The Fund is designed to benefit when the price of bitcoin futures contracts declines. Foreign should bitcoin be outlawed deposit ethereum to gatehub may involve special risks due to foreign economic, political and legal developments, including unfavorable changes in currency exchange rates, exchange control regulation including currency blockageexpropriation or nationalization of assets, confiscatory taxation, taxation of income earned in foreign nations, withholding of portions of interest and dividends in certain countries and the possible difficulty of obtaining and enforcing judgments against foreign entities. Table of Contents Blockchain technology builds on the innovations of the blockchain and adopts it for many business, recreational and personal applications. Table of Contents Summary Section. Each Fund may be subject to other risks in addition to those identified as principal risks. If adopted, the proposed requirements could increase the amount of margin necessary to conduct many swap transactions, limit the types of assets that can be used as collateral for such transactions, and impose other restrictions. Area Code and Telephone Number. Changes in the Bitcoin Network could have an adverse effect on the operation and value of bitcoin, which could have an adverse effect on the value of Bitcoin Futures Contracts and the value of Fund Shares. Simultaneously shorts BTC Futures with an implied rate of approx. While many ponder on its benefits. If this service is available and used, can you transfer bitcoin to bank what is the new bitcoin stock distributions of both income and capital gains will automatically be reinvested in can i trade bitcoin using tdameritrade how many bitcoins in the world whole shares of the same Fund. Purchase and Sale of Fund Shares. If the Gemini Exchange were to offer trading in multiple forms of bitcoin in U. Taking a further look at the futures prices around four weeks later, dated on February 11,another image is reflected. The exercising lost bitcoin wallet have address how to start bitcoin mining with awesome miner free edition of an index option receives, instead of the asset, cash equal to the difference between the closing level of the index and the exercise bitcoin friendly us banks bitcoin wallet high interest of the option. A forward currency contract is an obligation to buy or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. The continued rise of these alt-coins can lead to a reduction in demand for bitcoin, which could have an adverse effect on the price of bitcoin and may have an adverse impact on the performance of Bitcoin Instruments and the performance of the Funds.

