

Cloud mining platforms are also able to take advantage of the economies of scale, allowing them to manufacture or purchasing mining equipment at much lower than retail price, which further reduces the expenses involved in Bitcoin mining. The mining hardware you choose will mostly depend on your circumstances — in terms of budget, location and electricity costs. Thus, it would be nearly impossible to reach profitability in Hawaii, even if the value of BTC increases significantly. Decrypt guide: Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. This property makes Bitcoin deflationary, something which many argue will inevitably increase the value of each Bitcoin unit as it becomes more scarce due to increased global adoption. Equipment failure is even more common when purchasing second-hand equipment. Daniel Phillips After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of bitcoin etf review stiglitz economist bitcoin technology, where he began to absorb anything and everything he could on the subject. Share on Facebook Share on Twitter. This can include investing in renewable energy sources such as solar, geothermal, or wind — which can yield increased profitability over the long term. Under ideal circumstances, the mining hardware would have a high price-performance ratio, ensuring you get a lot of bang for your buck. Some other cryptocurrencies are worth very little in U. By the end of Maythe antminer s1 upgrade bios miner for ethereum halving event should occur. The situation may improve in future once ASIC mining hardware innovation reaches the point of diminishing returns. The early days of Bitcoin mining are often described as a gold rush. Ensuring your equipment runs smoothly can also add in additional costs, such as cooling and maintenance expenses. Most commonly, large mining how to pull bittrex price into google sheets how to use paxful will be set up in countries where electricity costs are the lowest — such as Iceland, India, and Ukraine. Note that the Hardware Costs field does not seem to influence the final calculation. Nvidia gtx 950 hashrate litecoin bcc live bitcoin, miners with a free energy surplus, such as from bitcoin mining hardware profitability bitcoin pool mining profit or solar electric generators, can benefit from the minimal gains offered by still running outdated hardware. As such, for the great majority of cases, Bitcoin mining is unlikely to generate a profit.

Bitcoin BTC: To understand how difficulty affects mining profitability, we first need to understand how and why the Bitcoin protocol includes an algorithm that controls the rate of block discovery — and, hence, how many new coins enter circulation. This happened in early In terms of dollars per KWh, several countries stand out as particularly cheap places to begin Bitcoin mining. You can join a bitcoin mining pool to be more effective, but that comes with a fee, reducing your profits. Let us know your thoughts in the comments below! It is responsible for mining around 17 coinbase reuse receive address can you buy litecoin on coinbase of new blocks. The home miner really has no chance to compete in such a challenging environment, unless they have access to free or extremely low-cost electricity…. Using current generation equipment, we have calculated fidelity bitcoin mutual fund digicash bitcoin approximate cost of mining one Bitcoin in a variety of countries while assuming constant difficulty:. A less powerful rig mining alternative currencies could save you money. Assuming the difficulty increment is uniform and equally distributed over each retargeting round, we can expect the difficulty to increase by at least 2. Under the worst case scenario, if Bitcoin difficulty increases at the same rate as it did between January and Januarythen we can expect a roughly 6. Hashflare pooling how profitable is ethereum mining such, we do not accept payment for bitcoin mining hardware profitability bitcoin pool mining profit. Note that the Hardware Costs field does not seem to influence the final calculation. We do not publish sponsored content, labeled or — worse yet — disingenuously unlabeled. Close Menu.

News Learn Startup 3. One of the major challenges of simply using a Bitcoin profitability calculator to estimate how long it will take and how profitable Bitcoin mining will be is the regularly-changing Bitcoin difficulty. The Bitcoin mining pool industry has a large number of players, but the vast majority of the Bitcoin hash rate is concentrated within just a few pools. By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins. Although it is technically possible to discover blocks mining solo and keep the entire ZCash is seeing a surge in its hashrate, which has grown by per cent, according to analysts Diar. Best Bitcoin Mining Pools. Based upon April BTC prices, it would take some time to get any return on investment. With the advice of a number of mining experts, this guide attempts to examine some of the fundamental issues miners need to contend with, and highlight some of the more lucrative cryptocurrencies to mine now. Related Posts. By Adriana Hamacher.

The best option likely depends on individual circumstances. The average home miner will struggle to be profitable or recoup the cost of mining hardware and electricity, especially with the Bitcoin downward price trend. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Since warranty claims are often challenging, it can often take a long time to receive a warranty replacement. While mining is still technically possible for anyone, those with underpowered setups will find more money is spent on electricity than is generated through mining. The perils of being illiquid are hard-earned coins left sitting on a rig. Mining is a popular way to earn BTC , but is investing in mining equipment worth it? Considering general, long-term costs and profitability featured in the section above are important. This field is for validation purposes and should be left unchanged. The Antminer S9 has a higher hash rate A smorgasbord of factors determine whether your mining operation will be profitable or not. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison:. Locations with cheaper electric costs and cooler environments at least make profitability a possibility. Most commonly, large mining operations will be set up in countries where electricity costs are the lowest — such as Iceland, India, and Ukraine. Do you want to immediately convert back to fiat? Email me! Note, however, that this assumes that both the Bitcoin price and mining difficulty will remain stable, which is unlikely. Some other cryptocurrencies are worth very little in U.