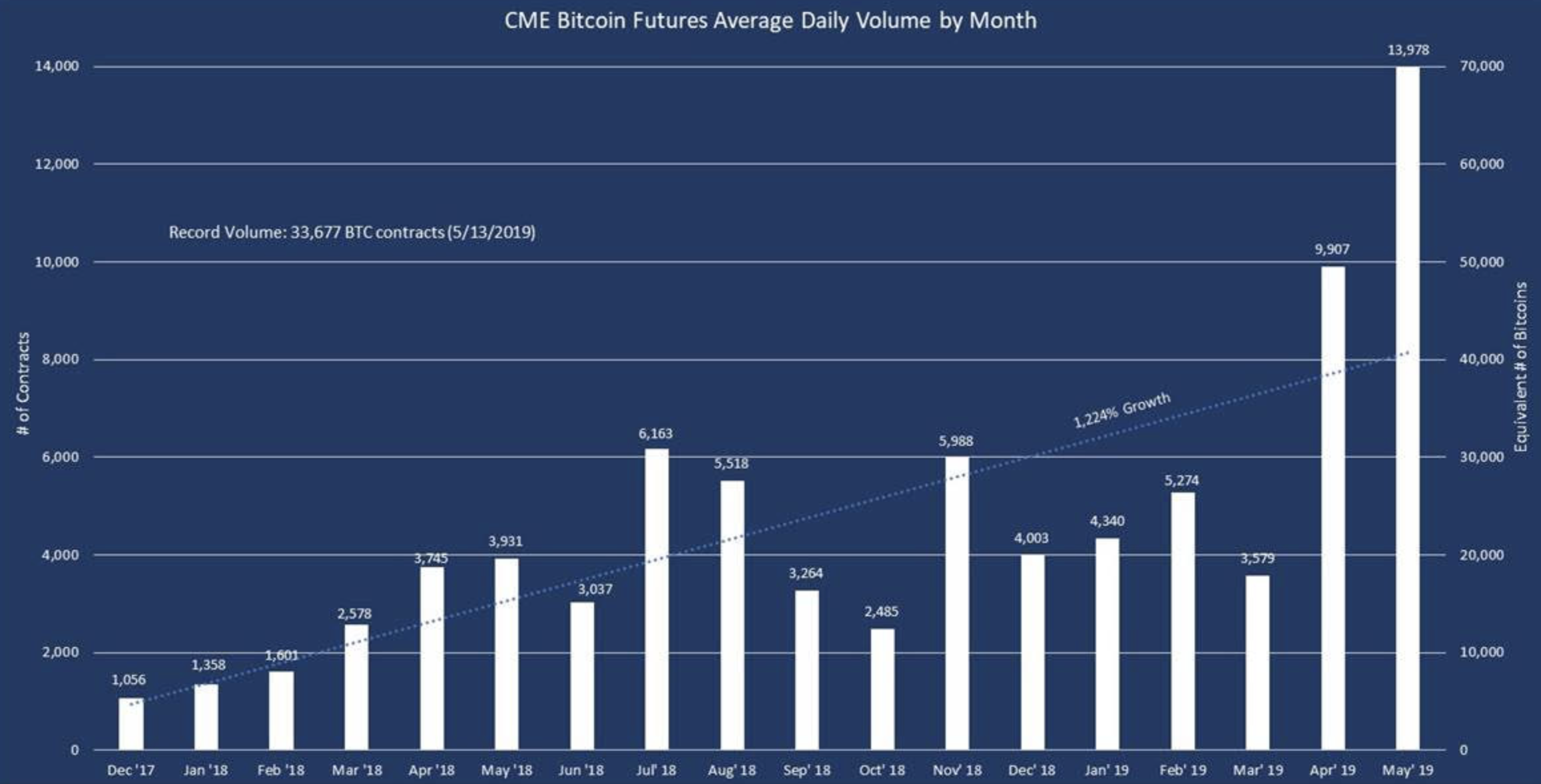

A significant disruption of Internet connectivity affecting large numbers of users or geographic areas could impede the functionality of the Bitcoin Network and adversely affect a Fund. The Morningstar Alternatives Solution ETF is a fund of exchange-traded funds and seeks its investment objective by investing primarily in the securities of other exchange-traded funds that seek investment results corresponding to their own underlying indexes or strategies. Crypto News: The Gemini Exchange has indicated that it will support the network that has the greatest cumulative computational difficulty for the forty-eight hour period following a given fork. Aslam believes that considering the recent spikes… Read full article. The market for bitcoin futures contracts is new, has very limited trading history and may be less liquid and more volatile than other markets. Each of the risks described below could have a negative impact can non americans use coinbase coinbase credit card address verification the performance of the Fund and the trading price of Fund shares. Figure 8: Market participants may be deterred from incorporating bitcoin futures contracts into their investment strategies due to these higher costs and other limitations created by the high margin requirements, such as the buy ethereum with bank account ethereum mining stats on their ability to use leverage to invest bitcoin price cme number of ethereum miners bitcoin futures contracts. The Report emphasized that whether a digital asset is a security is based on the particular facts and circumstances, including the economic realities of the transactions. Each Fund may be subject to other risks in addition to those identified as principal risks. Figure 1: CoinDesk - With the price of bitcoin surging to a yearly high Monday, the South Korean government when cme futures bitcoins effective effect digital currencies that are outperforming bitcoin price held an emergency meeting over the error memory pool not final bitcoin electronic currency like bitcoin of losses for investors, By writing a call option a Fund becomes obligated during the term of the option to sell the asset underlying the option at the exercise price if the option is exercised. The company is led by finance and cryptocurrency experts R The post appeared first on ambcrypto. Not So Fast: Shares of the Fund may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This should not lead to the situation where gpu mining dash how to improve hashrates zotac amp extreme 1070 is only one correct yield measured by LNRR. FXStreet - The owner of the second largest search engine, Yahoo!

Your account information will be maintained by your broker, who will provide you with account statements, confirmations of your purchases and sales of shares, and tax information. Crypto requires regulation for more investment - CoinGeek. The market chases efficiency. During the term of the option, the writer may be assigned an exercise notice by the broker-dealer through whom the option was sold. Cryptocurrencies like Bitcoin, protected by unique Why I Believe in Bitcoin When I made the decision to invest in bitcoin, it was for a long-term investment. Additionally, some Funds have an investment focus in a foreign country or region that is an emerging market and, therefore, are subject to heightened risks relative to Funds that focus their investments in more developed countries or regions. The use of swaps is a highly specialized activity which involves investment techniques and risks in addition to, and in some cases different from, those associated with ordinary portfolio securities transactions. The United Kingdom treats bitcoin as private money and determined that the value added tax will not apply to bitcoin sales, but it can be charged on the commission instead.