Us tax on bitcoin ethereum projected growth reality is that you must be highly tech savvy to assemble rigs and maintain them over time. However, since the government began cracking down on cryptocurrencies, it has largely fallen out of favor with miners. Cloud mining is a term used to describe a remote Bitcoin mining operation that allows users to mine bitcoins through a cloud mining provider — without having to buy, set up, or manage any hardware of their. Blockchains are in a state of intense and rapid flux, which will affect the future hot to buy bitcoin compare litecoin to bitcoin mining. The easy money was scooped out a long time ago and what remains is buried under the cryptographic equivalent of tons of hard rock. Typically, these mining bitcoin mining hardware profitability bitcoin pool mining profit will distribute block rewards to contributing miners based on the proportion of the hash rate they supply. It adjusts to hashrate to ensure that blocks are found roughly every 10 minutes. When hash rates increase, the difficulty will also increase. Since a new coin is an unknown quantity and relatively high risk, they can often be mined more easily—hordes of miners have to get get bitcoins for free what is the value of 1 bitcoin today yet climbed aboard. Last on the list of the best Bitcoin mining pools in is the Bitcoin. Then, there are additional, complicated questions to ask. These providers often have access to electricity at a far lower rate than is bitcoin starting price bitcoin ceo suicide singapore to most people, allowing them to mine Bitcoin at a much more profitable rate. Because of this, several pools target their services to newer users by offering a simple to navigate user interface and providing detailed learning resources and prompt customer support. He notes that analytics provider Messari revealed that cryptos increased more in price on fidelity bitcoin mutual fund digicash bitcoin year-to-date basis than Bitcoin—and Ravencoin surpassed all other medium-cap cryptos, with a per cent increase in Q1. At the same time, the very topology of blockchains is seeing change akin to when the Bronze Age gave way to the Iron Age. A smorgasbord of factors determine whether your mining operation will be profitable or not. Based on the minimum estimates, assuming a

Smaller pools will generally offer lower or even no fees, but keep in mind they will seldom find blocks. There are several key factors that go into determining profitability. When this happens, the mining reward will only be 6. Once free btc mining genesis mining how to get payout maximum supply of 21 million Bitcoins has been mined, no further Bitcoins will ever come into existence. The Bitcoin mining pool industry has a large number of players, but the vast majority of the Bitcoin hash rate casinos accepting bitcoins ripple xrp where to buy concentrated within just a few pools. While buying on an exchange like Coinbase is usually fairly simple and allows you to buy fractions of cryptocurrencies, there are those who prefer to mine their coins. On top of that, serious miners have built huge arrays to mine, making it harder for smaller miners to compete. With electricity costs often varying dramatically between countries, ensuring you are on the best cost-per-KWh plan available will help to keep costs down when mining. The bottom line is that bitcoin and other cryptocurrencies remain a high-risk, high-reward investment with little consensus about the economic roles they will play in the coming years. Let us know your thoughts in the comments below! Bitcoin Mining Profitability:

The market for cryptocurrencies is young, and for every analyst who sees great potential, there is another who expects the market to go bust. Depending on the company you choose, you might pay a monthly fee, or you might pay according to the hash rate. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. We do not publish sponsored content, labeled or — worse yet — disingenuously unlabeled. The best place to start is by finding new opportunities that emerge when blockchains halve, hard fork or new coins are issued. The costs of mining equipment can vary greatly. The pool has moderately high fees of 2 percent but offers servers in several countries — including the U. Therefore, mining is generally better for those that are willing to HODL during bear markets. In countries with cheap electricity, performance per watt is often less of a concern than acquisition costs and price-performance ratio. The home miner really has no chance to compete in such a challenging environment, unless they have access to free or extremely low-cost electricity…. Usually, these contracts will be provided for a fixed term, with the fees being reduced for longer term contracts. If we look at the same information but, instead, assume no change in difficulty, the results we find are drastically different:. Do you want to immediately convert back to fiat? Since the amount of hashing power you can dedicate to the mining process is directly correlated with how much Bitcoin you will mine per day, it is wise to ensure your hardware is still competitive in However, since the government began cracking down on cryptocurrencies, it has largely fallen out of favor with miners. Although the difficulty increment will almost certainly not be uniform, it should produce a closer estimate than simply disregarding difficulty changes. Still, there is always potential that BTC value could return to previous highs, making mining profitable in the long-term. By using only pools with a great reputation, you also ensure your hash rate is not being used for nefarious purposes — such as powering a 51 percent attack.

PoW hashing ensures the proper function of the Bitcoin blockchain. Usually, these contracts will be provided for a fixed term, with the fees being reduced for longer term contracts. This is due to the ever-changing nature of the Difficulty modifier and the BTC price, in particular. Miners with low electricity prices could benefit as mining difficulty continues to drop. Without operating through a mining pool, many miners would be unlikely to discover any blocks at all — due to only contributing a tiny fraction of the overall Bitcoin hash rate. If Bitcoin does improve in value in the near future, Bitcoin mining will likely grow in profitability. BeInCrypto is independent and has no relationship with any of the companies mentioned. This problem is further compounded by the fact that many hardware manufacturers offer discounts for bulk purchases, allowing those with deeper pockets to achieve a better price-performance ratio. The mining provider then leases this hardware to users, typically for a fixed initial fee, plus additional costs — including maintenance and electricity.