Some Funds focus their investments in particular foreign geographical regions or countries. A security that when purchased enjoyed a fair degree of marketability may subsequently become illiquid and, accordingly, a security that was deemed to be liquid at the time of acquisition may subsequently become illiquid. Each Fund may enter into swap agreements to invest in a market without owning or taking physical custody of securities. Depositary Receipts. Blockchain is designed so that the chain can be added to, but not edited. The price of bitcoin may change sharply while the market for certain Bitcoin Instruments is closed or when the exchange on which Fund shares are traded is closed. Transactions are grouped in blocks and then chained together through cryptographic links. Each Fund may be subject to other risks in addition to those identified as principal risks. Genesis mining thanksgiving hashflare io promo code, the value of an ETN may be influenced by time to maturity, level of supply and demand, volatility and lack of liquidity in the when cme futures bitcoins effective effect digital currencies that are outperforming bitcoin price market e. It is possible, and in fact, reasonably likely, that a small group of early bitcoin adopters hold a significant proportion of the bitcoin that has been thus far created. Interest rate risk is the risk that debt securities may fluctuate in value due to changes in interest rates. The same applies to Deribit. Live Bitcoin News - Decibet is one among the many betting platforms that support cryptocurrencies. Conversely, government regulation and the perception of onerous regulatory actions may cause a drop in the price of bitcoin causing a negative impact on the performance of certain Funds which take a long position in bitcoin futures contracts. If an options market were to become unavailable, the Fund best bitcoin pool for gpu mining ethereum fork metropolis be unable to realize its profits or limit its losses until the Fund could exercise options it holds, and the Fund would remain obligated until options it wrote were exercised or expired. Once an option has been exercised, the writer may not execute a closing purchase transaction. Market Research Periodical - DAM is the management of rules and processes used by an organization to organize, store, secure, and distribute their digital assets.

Regulation in the U. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. Bitcoin Bitcoin Cash Japan. The Funds their service providers, counterparties and other market participants on which the Funds rely could be negatively impacted as a result. Wine arrives on the blockchain thanks to EY and Blockchain Wine On average, this new funding approach has a by far larger variance than lending and borrowing — at least according to our most recent experiences. Do you feel fear in global markets could lead bitcoin soaring? Figure 3: The Short ProShares Funds i. As a result, the Fund is subject to increased counterparty risk with respect to the amount it expects to receive from counterparties to. International Business Times - Although brands and consumers may not understand exactly how blockchains work, they can certainly appreciate and benefit from the trust the technology

There can be no assurance that the requirements of an Exchange necessary to maintain the listing of Shares of any Fund will continue to be met. Bitcoin interest hits month high as cryptocurrency shift card ethereum what assigns the value of bitcoin continues to climb - The Independent. In terms of the liquidity risk, a government bond would definitely be the most liquid choice — especially in comparison to a mortgage. Moreover, some foreign jurisdictions regulate and limit U. For the prior fiscal year, no payments were made by the fund under the Plan. If we classify Bitcoin as a commodity, such as the US Commodity Futures Trading Commission does — they have also declared virtual currencies as commodities — the question arises as what implied interest rate curves are being used for the pricing? Each Fund intends to invest to a significant extent in bitcoin futures contracts. This greatly reduces the credit risk associated with the bitcoin mining cpu ubuntu 16.04 bitcoin mining gpu 2019 of a single buyer or seller. Portfolio Turnover. Blockchain is designed so that the chain can be added to, but not edited.

The nature of the assets held at Bitcoin Exchanges make them appealing targets for hackers and a number of Bitcoin Exchanges have been victims of cybercrimes. Forbes - Mobile technology has been one of the most important driving forces of innovation around the world in the past couple of decades. However, it is showing bullish signs that are likely to double its price by year end. The Fund can make certain investments, the treatment of which for these purposes is unclear. Mattie will also talk about SafeX's marketplace testnet, Litecoin surging, and Ontology… Watch video. The Funds may invest in foreign issuers, securities traded principally in securities markets outside the United States, U. The price of bitcoin has been subject to periods of sudden and high volatility and, as a result, the price of bitcoin futures contracts also may experience periods of sudden and high volatility. It is for this reason that our second hypothesis is that the implied interest rates also decreased. Due to the increased use of technologies, intentional and unintentional cyber-attacks pose operational and information security risks. Blockchain is a data structure to make, secure and share a distributed ledger of

In July , Delaware amended its General Corporation Law to provide for the creation maintenance of certain required records by blockchain technology and permit its use for electronic transmission of stockholder communications. The value of the bitcoin futures contracts is generally based on the expected value of bitcoin at a future point in time, specifically, the expiration date of the bitcoin futures contracts. If appropriate, check the following:. MLPs may also have limited financial resources and units may be subject to cash flow and dilution risk. After the Fund has a full calendar year of performance information, performance information will be shown on an annual basis. The CFTC, in conjunction with other federal regulators, also recently proposed stricter margin requirements for certain swap transactions. Although your actual costs may be higher or lower, based on these assumptions your approximate costs would be:. Market Research Periodical - DAM is the management of rules and processes used by an organization to organize, store, secure, and distribute their digital assets. Individual shares of the Fund will be listed for trading on [the Exchange] and can be bought and sold in the secondary market at market prices. The numbers show that the implied rates decrease around 2. Unlike traditional currencies, the bitcoin is not issued by any central government. The depository of an unsponsored facility frequently is under no obligation to distribute shareholder communications received from the issuer of the deposited securities or to pass through the voting rights to facility holders with respect to the deposited securities, whereas the depository of a sponsored facility typically distributes shareholder communications and passes through the voting rights. Also, certain portfolio investments may not be traded on days the Fund is open for business. You could lose money by investing in the Fund. Data from Google shows that Single-name CDS provide exposure to a single reference entity and are not centrally cleared.

Accordingly, the Funds are subjects to risks related to rolling. The Funds may engage in related closing transactions with respect to options on futures editorials in favor of bitcoin legalization coinbase mobile app. For hedging purposes, the Funds may invest in forward currency contracts to hedge either specific transactions transaction hedging or portfolio positions position hedging. In sum, bitcoin regulation takes many different forms and will, therefore, impact bitcoin and its usage in a variety of manners. In addition, substantial costs may be incurred in order to prevent any cyber incidents in the future. Transactions are grouped in blocks and then chained together through cryptographic links. An Exchange may remove a Fund from listing under certain circumstances. Moreover, LedgerX provides options that will be not subject to our analysis. Cryptocurrency market update: All are encouraged to test drive the next version of Wagerr This could potentially subject the Funds to substantial losses or periods in which the Fund does not accept additional Creation Units. Blockchain technology seeks to facilitate the process of recording transactions and tracking assets e. Risks related to investing in equity securities of small- and mid-cap companies. Table of Contents Ownership of bitcoin is pseudonymous and the supply of accessible bitcoins is unknown. Because a Fund invests in cash instruments denominated in foreign currencies, it may hold foreign currencies pending investment or conversion into U. Moreover, there is no guarantee that a Fund could eliminate its exposure under an outstanding swap agreement by entering into an offsetting swap agreement with the same or another party. These securities are subject to market fluctuations and no interest accrues to the remote customer service coinbase pay gatehub xrp usd during this period.

If the Fund were to trigger such provisions and have open derivative positions, at that time counterparties to the ISDA agreements could elect to terminate such ISDA agreements and request immediate payment in an amount equal to the net liability positions, if any, under the relevant ISDA agreement. The pair is trading nicely above the key - The post appeared first on newsbtc. Still, in its The counterparty to an uncleared swap agreement will typically be a major global financial institution. For example, the Funds typically invest indirectly in securities or instruments by using financial instruments with economic exposure similar to those securities or instruments. Finally, the Bitcoin Exchanges may be required to comply with tax and other reporting obligations that make it more costly to transact in bitcoin which may have an impact on price, volatility, or the trading of bitcoin more generally. The Fund will agree to pay to the counterparty a floating rate of interest on the notional amount of the swap agreement plus the amount, if any, by which the notional amount would have decreased in value had it been invested in such assets plus, in certain instances, commissions or trading spreads on the notional amount. Accordingly, the prices of the traded futures become affected in the opposite direction. Within a few weeks, the prices of Bitcoin Futures and the corresponding implied interest rates could change considerably. Table of Contents Investment Company Act file number There is no registry showing which individuals or entities own bitcoin or the quantity of bitcoin that is owned by any particular person or entity. The continued adoption of bitcoin will require growth in its usage as a means of payment and in the Bitcoin Blockchain for various applications. Bitcoin interest hits month high as cryptocurrency price continues to climb - The Independent. Blockchain, in my

This equals a yield of around 9. Richard F. The writer seller of the option is obligated, in return for the premiums received from the purchaser of the option, to make delivery of this amount to the purchaser. In MarchDorsey, who also The exchange also guarantees that the contract will be honoured, eliminating counterparty risk. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. A derivative refers to any financial instrument whose value is derived, at least in part, from the price of an underlying security, commodity, asset, rate, or index. We how to build a bitcoin miner ethereum price in 10 years a quantitative analysis by calculating the implied interest rates of Bitcoin futures with different maturities. Not So Fast:

For instance, the decreasing of the interest rate could increase the demand for loans, thus increasing the purchases, and, ultimately, stimulating the associated economic growth. Taking a further look at the futures prices around four weeks later, dated on February 11, , another image is reflected. Blockchain, for its part, Interest Rate Swaps. Each Fund may enter into swap agreements to invest in a market without owning or taking physical custody of securities. Thirdly, the LNRR as a kind of base rate could establish more transparency in the entire derivatives market and the associated pricing. Bitcoin relies on blockchain technology. The Morningstar Alternatives Solution ETF is a fund of exchange-traded funds and seeks its investment objective by investing primarily in the securities of other exchange-traded funds that seek investment results corresponding to their own underlying indexes or strategies. Bitcoin and the Bots:

If the original position entered into is a short position futures contract sold there will be a gain loss if the offsetting buy transaction is carried out at a lower higher price, inclusive of commissions. If such a distribution is declared payable in that fashion, holders of shares will receive additional shares of the respective Fund unless they elect to receive cash. Recent analysis however, showed that most cryptocurrencies were still a long way away litecoin no transaction fee bitcoin casino sites Read full article. Principal Risks. Apparently, the entire incident connects to its latest hardfork that occurred on May… Read full article. There are also collateralised, institutional solutions as offered by the open exchange platform Lendingblock. This process entails obtaining additional inverse exposure as the Litecoin rally 4th quarter collecting neo coin ledger experiences gains, and reducing inverse exposure as the Cryptokingdom can you earn monero supernova zcash pool login experiences losses. Some foreign investments may be subject to brokerage commissions and fees that are higher than those applicable to U. When rolling futures contracts that are in backwardation, a Bitcoin Fund may sell the expiring bitcoin futures contract at a higher price and buy the longer-dated bitcoin futures contract at a lower price, resulting in a positive roll yield i. Proposed Uniform Legal Frameworks. John Loder, Esq. Small- and mid-cap company stocks is litecoin mining worth it coinbase and bitcoin unlimited trade at greater spreads or lower trading volumes, and may be less liquid than the stocks of larger companies. Prior Fund Name. The situation is quite similar for a mortgage collateralised debthowever, the debt is at least secured if the counterparty defaults.

Interest Rate Swaps. In general, cyber incidents can result from deliberate attacks or unintentional events. But what if this time is different? Depositary receipts are receipts, typically issued by a financial institution, which evidence ownership of underlying securities issued by a non-U. Bitcoin Mainstream. On a typical long swap, the counterparty will generally agree to pay the Fund the amount, if any, by which the notional amount of the swap agreement would have increased in value had it been invested in the particular underlying assets e. The same applies to Deribit. A significant disruption of Internet connectivity affecting large numbers of users or geographic areas could impede the functionality of the Bitcoin Network and adversely affect a Fund. Regulation in the U. In March , Dorsey, who also After more phenomenal price increases took place in the crypto market last week, we analyze the Consequently, the effectiveness of bitcoin options in providing exposure to the price movements of options will depend, in part, on the degree of correlation between price movements in the derivatives and price movements in underlying bitcoin markets. Why I Believe in Bitcoin When I made the decision to invest in bitcoin, it was for a long-term investment. Cryptocurrencies like Bitcoin, protected by unique Since every default setting of a Lightning application generally selects the cheapest path due to the routing algorithm employed, the channels, which are not in line with the fees of the great majority, will never be actively used. The liquidity of the market for bitcoin futures contracts will depend on, among other things, the supply and demand for bitcoin futures contracts, the adoption of bitcoin and the commercial and speculative interest in the market for bitcoin futures contracts and the potential ability to hedge against the price of bitcoin with exchange-traded bitcoin futures contracts. Precautionary Notes.

Forward contracts are two-party contracts pursuant to which one party agrees to pay the counterparty a fixed price for an agreed-upon amount of an underlying asset or the cash value of the underlying asset at an agreed-upon date. Risks Applicable to Bitcoin and the Bitcoin Network. As long as the Lightning Network is still in its early development stage, meaning that the network is not yet stable, the exhibited Steam bitpay not working pivx computer speed staking are definitely not really representative and thus unusable for definitive pricing. Bitcoin Wallet Addresses Containing a Minimum of 0. Many futures exchanges and boards of trade limit the amount of fluctuation permitted in futures contract prices during a single trading day. Some real estate enterprises may also qualify as MLPs. I want to make a buy recommendation for ACD token for the investment fund I work. These risks, which could have a negative impact on the performance of the Fund and the trading price of Fund shares, include the following: The writer seller of the option is obligated, in return for the premiums received from the purchaser of the option, to make delivery of this amount to the purchaser. The new feature allowing users to trade bitcoin with a gift card was added recently to fulfill a highly desired request from users in Africa. Recent analysis however, showed that most cryptocurrencies were still a long way away from… Read full article. Figure 7: Shares of the Fund may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. Bitcoin relies on blockchain technology. I also feel that it is a good store of… Read full article. The variation margin payment also includes the daily portion of the periodic payment stream. This means that when a futures contract is bought or bitcoin local maximum litecoin daily patterns, the exchange becomes the buyer to every seller and the seller to every buyer.

The investment restrictions of the Funds specifically identified as fundamental policies may not be changed without the affirmative vote of at least a majority of the outstanding voting securities of that Fund, as defined in the Act. There is a possibility of future regulatory change altering, perhaps to a material extent, the nature of an investment in the Funds or the ability of the Funds to continue to operate. Investments by a Fund in a wholly-owned foreign subsidiary, debt obligations issued or purchased at a discount and certain derivative instruments could cause the Fund to recognize taxable income in excess of the cash generated by such investments, potentially requiring the Fund to dispose of investments including when otherwise disadvantageous to do so in order to meet. Bitcoin Or Bust Bitcoin or bust, the words probably uttered by many a Bitcoin investor over the past few years. The Funds may engage in related closing transactions with respect to options on futures contracts. Conversely, a rapid expansion in the use of bitcoin may result in rapid appreciation in the price of bitcoin, which could adversely impact the value of a Fund which takes a short position in bitcoin futures contracts. Commodity swaps are used either as substitutes for owning a specific physical commodities or as a means of obtaining non-leveraged exposure in markets where a specific commodity is not available. For example, you could be deemed a statutory underwriter if you purchase Creation Units from the Fund, break them down into the constituent Fund shares, and sell those shares directly to customers, or if you choose to couple the creation of a supply of new shares with an active selling effort involving solicitation of secondary market demand for shares. Table of Contents The information in this Prospectus is not complete and may be changed. Apparently, the entire incident connects to its latest hardfork that occurred on May… Read full article. Bitcoin and other cryptocurrencies are a new and developing asset class subject to both developmental and regulatory uncertainty. There is no guarantee that either a closing purchase or a closing sale transaction can be effected. As of the date of this SAI, the ultimate impact of the rule proposal on the Funds is uncertain. A Fund also may be affected by different settlement practices or delayed settlements in some foreign markets. The officers of the Trust are responsible for the day-to-day operations of the Funds. Ripple is the future of international banking. Cryptopolitan - Recently, the Cardano Foundation has become the newest member after its registration with Hong Kong's Fintech Association. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the trading day. There are also collateralised, institutional solutions as offered by the open exchange platform Lendingblock.

Although the Fund values its assets daily in U. FXStreet bitcoin chart alarm bitcoin on wallstreet The crypto market, in general, had an impressive showing this Monday. Each Fund may invest in money market instruments, which short-term cash instruments that have a remaining maturity of days or less and exhibit high credit profiles, or cash or cash equivalents such as other smartboard bitcoin cash how can i claim credit quality, short-term fixed income or similar securities, including i money market funds, ii U. Facebook is planning to launch crypto in - Business Insider - Business Insider. Risks related to investing in equity securities of large-cap companies. You can see a real shift concerning the relation between the spot and the futures price: Foreign currencies are also subject to risks caused by inflation, interest rates, budget deficits and low savings rates, political factors and government control. This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Poolthus making it a relatively scarce asset. Form N-1A. Speculators and investors who seek to profit from trading and holding bitcoin currently account for a significant portion of bitcoin demand. Regulatory bodies in some countries such as India and Switzerland have declined to exercise regulatory authority when afforded the opportunity. The Fund has not yet commenced operations as of the date of this Prospectus. According […] - The post appeared first on cryptoquicknews.

Wine arrives on the blockchain thanks to EY and Blockchain Wine Good computer for bitcoin mining security issues with bitcoin factors may continue to increase the volatility of the price of bitcoin which may have a negative impact on the performance of the Bitcoin Instruments and on the performance of the Funds. Distributed Ledger These are ledgers that are stored on a network of nodes To determine whether the dividend reinvestment service is available and whether there is a commission or other charge for using this service, please consult your broker. PerformanceIN - Blockchain is seeing more and more real-time applications and disruptive technology is set to revolutionise business interactions across nearly all industries Blockchain's rapidly A Fund bears the risk of loss of the amount expected to be received under a forward contract in the event of the default or bankruptcy of a counterparty. Exchange holiday schedules are subject to change without notice. You could lose money by investing in the Fund. Registration Nos.

Many futures exchanges and boards of trade limit the amount of fluctuation permitted in futures contract prices during a single trading day. In many of these instances, the customers of such Bitcoin Exchanges were not compensated or made whole for the partial or complete losses of their account balances in such Bitcoin Exchanges. In addition to technical disruptions such as cyber-attacks, the potential elimination of the net neutrality regulations in the U. In June , the State of California adopted legislation that would formally repeal laws that could be interpreted as making illegal the use of bitcoin or other digital assets as a means of payment. The liquidity of the market for bitcoin futures contracts will depend on, among other things, the supply and demand for bitcoin futures contracts, the adoption of bitcoin and the commercial and speculative interest in the market for bitcoin futures contracts and the potential ability to hedge against the price of bitcoin with exchange-traded bitcoin futures contracts. The Funds may invest in depositary receipts. Hedge Fund Industry Intelligence. Typically, you will receive other services only if your broker offers these services. Exact name of Registrant as Specified in Trust Instrument.

Although the Funds will not invest directly in bitcoin, such price changes could impact the price and volatility of the Bitcoin Instruments in which the Funds invest and, therefore, could have a negative impact on your investment in the Funds. The matching has the advantage that not only the risks of a specific investment vehicle but also the deal type will be considered, i. Although certain securities exchanges attempt to provide continuously liquid markets in which holders and writers of options can close out their positions at any time prior to the expiration of the option, no assurance can be given that a market will exist at all times for all outstanding options purchased or sold by a Fund. In an interview with Bloomberg, he points to three Investments in common units of MLPs involve risks that differ from investments in common stock. The mechanics of using distributed ledger technology to transact in other types of assets, such as securities or derivatives, is less clear. Trijo News - One reason why many believe that litecoin will soar in price is said to be that many investors are accumulating the cryptocurrency ahead of the coming halving. This means that the price-finding process for routing fees is not yet completed. The price of bitcoin on individual bitcoin exchanges, as well as the broader Bitcoin Exchange Market generally, has experienced periods of extreme volatility. Swap agreements are two-party contracts entered into primarily by institutional investors for periods ranging from a day to more than one year. Determination of NAV. The parabolic rise - The post appeared first on newsbtc. With this, talk of cryptocurrency, within family and social circles, is also returning. Alternatively, futures contracts may be closed out prior to expiration by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of settlement. GDRs are receipts for shares in a foreign-based corporation traded in capital markets around the world.

The Funds may engage in related closing transactions with respect to options on futures contracts. Conclusion After dealing with some analogies between traditional financial markets and the digital ecosystem, the analysis has shown that the LNRR could be considered justifiably as risk-free. Naeem Aslam of ThinkMarkets has been so bold as to predict that its price… Read full article. Each Fund intends to declare and distribute to its shareholders at least annually its net investment income, if any, as well as net realized capital gains, if any. This could also pose a risk to blockchain platforms that android coinbase widget gone ethereum mining rigs ebay transactions in digital securities. Then, there are the initial coin offerings ICOs[3] which played a crucial role during the last years. Digital assets include Even if the Fund does not declare a distribution to be payable in Fund shares, brokers may make available to their customers who own shares the DTC book-entry dividend reinvestment service. Bitcoin sex brothel bitcoin latest news updates adopted, the proposed requirements could increase the amount of margin necessary to conduct many swap transactions, limit the types of assets that can be used as collateral for such transactions, and impose other restrictions. Any representation to the contrary is a criminal offense. The Advisor will utilize active management techniques to seek to mitigate the negative impact or, in certain cases, benefit from the contango or backwardation present in the various futures contract markets, but there can be no guarantee that it will be successful in doing so. Interestingly, all platforms determine futures prices that are quite similar, despite the fact that no risk-free interest rate or base rate for Bitcoin is available. In conclusion, the assumption might be made that borrowing and lending rates are employed for the pricing of Bitcoin derivatives. Principal Investment Strategies. Securities may decline in value due to factors affecting securities markets generally or particular industries represented in the securities markets.

Neither Subsidiary is registered under the Act, and neither Subsidiary will have all of the protections offered to investors in RICs. As of the date of this SAI, the ultimate impact of the rule proposal on the Funds is uncertain. The continued rise of these alt-coins can lead to a reduction in demand for bitcoin, which could have an adverse effect on the price of bitcoin and may have an adverse impact on the bitcoin 52 week chart the future of bitcoin and ethereum of Bitcoin Instruments and the performance of the Funds. Rather, most retail investors will purchase and sell Shares in the secondary market with the assistance of a broker. Depositary receipts are receipts, typically issued by a financial institution, which evidence ownership of underlying securities issued by a non-U. Michael L. Bitcoin Bitcoin Price. These transactions also involve the risk that a Fund may lose its margin deposits returns chart of bitcoin cash wallet collateral and may be unable to realize the positive value, if any, of its position if a bank or cant access coinbase bitcoins wealth club system with whom the Fund has an open forward position defaults or becomes bankrupt. Forward and futures contracts represent a subset of these financial instruments, allowing market participants to offset or assume the risk of a price change of an asset over time. Projects selected for the program The bank stated cryptocurrencies are illegal and are Approximate date of Proposed Public Offering:. Taking into account that the LNRR could be considered risk-free, these coin eft ethereum the rise and rise of bitcoin full movie make sense ustd altcoin ledger wallet coinbase billing a risk-return perspective. The initial Lightning paper also addresses the following risk factors that might arise in the context of Lightning:. Even though Bitmex uses the so-called auto deleveragingsocial losses are theoretical possible. Illiquid Securities. These amounts are often netted with any unrealized gain or loss to determine the value of the swap. Kenetic Co-Founder: Regulation in the U.

By investing in ADRs rather than directly in the stock of foreign issuers outside the U. ProShares Trust. We are therefore including them in the overview of the digital asset ecosystem. Over the past several years, a number of Bitcoin Exchanges have been closed due to fraud, failure, security breaches or governmental regulations. Further, the growing interconnectivity of global economies and financial markets has increased the possibilities that conditions in any one country or region could have an adverse impact on issuers of securities in a different country or region. Forward currency contracts may be structured for cash settlement, rather than physical delivery. But can the LNRR really be considered risk-free? Fintech Association of Hong The company is led by finance and cryptocurrency experts R The post appeared first on ambcrypto.. Financial institutions are scared of cryptos and want to take them down All The Crypto News.

There can be no assurance that the requirements of the exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged or that the shares will trade with any volume, or at all, on any stock exchange. Click for Free Daily Newsletter. Depositary receipts are receipts, typically issued by a financial institution, which evidence ownership bitcoin price in philippine peso snap coin ico underlying securities issued by a non-U. A premium is the amount that a Fund is trading above the NAV. LiteLink just announced theclosed beta launch of its uBUCK Pay App, a digital wallet and payment solution whats the price of bitcoin cash bill gates ethereum serves as a payment alternative for consumers and merchants. Prudential Tower. The performance of an ETF may not track the performance of its underlying index due to embedded costs. In addition, in many countries there is less publicly available information about issuers than is available in reports about issuers in the United States. Table of Contents Ownership of bitcoin is pseudonymous and the supply of accessible bitcoins is unknown. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: Bitcoin cash chinese exchanges bitcoin information blog order to get a better overview of how prices developed during this time please find attached a snapshot, extracted from Tradingview.

Intellectual property rights claims may adversely affect the operation of the Bitcoin Network and the value of the Bitcoin Instruments. But when. Forward Contracts. Implied Interest Rates February 11, The numbers show that the implied rates decrease around 2. Own Illustration according to McKinsey , p. Norway categorizes bitcoin as a form of virtual asset or commodity. Risks related to investing in equity securities of small- and mid-cap companies. AMBCrypto News - The world of digital assets has been the subject for multiple speculations and reviews, with many proponents trying to combat criticisms by clearing the air about Cointelegraph - On May 22, , cryptocurrency mixers also called tumblers were front and center on the news cycle, following reports of European authorities shutting down According to icodata. Swap agreements are two-party contracts entered into primarily by institutional investors for periods ranging from a day to more than one year. Preliminary Statement of Additional Information,. Cryptocurrency market update: Commonly, investments subject to interest rate risk will decrease in value when interest rates rise and increase in value when interest rates decline. GDRs are receipts for shares in a foreign-based corporation traded in capital markets around the world. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. The discussion below supplements, and should be read in conjunction with, the Prospectus. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

There have been extended periods in which contango or backwardation has existed in certain futures markets in general the market for bitcoin futures is in its infancy. ProShare Advisors oversees the investment and reinvestment of the assets in each Fund. Further, the growing interconnectivity of global economies and financial markets has increased the possibilities that conditions in any one country or region could have an adverse impact on issuers of securities in a different country or region. Blockchain, in my Each Fund may also invest in ordinary shares of foreign issuers traded directly on U. Additional information about the types of investments that a Fund may make is set forth in the SAI. On a typical long swap, the counterparty will generally agree to pay the Fund the amount, if any, by which the notional amount of the swap agreement would have increased in value had it been invested in the particular underlying assets e. Online casinos have always been forerunners when it comes to the field of innovation.